Which Is A Characteristic Of Medicare Enrollment

Breaking News Today

Mar 29, 2025 · 6 min read

Table of Contents

Decoding Medicare Enrollment: A Comprehensive Guide to Eligibility, Parts, and Deadlines

Navigating the Medicare system can feel like traversing a labyrinth. Understanding its complexities is crucial, especially when it comes to enrollment. This comprehensive guide will unravel the mysteries of Medicare enrollment, detailing its characteristics, eligibility requirements, different parts, and critical deadlines. We'll cover everything you need to know to confidently enroll in the Medicare program that best fits your needs.

Understanding Medicare: A Foundation for Enrollment

Before delving into the specifics of enrollment, let's establish a solid understanding of Medicare itself. Medicare is a federal health insurance program primarily for individuals 65 and older and certain younger people with disabilities. It's designed to help cover the high cost of healthcare, offering a safety net for a significant portion of the population. Medicare isn't a single entity; rather, it's a collection of different parts, each serving a unique purpose.

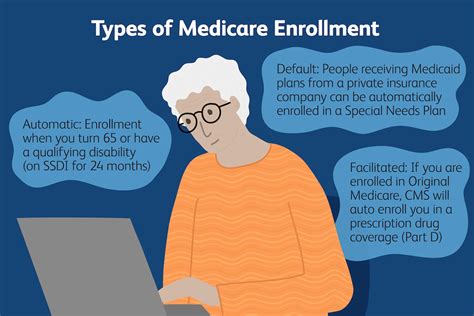

Key Characteristics of Medicare Enrollment:

-

Age-Based Eligibility: The most common route to Medicare eligibility is turning 65. You automatically become eligible three months before your 65th birthday, the month of your 65th birthday, and three months after. This seven-month window provides flexibility in choosing your enrollment date.

-

Disability-Based Eligibility: Individuals under 65 with certain disabilities and those with End-Stage Renal Disease (ESRD) may also qualify for Medicare. The Social Security Administration (SSA) determines eligibility for disability-based Medicare.

-

Initial Enrollment Period (IEP): This is the crucial seven-month period mentioned above, and missing it can result in penalties. This is your first opportunity to enroll in Medicare Parts A and B.

-

General Enrollment Period (GEP): If you miss your IEP, you can enroll during the GEP, which runs from January 1st to March 31st each year. However, late enrollment penalties apply.

-

Special Enrollment Period (SEP): Various circumstances, such as losing employer-sponsored coverage, could qualify you for a SEP. These periods offer opportunities to enroll or change plans outside of the standard enrollment periods.

Delving into the Parts of Medicare:

Medicare is composed of four main parts: A, B, C, and D. Understanding their roles is essential to selecting the right coverage for your needs.

Part A: Hospital Insurance

-

Generally Premium-Free: Most people don't pay a monthly premium for Part A because they or their spouse worked and paid Medicare taxes for a sufficient period.

-

Covers Inpatient Care: Part A helps cover the cost of hospital stays, skilled nursing facility care, hospice care, and some home healthcare.

-

Deductibles and Coinsurance: While premium-free, Part A still involves deductibles and coinsurance, meaning you'll bear some costs out-of-pocket.

Part B: Medical Insurance

-

Monthly Premium: Part B covers doctor visits, outpatient care, some preventive services, and durable medical equipment. There's a monthly premium, the amount depending on your income.

-

Annual Deductible: Like Part A, Part B has an annual deductible you need to meet before coverage kicks in.

-

Coinsurance and Copayments: After the deductible, you'll typically pay a coinsurance amount or copayment for services.

Part C: Medicare Advantage

-

All-in-One Coverage: Medicare Advantage (also known as Part C) combines Part A, Part B, and often Part D into a single plan offered by private insurance companies.

-

Various Plan Options: Medicare Advantage plans offer a range of options, including HMOs, PPOs, and Special Needs Plans, allowing you to choose a plan that fits your preferences and healthcare needs.

-

Additional Benefits: Some Medicare Advantage plans provide extra benefits not covered by traditional Medicare, like vision, hearing, and dental care.

Part D: Prescription Drug Insurance

-

Separate Enrollment: Enrollment in Part D is separate from Parts A, B, and C.

-

Monthly Premiums and Deductibles: Part D plans have monthly premiums and annual deductibles. The costs vary depending on the plan's formulary (the list of covered drugs).

-

Coverage Gaps: As prescription drug costs increase, you'll enter a coverage gap (donut hole) where you pay a higher share of the cost. Once you reach a certain spending threshold, catastrophic coverage kicks in.

Navigating Medicare Enrollment Deadlines: A Critical Aspect

Meeting the correct deadlines is crucial to avoid penalties and ensure continuous coverage. Missing these deadlines can lead to significant financial repercussions. Understanding the various enrollment periods is essential.

Initial Enrollment Period (IEP):

This is your first opportunity to sign up for Medicare Parts A and B. It's a seven-month window that includes:

- Three months before your 65th birthday.

- The month of your 65th birthday.

- Three months after your 65th birthday.

Failing to enroll during your IEP will result in late enrollment penalties for Part B.

General Enrollment Period (GEP):

If you didn't enroll in Part B during your IEP, you can enroll during the GEP, which runs from January 1st to March 31st each year. However, you'll face late enrollment penalties that continue for as long as you have Part B. These penalties can be substantial, adding to your monthly premium.

Special Enrollment Periods (SEPs):

These are available to individuals who miss their IEP or GEP due to specific circumstances, including:

- Job loss and loss of employer-sponsored health insurance.

- Moving to an area where you no longer have access to your current plan.

- Certain life events, such as the death of a spouse.

Essential Tips for Successful Medicare Enrollment:

-

Plan Ahead: Begin researching your options well in advance of your 65th birthday. Understanding your health needs and healthcare costs will influence your choice.

-

Review Your Income: Your income will determine your Part B premium and potential cost-sharing for other parts of Medicare.

-

Compare Plans: Don't settle for the first plan you see. Compare different Medicare Advantage and Part D plans to find the one that best suits your needs and budget. Medicare.gov provides valuable comparison tools.

-

Understand Your Needs: Consider factors like your current health status, prescription drug usage, and preferred healthcare providers when selecting a plan.

-

Seek Professional Advice: A Medicare specialist or a qualified insurance agent can provide personalized guidance and help you navigate the complexities of the system.

Common Medicare Enrollment Mistakes to Avoid:

-

Not enrolling during the IEP: This can lead to significant penalties for Part B.

-

Not understanding the different parts of Medicare: Failing to grasp the nuances of each part (A, B, C, and D) can result in inadequate coverage.

-

Choosing a plan without comparing options: Failing to compare plans can lead to paying more for less coverage.

-

Ignoring late enrollment penalties: Understanding the implications of late enrollment is crucial for avoiding substantial financial burdens.

-

Not reviewing your plan annually: Your healthcare needs and the Medicare landscape change. Reviewing your plan annually ensures you're receiving the most suitable coverage.

Conclusion: Empowering Your Medicare Journey

Navigating Medicare enrollment requires careful planning and a solid understanding of its intricacies. By understanding the eligibility requirements, the various parts of Medicare, the critical enrollment periods, and the common pitfalls, you can confidently make informed choices to secure the most appropriate and cost-effective coverage for your healthcare needs. Remember, proactive planning is key to a smooth and successful Medicare enrollment experience. Don't hesitate to seek professional assistance if needed, ensuring you’re well-equipped to embark on this crucial stage of your healthcare journey. Your health and financial well-being depend on making informed decisions during the Medicare enrollment process.

Latest Posts

Latest Posts

-

How Many Acres Are In A Section Of Land

Mar 31, 2025

-

Careers In Science Technology Engineering And Mathematics Quizlet

Mar 31, 2025

-

If You Are Charged With Selling Providing Delivering Alcohol Class B

Mar 31, 2025

-

What Is The Underlying Concept Regarding Level Premiums

Mar 31, 2025

-

Care Of The Patient With Hiv Aids Quizlet

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Which Is A Characteristic Of Medicare Enrollment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.