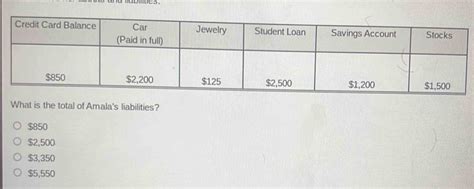

What Is The Total Of Amala's Liabilities

Breaking News Today

Apr 01, 2025 · 6 min read

Table of Contents

What is the Total of Amala's Liabilities? A Comprehensive Guide to Understanding Personal Finance

Determining the total of Amala's liabilities requires a detailed look into her financial situation. Unfortunately, without specific financial data about Amala, we can only provide a framework for understanding how to calculate her total liabilities and the importance of this calculation in personal finance. This article will guide you through the process, using hypothetical examples to illustrate the concepts.

Understanding Liabilities: What They Are and Why They Matter

Before we delve into Amala's hypothetical liabilities, let's establish a solid understanding of what constitutes a liability. Simply put, a liability is anything you owe to someone else. This includes debts that must be repaid with interest or without. Understanding your liabilities is crucial for managing your personal finances effectively. It helps you:

- Track your financial health: Knowing your total liabilities provides a clear picture of your current financial standing.

- Budget effectively: This allows you to allocate funds appropriately for debt repayment and other essential expenses.

- Make informed financial decisions: A clear understanding of liabilities assists in making sound financial choices like loan applications or investments.

- Avoid financial difficulties: By monitoring liabilities, you can proactively address potential financial problems before they escalate.

- Improve your credit score: Responsible management of liabilities improves your creditworthiness.

Types of Liabilities: A Comprehensive Overview

Amala's liabilities, like anyone's, could fall into several categories:

1. Short-Term Liabilities: Due Within One Year

These are debts that are typically due within a year. Examples include:

- Credit card debt: The outstanding balance on Amala's credit cards. This often carries high interest rates.

- Short-term loans: These are loans with a repayment period of less than a year. Examples include payday loans or personal loans with short repayment terms.

- Overdue bills: Unpaid utility bills (electricity, water, gas), phone bills, or other service bills.

- Medical bills: Outstanding payments for medical services.

2. Long-Term Liabilities: Due in More Than One Year

These are debts with repayment terms exceeding one year. They typically carry lower interest rates than short-term liabilities but represent a significant financial commitment over a longer period. Examples include:

- Mortgage: If Amala owns a house, the outstanding balance on her mortgage is a substantial long-term liability.

- Auto loan: The amount still owed on a car loan.

- Student loans: Outstanding balances on educational loans.

- Personal loans: Loans with longer repayment terms.

3. Contingent Liabilities: Potential Future Liabilities

These are potential liabilities that may arise depending on future events. They are not yet recorded as liabilities but should be considered when assessing one's overall financial health. Examples include:

- Guarantees: If Amala has guaranteed a loan for someone else, she could become liable if the borrower defaults.

- Lawsuits: If Amala is involved in a lawsuit, she may face potential financial liability depending on the outcome.

Calculating Amala's Total Liabilities: A Step-by-Step Guide

To calculate the total of Amala's liabilities, we need to gather data on all her debts, both short-term and long-term. Let's assume, for illustrative purposes, that Amala has the following liabilities:

- Credit card debt: $2,000

- Auto loan: $15,000

- Student loan: $10,000

- Personal loan: $3,000

- Unpaid utility bills: $500

Step 1: List all liabilities: First, meticulously list all of Amala's debts, ensuring nothing is missed. This involves checking bank statements, loan documents, and bills.

Step 2: Categorize liabilities: Categorize each liability as either short-term or long-term.

Step 3: Sum up the liabilities: Add up all the short-term and long-term liabilities separately.

Step 4: Calculate the total liabilities: Add the total short-term liabilities and the total long-term liabilities to arrive at Amala's total liabilities.

In Amala's case:

- Short-term liabilities: $2,000 (credit card) + $500 (utility bills) = $2,500

- Long-term liabilities: $15,000 (auto loan) + $10,000 (student loan) + $3,000 (personal loan) = $28,000

- Total liabilities: $2,500 + $28,000 = $30,500

Therefore, based on our hypothetical data, Amala's total liabilities are $30,500.

Important Considerations:

- Accuracy is paramount: Ensure that the figures used are accurate and up-to-date. Even small inaccuracies can significantly affect the overall calculation.

- Include all debts: Don't overlook any debts, no matter how small they seem. Every debt contributes to the total liability.

- Regular review: Regularly review and update your liability calculation to reflect changes in your financial situation.

- Seek professional advice: If you are struggling to manage your liabilities, seek professional financial advice. A financial advisor can help you develop a debt management plan.

Beyond the Numbers: Understanding the Implications of High Liabilities

A high level of liabilities can have significant implications for Amala's financial well-being. High debt levels can:

- Restrict financial flexibility: A large portion of Amala's income might be dedicated to debt repayment, leaving little for savings, investments, or unexpected expenses.

- Increase financial stress: Managing substantial debt can be stressful and emotionally taxing.

- Damage credit score: Consistent late payments or defaults can severely damage Amala's credit score, making it difficult to obtain future credit.

- Impact future opportunities: High debt levels can hinder Amala's ability to achieve her financial goals, such as buying a home, investing, or starting a business.

Strategies for Managing Liabilities Effectively

There are several strategies Amala can implement to manage her liabilities more effectively:

- Create a budget: Developing a detailed budget helps Amala track her income and expenses, allowing her to allocate funds for debt repayment.

- Prioritize high-interest debts: Focus on repaying debts with the highest interest rates first to minimize the overall interest paid. Methods like the debt snowball or debt avalanche method can be effective.

- Negotiate with creditors: Amala can negotiate with her creditors to lower interest rates or adjust payment plans.

- Explore debt consolidation: Consolidating multiple debts into a single loan with a lower interest rate can simplify repayment and potentially reduce the overall cost of borrowing.

- Seek professional help: If she's struggling to manage her debt, Amala should seek help from a credit counselor or financial advisor.

Conclusion:

Determining the total of Amala's liabilities is a crucial step in understanding her overall financial health. By systematically gathering data on her debts, categorizing them, and calculating the total, Amala can gain a clear picture of her financial situation. This understanding allows for better financial planning, more informed decision-making, and the implementation of effective strategies for managing her liabilities. Remember, proactive management of liabilities is essential for achieving long-term financial well-being. This detailed analysis provides a solid foundation for understanding personal finance and the importance of accurate liability tracking. Regularly reviewing and adjusting your financial strategies is key to maintaining a healthy financial life.

Latest Posts

Latest Posts

-

In This Scene The Primary Danger Is

Apr 02, 2025

-

Whats Wrong With Timothy Case Study Answers

Apr 02, 2025

-

Mrs Walters Is Enrolled In Her States

Apr 02, 2025

-

The Slightly Moveable Joint Is A Joint

Apr 02, 2025

-

Match Each Principal Function Of Management With Its Definition

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about What Is The Total Of Amala's Liabilities . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.