What Type Of Reinsurance Contract Involves Two Companies

Breaking News Today

Mar 22, 2025 · 6 min read

Table of Contents

What Type of Reinsurance Contract Involves Two Companies? A Deep Dive into Reinsurance Agreements

The world of insurance is complex, a carefully constructed system of risk transfer and mitigation. At its core lies the concept of reinsurance – a crucial mechanism that allows insurance companies (cedents) to transfer some of their risk to other insurance companies (reinsurers). Understanding the various types of reinsurance contracts is essential for anyone involved in the industry, from actuaries to underwriters and risk managers. This article delves into the intricacies of reinsurance contracts, focusing specifically on those involving two companies. While many reinsurance arrangements involve multiple parties, the core principles are often mirrored in simpler, bilateral agreements.

The Foundation: Understanding Reinsurance

Before diving into specific contract types, it’s crucial to grasp the fundamental principles of reinsurance. Reinsurance is essentially "insurance for insurance companies." It's a safety net designed to protect primary insurers from catastrophic losses that could threaten their solvency. By ceding a portion of their risk to reinsurers, primary insurers can manage their exposure and maintain financial stability. This transfer of risk is facilitated through various contracts, each designed to address different risk profiles and needs.

Key Players in Reinsurance Contracts

Two principal players always feature in any reinsurance agreement:

- The Ceding Company (Cedent): This is the primary insurance company that transfers a portion of its risk to a reinsurer.

- The Reinsurer: This is the company that assumes a portion of the risk from the cedent, receiving a premium in exchange for this undertaking.

While these two are the fundamental players, several other parties might become involved, depending on the complexity of the reinsurance arrangement. These might include brokers, intermediaries, and legal counsel, each playing their unique role in facilitating the agreement and ensuring its smooth execution.

Types of Reinsurance Contracts Involving Two Companies

Many different types of reinsurance contracts exist, each with its unique features and application. Let’s explore several key types that primarily involve two companies:

1. Facultative Reinsurance: A Tailored Approach

Facultative reinsurance involves a case-by-case agreement between the cedent and reinsurer. This means that for each individual risk, the cedent can choose whether or not to seek reinsurance. The reinsurer assesses each risk individually and decides whether to accept or reject the offer, often using its own underwriting criteria.

Characteristics of Facultative Reinsurance:

- Flexibility: This allows for a high degree of flexibility, enabling the cedent to tailor their reinsurance protection to specific, high-value, or unusual risks.

- Individual Assessment: Each risk undergoes individual assessment, meaning that the reinsurer can apply specific underwriting requirements to each case.

- Negotiated Terms: The terms of each reinsurance contract are negotiated individually between the cedent and reinsurer, leading to customized protection levels.

- Suitable for Large or Unconventional Risks: Ideal for risks that fall outside the scope of a treaty agreement or pose higher-than-average risk profiles.

Example: An insurance company might seek facultative reinsurance for a particularly high-value commercial property or a specialized liability risk that exceeds its comfortable risk retention capacity.

2. Treaty Reinsurance: A Comprehensive Agreement

Treaty reinsurance represents a pre-arranged, ongoing agreement between the cedent and reinsurer. Under a treaty, the cedent automatically cedes a specified portion of its risk to the reinsurer without individual assessment for each risk. This often covers a portfolio of risks or a specific line of business, offering predictable and consistent reinsurance protection.

Characteristics of Treaty Reinsurance:

- Predictability: Provides predictable and consistent risk transfer for the cedent, streamlining the reinsurance process.

- Automated Risk Transfer: Risk is automatically ceded to the reinsurer based on pre-agreed terms, eliminating the need for individual case assessment.

- Efficiency: Facilitates efficient risk management, particularly for high-volume transactions.

- Cost-Effective: The predictable nature of treaty reinsurance can lead to more cost-effective reinsurance pricing.

Several subtypes of treaty reinsurance exist, each suited to different risk profiles and needs. Some common variations include:

-

Quota Share Treaty: The reinsurer agrees to cover a fixed percentage of each risk within the agreed portfolio. This is a straightforward approach that is easy to administer.

-

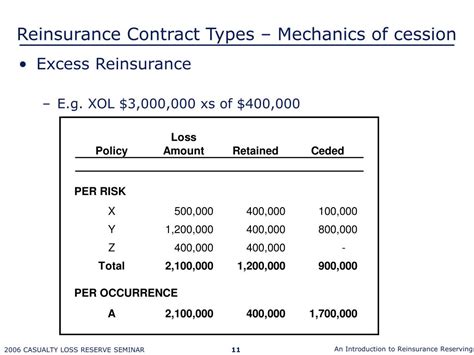

Excess of Loss Treaty: The reinsurer covers losses only exceeding a certain predetermined amount (retention). This protects the cedent from catastrophic events impacting a large number of risks, providing a significant safety net.

-

Surplus Treaty: The reinsurer covers losses exceeding the cedent’s retention level, but only up to a specific limit. This approach provides a balance between risk transfer and cost-effectiveness.

-

Proportional Treaty: This treaty divides the risk and premium proportionally between the cedent and reinsurer. Quota-share is a subset of this treaty.

-

Non-Proportional Treaty: This treaty focuses on the excess of loss, protecting the cedent from large-scale claims that could exhaust their reserves.

Example: An automobile insurer might enter a quota-share treaty with a reinsurer, whereby the reinsurer takes on 25% of each auto insurance policy's risk, providing a consistent stream of premium and protection against high-loss scenarios. Alternatively, they might employ an excess-of-loss treaty to protect against catastrophic events like a major earthquake impacting many policyholders simultaneously.

3. Other Reinsurance Arrangements: Beyond the Basics

While facultative and treaty reinsurance are the most prevalent types, other specialized agreements involving two companies can exist, often incorporating elements of both. These are frequently tailored to meet specific circumstances and risk profiles.

-

Stop-Loss Reinsurance: A form of excess-of-loss reinsurance, this protects the cedent from an accumulation of losses exceeding a predetermined limit over a specific period, irrespective of the number of individual claims.

-

Catastrophe Reinsurance: Designed specifically to mitigate risks associated with large-scale events like earthquakes, hurricanes, and floods. These often have high premiums and significant coverage limits.

Key Considerations When Choosing a Reinsurance Contract

Selecting the appropriate reinsurance contract is crucial for effective risk management. Several key factors influence this decision:

-

Risk Profile: The nature and extent of the risks faced by the cedent dictates the type of reinsurance best suited to their needs.

-

Financial Capacity: The cedent's financial strength influences its ability to retain risk and the level of reinsurance protection needed.

-

Cost-Effectiveness: Reinsurance premiums vary depending on the type of contract and the risks involved. Choosing the most cost-effective option is vital.

-

Reinsurer Selection: Careful evaluation of the reinsurer’s financial stability and reputation is crucial for ensuring effective risk transfer.

-

Contractual Terms: Thorough understanding and negotiation of the contract’s terms and conditions are vital for protecting the cedent’s interests.

The Importance of Legal and Regulatory Compliance

Reinsurance contracts, irrespective of their type, are subject to regulatory oversight and legal frameworks that govern their formation, execution, and enforcement. Compliance with these rules is critical for all parties involved. Failure to comply can result in serious legal and financial repercussions.

Conclusion: A Vital Component of the Insurance Ecosystem

Reinsurance contracts are essential for maintaining the stability and solvency of the insurance industry. The various types available, ranging from the highly flexible facultative contracts to the structured certainty of treaty agreements, provide insurance companies with critical tools for managing and mitigating risk. Understanding the nuances of each contract type and choosing the appropriate solution is paramount for effective risk management and financial resilience. By carefully analyzing their risk profile, financial capacity, and contractual needs, insurance companies can effectively leverage reinsurance to protect their business and continue to offer vital coverage to their policyholders. The dynamic relationship between the cedent and reinsurer, facilitated through these varied contracts, forms a cornerstone of the global insurance ecosystem, underpinning financial stability and security.

Latest Posts

Latest Posts

-

Which Bone Forms The Inferior Portion Of The Nasal Septum

Mar 22, 2025

-

The Policy Of Deterrence Is Based On The Idea That

Mar 22, 2025

-

If You Lose Traction You Should Not

Mar 22, 2025

-

Which Carbohydrate Is Not Found In Foods From Plants

Mar 22, 2025

-

President Carter Wanted To Establish Peace Between

Mar 22, 2025

Related Post

Thank you for visiting our website which covers about What Type Of Reinsurance Contract Involves Two Companies . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.