Which Of The Following Is Not A Period Cost

Breaking News Today

Mar 27, 2025 · 6 min read

Table of Contents

Which of the Following is Not a Period Cost? Understanding Cost Classification in Accounting

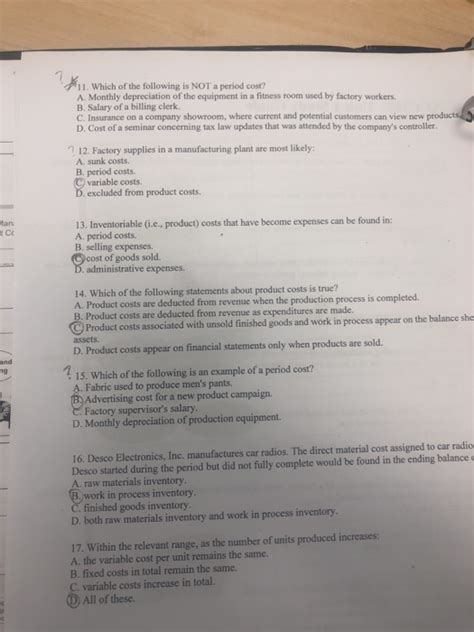

Cost accounting is the bedrock of sound financial management. Understanding how costs are classified is crucial for accurate financial reporting, effective decision-making, and successful business operations. One key classification is the distinction between product costs and period costs. This article delves deep into this crucial distinction, focusing specifically on identifying which of various costs are not period costs. We'll explore different cost categories, provide clear examples, and offer practical insights to solidify your understanding.

Understanding Product Costs vs. Period Costs

Before we dive into identifying which costs are not period costs, let's establish a clear understanding of both categories.

Product Costs (Manufacturing Costs): These are costs directly associated with the production of goods. They are included in the cost of inventory until the goods are sold, at which point they are expensed on the income statement as cost of goods sold (COGS). Product costs are comprised of:

- Direct Materials: The raw materials that become part of the finished product (e.g., wood for furniture, steel for automobiles).

- Direct Labor: The wages paid to workers directly involved in the manufacturing process (e.g., assembly line workers, machinists).

- Manufacturing Overhead: All other costs incurred in the manufacturing process that are not directly traceable to specific products. This includes indirect materials, indirect labor, factory rent, utilities, and depreciation of factory equipment.

Period Costs: Unlike product costs, period costs are not directly tied to the production of goods. They are expensed in the period they are incurred, regardless of whether goods are sold. These costs are often associated with selling, general, and administrative activities. Examples include:

- Selling Expenses: Costs associated with marketing and selling products (e.g., advertising, sales commissions, shipping costs).

- General and Administrative Expenses: Costs related to overall business operations (e.g., salaries of administrative staff, rent for office space, insurance).

- Research and Development Expenses: Costs incurred in developing new products or improving existing ones.

Identifying Costs That Are NOT Period Costs: A Detailed Analysis

Now, let's tackle the core question: which of the following is not a period cost? To effectively answer this, we need to consider various cost scenarios. The key is to determine whether the cost is directly tied to production (product cost) or to the general operation and administration of the business (period cost).

Let's examine several examples:

1. Direct Materials: This is unequivocally not a period cost. As a fundamental component of product cost, it's directly involved in creating the final product and is expensed only when the product is sold as part of COGS.

2. Factory Rent: This is not a period cost, provided it relates directly to manufacturing. If the rent is for the factory where production takes place, it's considered manufacturing overhead, a component of product cost. However, if the rent is for administrative offices, it becomes a period cost (general and administrative expense).

3. Sales Commissions: This is a period cost. It's directly related to selling the product, not producing it. Sales commissions are expensed in the period they are earned.

4. Depreciation of Factory Equipment: This is not a period cost. Depreciation of equipment used in the manufacturing process is considered manufacturing overhead, a component of the product cost.

5. Salaries of Administrative Staff: This is a period cost. These salaries are related to the general administration of the business and are not directly involved in production.

6. Advertising Expenses: This is a period cost. Advertising is a selling expense and is incurred to promote the sale of goods, not their manufacture.

7. Direct Labor: This is not a period cost. Wages paid to workers directly involved in production are a fundamental component of product cost.

8. Utilities for the Factory: Similar to factory rent, if the utilities are consumed in the factory during the manufacturing process, they are considered manufacturing overhead and therefore not a period cost. However, if these utilities are for administrative offices, they are classified as period costs.

9. Insurance on Factory Buildings: Insurance on the factory building is a component of manufacturing overhead; therefore it's not a period cost.

10. Research and Development Costs: While often capitalized initially, R&D costs are eventually expensed and are therefore considered period costs, despite potentially contributing to future product development.

11. Freight-in Costs (on raw materials): These are costs incurred to transport raw materials to the factory. They are considered part of direct materials cost, making them not a period cost.

12. Freight-out Costs (on finished goods): This refers to the cost of shipping finished goods to customers. This is a selling expense, making it a period cost.

13. Office Supplies: Costs associated with administrative office supplies are categorized as general and administrative expenses, hence they are period costs.

14. Legal Fees (relating to product liability): Depending on the context, this could be classified as either a product cost or period cost. If directly related to a specific product's defect, it could potentially be a product cost. However, legal fees associated with the general operations of the company would be considered a period cost.

15. Warranty Expenses: Similar to legal fees, warranty expenses are usually considered period costs unless tied directly to a specific faulty product.

Practical Implications of Understanding Period Costs

Correctly classifying costs as product or period costs has significant implications:

- Inventory Valuation: Product costs directly impact the valuation of inventory. Accurate classification ensures that inventory is valued correctly on the balance sheet.

- Cost of Goods Sold: Product costs determine the cost of goods sold, which affects the gross profit and net income reported on the income statement.

- Profitability Analysis: Understanding the breakdown of product and period costs facilitates effective profitability analysis, allowing businesses to identify areas for cost reduction and improvement.

- Decision-Making: Correct cost classification is essential for informed decision-making regarding pricing, production levels, and other strategic business choices.

Conclusion: Mastering Cost Classification

The distinction between product and period costs is a cornerstone of managerial accounting. Accurately identifying which costs are not period costs is vital for generating reliable financial reports, making sound business decisions, and optimizing operational efficiency. While the examples above provide a solid foundation, remember that the specific classification of a cost can be context-dependent. Careful analysis and a thorough understanding of the nature of the cost are key to accurate classification. By consistently applying these principles, businesses can achieve a clear and precise understanding of their cost structure, leading to improved profitability and sustainable growth. The more accurately you classify costs, the stronger your financial foundation will become.

Latest Posts

Latest Posts

-

Which Of The Following Statements Is True About Managerial Compensation

Mar 30, 2025

-

Ordered A Blockade To Prevent Trade And Communication

Mar 30, 2025

-

Correctly Label The Following Parts Of The Male Reproductive System

Mar 30, 2025

-

Consider The Following Scenarios Which Behaviors Must Be Reported

Mar 30, 2025

-

Giuseppe Garibaldi Helped The Nationalist Cause By

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is Not A Period Cost . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.