Which Of The Following Describes A General Ledger

Breaking News Today

Mar 14, 2025 · 6 min read

Table of Contents

Which of the Following Describes a General Ledger?

The general ledger is the cornerstone of any accounting system. Understanding its function is crucial for anyone involved in finance, from small business owners to seasoned accountants. This comprehensive guide will delve into the nature of a general ledger, exploring its definition, purpose, components, and how it differs from other accounting records. We'll address the question directly: which of the following describes a general ledger? by outlining the key characteristics that distinguish it.

Understanding the General Ledger: A Core Accounting Concept

Before we tackle specific descriptions, let's solidify our understanding of the general ledger itself. In essence, the general ledger is a central repository of all financial transactions for a business. It's a collection of accounts that chronologically records every debit and credit entry, providing a comprehensive overview of a company's financial position. Think of it as the heart of the accounting system, constantly pulsing with the lifeblood of financial activity.

This single, integrated record keeps track of all financial activity, ensuring accuracy and facilitating the creation of financial statements. Its importance cannot be overstated – it's the foundation upon which financial reporting is built.

Key Characteristics of a General Ledger

Several characteristics define a general ledger and distinguish it from other accounting records:

-

Centralized Record: It consolidates all transactions from various sources into one place. This centralization is key for maintaining a complete and consistent financial picture.

-

Chronological Ordering: Entries are typically recorded in chronological order, meaning the order in which they occurred. This allows for tracking financial activity over time and facilitates auditing processes.

-

Double-Entry Bookkeeping: The general ledger adheres to the principle of double-entry bookkeeping. Every transaction impacts at least two accounts – a debit and a credit – ensuring the accounting equation (Assets = Liabilities + Equity) always remains balanced.

-

Account-Based Structure: The ledger is organized into individual accounts, each representing a specific aspect of the business's finances (e.g., Cash, Accounts Receivable, Inventory, Accounts Payable, Revenue, Expenses).

-

Basis for Financial Statements: The data within the general ledger forms the raw material for generating key financial statements like the balance sheet, income statement, and statement of cash flows.

Differentiating the General Ledger from Other Accounting Records

To fully grasp the nature of a general ledger, it's helpful to compare and contrast it with other accounting records.

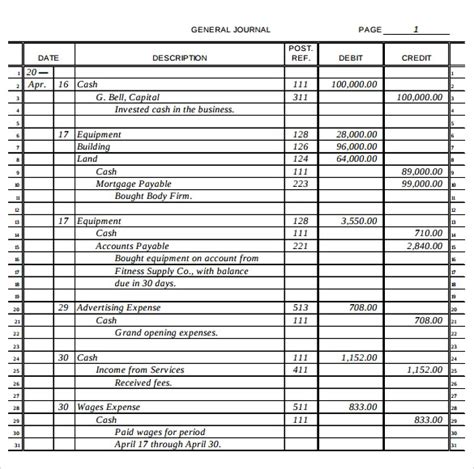

1. Journal Entries vs. General Ledger

While often confused, journal entries and the general ledger serve distinct purposes:

-

Journal Entries: These are the initial recordings of transactions. They detail the accounts affected, the amounts involved, and a brief description. Think of journal entries as the raw data.

-

General Ledger: The general ledger is where the information from journal entries is posted and summarized. It provides a consolidated view of all account balances. It's the organized summary of the raw data.

2. Subsidiary Ledgers vs. General Ledger

Subsidiary ledgers offer a more detailed breakdown of specific account types within the general ledger:

-

Subsidiary Ledgers: These contain more granular details on specific accounts, such as individual customer balances (Accounts Receivable subsidiary ledger) or individual supplier balances (Accounts Payable subsidiary ledger).

-

General Ledger: The general ledger provides a summarized overview of all accounts, while subsidiary ledgers provide the detailed supporting information for specific account types. The subsidiary ledgers feed into the general ledger.

3. Trial Balance vs. General Ledger

A trial balance is a snapshot in time derived from the general ledger:

-

Trial Balance: This is a report that lists the balances of all accounts in the general ledger at a specific point in time. It helps verify that the debits and credits are equal, indicating the accounting equation is balanced.

-

General Ledger: The trial balance is created from the general ledger. The general ledger provides the ongoing, chronological record, while the trial balance provides a summary at a particular point in time.

Common Descriptions of a General Ledger: Which One is Correct?

Now let's address the core question: which of the following descriptions accurately portrays a general ledger? While a definitive list is impossible without knowing the specific options provided, we can explore several common descriptions and determine their accuracy.

Accurate Descriptions:

-

A centralized record of all financial transactions: This is a fundamental characteristic, highlighting the consolidation of all financial activity into a single repository.

-

A collection of accounts showing debits and credits: This emphasizes the account-based structure and the double-entry bookkeeping system inherent in the general ledger.

-

The foundation for preparing financial statements: This emphasizes the general ledger's crucial role in providing the data needed for generating the balance sheet, income statement, and statement of cash flows.

-

A chronological record of financial transactions: This highlights the temporal aspect – the recording of transactions in the order they occurred.

-

A system that maintains the accounting equation: This points to the core principle of double-entry bookkeeping and the general ledger's role in ensuring that the accounting equation remains balanced.

Inaccurate or Incomplete Descriptions:

-

A journal entry showing a single transaction: This is incorrect as the general ledger contains a summary of many journal entries, not just one.

-

A subsidiary ledger detailing specific accounts: This is incorrect as a subsidiary ledger provides detail on specific accounts, while the general ledger provides a summary of all accounts.

-

A report summarizing financial performance for a specific period: This is closer to the description of an income statement or a trial balance. While the general ledger data informs these reports, it's not the report itself.

-

A list of assets and liabilities: While the general ledger contains accounts related to assets and liabilities, it's much broader and includes equity, revenue, and expense accounts as well.

Importance of a Well-Maintained General Ledger

A meticulously maintained general ledger is essential for several reasons:

-

Accurate Financial Reporting: Accurate financial statements rely directly on accurate general ledger data. Errors in the general ledger will directly impact the reliability of financial reports.

-

Effective Decision-Making: Reliable financial data enables informed business decisions concerning pricing, investments, expansion, and more.

-

Compliance and Auditing: A well-maintained general ledger simplifies audits and ensures compliance with regulatory requirements. Auditors rely heavily on the general ledger to verify the accuracy of financial information.

-

Improved Internal Controls: A robust general ledger system helps strengthen internal controls by providing a clear audit trail of all financial transactions, reducing the risk of fraud and errors.

-

Streamlined Operations: An efficient general ledger system streamlines accounting operations, freeing up time and resources for other essential tasks.

Conclusion: The Heart of the Accounting System

The general ledger is the core component of any sound accounting system. Its ability to centralize, organize, and summarize financial transactions is invaluable for accurate financial reporting, informed decision-making, and regulatory compliance. By understanding its characteristics and its relationship to other accounting records, you can gain a deeper appreciation for its critical role in the financial health of any organization. Choosing a description of a general ledger should always consider these essential aspects: its centralized nature, its chronological recording of transactions using double-entry bookkeeping, and its function as the basis for all financial statements. Ignoring these core attributes will lead to an incomplete or inaccurate understanding of this fundamental accounting tool.

Latest Posts

Latest Posts

-

Match Each Expedition With The Leader Who Funded It

May 09, 2025

-

Art Labeling Activity Accessory Structures Of The Eye

May 09, 2025

-

The Risk Of Wrongful Termination Lawsuits Is Reduced With Careful

May 09, 2025

-

When Cylinders Are Transported By Power Vehicles

May 09, 2025

-

Grants Are Targeted For Specific Purposes

May 09, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Describes A General Ledger . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.