When Preparing The Bank Deposit Currency Is

Breaking News Today

Mar 26, 2025 · 6 min read

Table of Contents

When Preparing the Bank Deposit Currency Is… Crucial! A Comprehensive Guide

Depositing money into your bank account seems simple enough, right? However, there's more to it than just handing over cash or writing a check. The currency you use, its condition, and the preparation involved significantly impact the speed and success of your deposit. This comprehensive guide delves into the intricacies of preparing currency for bank deposits, ensuring a smooth and efficient transaction every time.

Understanding Currency Acceptance Policies

Before we dive into preparation, it's crucial to understand that each bank has its own specific policies regarding currency acceptance. While there are common standards, variations exist depending on factors like:

- Bank Type: Large national banks might have more lenient policies compared to smaller regional banks or credit unions.

- Branch Location: Policies can differ between branches within the same bank, particularly in areas with higher cash transaction volumes.

- Account Type: The type of account (personal, business, etc.) might influence the bank's acceptance criteria.

Always contact your specific bank branch to verify their policies regarding currency types, condition, and deposit limits before making a significant deposit. Don't rely solely on general information found online. Proactive communication prevents potential delays and frustrations.

Preparing Different Types of Currency for Deposit

Now, let's delve into the specifics of preparing various types of currency for a bank deposit:

1. Cash (Bills and Coins)

- Counting and Sorting: Accuracy is paramount. Carefully count and sort your bills by denomination (e.g., $1, $5, $10, $20, $50, $100). Similarly, sort coins into separate containers by denomination. Using a coin counter can significantly expedite this process, especially for large amounts of coins.

- Condition: Banks typically reject heavily damaged or soiled bills. Avoid depositing torn, excessively wrinkled, or otherwise significantly damaged currency. While small imperfections are usually acceptable, excessively damaged bills might require special handling or rejection.

- Securing Your Cash: Transport your cash securely to the bank. Use a bank bag, a secure briefcase, or another discreet and protective container to prevent loss or theft.

- Large Deposits: For exceptionally large cash deposits, it's advisable to contact the bank beforehand to arrange for a more efficient and secure deposit process. They might have specific procedures in place for handling such transactions.

2. Checks

- Endorsement: Properly endorse all checks by signing the back in the designated area. This confirms your authorization for the bank to process the payment.

- Completeness: Ensure all necessary information is correctly filled out on the check, including the date, payee's name, and the amount written both numerically and in words.

- Condition: Deposit checks promptly. Avoid folding or damaging checks, as this can impede processing.

- Third-Party Checks: Be prepared to provide identification if depositing a check that's not drawn to your account. Banks require verification to prevent fraud.

3. Foreign Currency

- Exchange Rate: Be aware that foreign currency will be converted to your local currency at the bank's prevailing exchange rate. This rate might differ slightly from online exchange rates, so be prepared for potential variations.

- Verification: Some banks might require verification of the authenticity of foreign currency, especially if the amounts are significant. It's best to contact your bank beforehand for their specific procedures.

- Documentation: Keep any relevant documentation related to the origin and exchange of foreign currency. This can be helpful for record-keeping and tax purposes.

4. Money Orders and Cashier's Checks

- Verification: While generally easier to deposit than cash or personal checks, ensure the money order or cashier's check is correctly filled out and appears authentic.

- Identification: Some banks might require you to show identification when depositing money orders or cashier's checks, especially if the amount is substantial.

- Lost or Stolen: If a money order or cashier's check is lost or stolen, report it immediately to the issuing institution.

Optimizing Your Deposit Process for Efficiency

Beyond preparing the currency itself, several strategies can streamline your bank deposit experience:

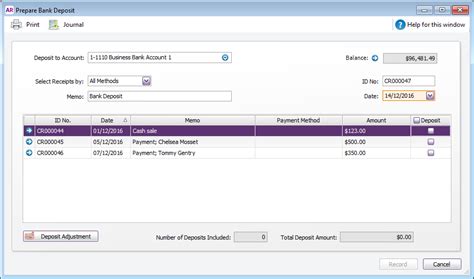

- Using Deposit Slips: Most banks provide deposit slips to accurately record the details of your deposit. Fill these out completely and accurately to avoid processing delays. Double-check your figures before submitting the slip.

- Mobile Deposit Apps: Many banks offer mobile deposit apps, allowing you to deposit checks and sometimes even cash using your smartphone. This can save you a trip to the branch, but always check your bank's app capabilities and limitations.

- Automated Teller Machines (ATMs): ATMs can accept deposits, but the acceptable types of currency and deposit limits might be restricted compared to in-person deposits at a branch.

- Scheduling Your Deposit: Consider the bank's busiest times to avoid long lines. Early mornings or weekdays during off-peak hours are often less crowded.

Handling Potential Issues During Deposit

Despite meticulous preparation, issues can sometimes arise. Here's how to handle some common scenarios:

- Rejected Currency: If the bank rejects some of your currency, inquire about the reason. It might be due to damage, authenticity concerns, or other factors. Understanding the cause will help you prevent similar issues in future deposits.

- Deposit Errors: Double-check your deposit slip and bank statement for accuracy. Report any discrepancies to the bank promptly to resolve any errors.

- Security Concerns: If you have security concerns about transporting large amounts of cash, consider using armored car services or alternative electronic payment methods.

Advanced Considerations for Businesses and High-Volume Deposits

For businesses or individuals making frequent or high-volume deposits, certain advanced considerations apply:

- Establishing Business Accounts: Business accounts often offer specialized services for handling large cash deposits, including armored car pick-up options and dedicated account managers.

- Negotiating Deposit Limits: If your business consistently exceeds standard deposit limits, discuss this with your bank to establish tailored solutions.

- Regulatory Compliance: Businesses must adhere to strict anti-money laundering (AML) and know your customer (KYC) regulations when making large cash deposits. Non-compliance can lead to serious consequences.

Maintaining Accurate Records

Regardless of the deposit method, keeping accurate records is vital for financial management and tax purposes. Maintain detailed records including:

- Date of Deposit: Precise date and time of the transaction.

- Amount Deposited: Total amount deposited, broken down by currency type.

- Deposit Method: Cash, check, money order, etc.

- Transaction ID: Any unique identification numbers associated with the deposit.

- Supporting Documentation: Copies of checks, deposit slips, and other relevant documents.

Conclusion: Proactive Preparation Leads to Seamless Deposits

Preparing currency for bank deposits is more than just counting bills and writing checks. A thorough understanding of your bank's policies, proper sorting and handling of currency, and proactive planning can significantly enhance the efficiency and security of your deposit process. By following the guidelines outlined in this comprehensive guide, you can ensure your banking transactions are smooth, accurate, and free of unnecessary delays. Remember, communication with your bank is key to avoiding problems and ensuring a positive banking experience.

Latest Posts

Latest Posts

-

When Preparing A Speech Introduction You Should Usually

Mar 29, 2025

-

What Are The Types Of Rules Contained In The Nec

Mar 29, 2025

-

Fui A La Agencia De Viajes Porque Queria Ir

Mar 29, 2025

-

Across Childhood And Adolescence Research Suggests That

Mar 29, 2025

-

What Are The Packaging Criteria For Accepting Nonfood Items

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about When Preparing The Bank Deposit Currency Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.