Which One Of The Following Is A Primary Market Transaction

Breaking News Today

Mar 20, 2025 · 6 min read

Table of Contents

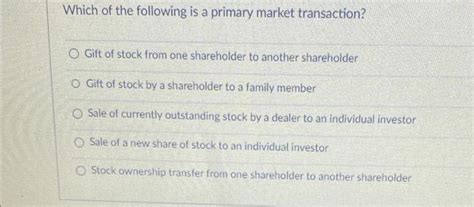

Which One of the Following is a Primary Market Transaction? Understanding Primary and Secondary Markets

The financial world can seem like a labyrinth of complex transactions, but understanding the difference between primary and secondary markets is crucial, especially for investors. This article delves deep into the definition and characteristics of primary market transactions, contrasting them with secondary market activity to solidify your understanding. We'll explore various scenarios, examining which transactions qualify as primary and why, ultimately equipping you with the knowledge to confidently identify a primary market transaction.

Defining Primary and Secondary Markets

Before we dive into specific examples, let's establish a clear definition of each market type.

Primary Market: This is where securities are created and sold for the first time. Think of it as the "initial public offering" (IPO) stage for stocks or the first issuance of bonds. The issuer (company or government) receives the proceeds from the sale directly. No existing securities are traded hands; new ones are created. Key players include investment banks underwriting the offering and initial investors purchasing the securities.

Secondary Market: This is where existing securities are traded between investors. Think of the New York Stock Exchange (NYSE) or NASDAQ. The original issuer does not receive any funds from transactions in the secondary market. The price of the security is determined by supply and demand among investors. The secondary market provides liquidity, allowing investors to buy and sell securities easily.

The distinction between these two markets is crucial because the implications for the issuer and investors are drastically different. Understanding this difference is fundamental to making sound investment decisions.

Identifying a Primary Market Transaction: Key Characteristics

Several key characteristics distinguish a primary market transaction. Let's explore these characteristics to clarify the identification process.

1. Issuance of New Securities:

This is the most fundamental characteristic. A primary market transaction always involves the creation and sale of brand-new securities. These securities haven't been traded before; they're entering the market for the very first time. This contrasts sharply with secondary market transactions, which involve the trading of existing securities.

2. Funds Flow Directly to the Issuer:

The proceeds from the sale of securities in a primary market transaction go directly to the entity issuing them. This is a crucial differentiator. In a secondary market transaction, the funds change hands between investors; the original issuer doesn't receive any money.

3. Involvement of Investment Banks (Often):

While not always mandatory, investment banks often play a significant role in primary market transactions. They act as underwriters, helping companies prepare and issue securities. Their involvement is a strong indicator of a primary market offering. This support in pricing, marketing, and distribution is key to a successful primary market issuance.

4. Prospectus and Registration:

Most primary market offerings require a detailed prospectus outlining the investment opportunity. This document provides crucial information to potential investors, helping them make informed decisions. Further, the offering often requires registration with regulatory bodies, ensuring transparency and compliance with securities laws.

Scenarios: Primary vs. Secondary Market Transactions

Let's examine several scenarios to illustrate the difference:

Scenario 1: IPO of a Tech Startup

A newly formed technology company, "InnovateTech," decides to go public. It hires an investment bank to manage its IPO, offering shares to the public for the first time. Investors who purchase these shares are participating in a primary market transaction. InnovateTech receives the proceeds from the sale, using the funds to expand its operations. This is a quintessential example of a primary market transaction.

Scenario 2: Trading Shares of a Listed Company

John buys 100 shares of "MegaCorp" from Jane on the NYSE. This is a secondary market transaction. MegaCorp doesn't receive any money from this trade; the funds flow directly between John and Jane. The transaction simply transfers ownership of existing securities.

Scenario 3: A Government Issuing Bonds

The government issues new treasury bonds to finance infrastructure projects. Investors purchase these bonds directly from the government. This is a primary market transaction. The government receives the funds, utilizing them to fund the intended projects. This is analogous to a company issuing shares but at the governmental level.

Scenario 4: Purchasing Shares in a Private Placement

A small company, "GreenEnergy," raises capital by selling shares privately to a limited group of accredited investors. This is a primary market transaction. GreenEnergy receives the proceeds, bypassing the public markets entirely. While this is a less common primary market transaction compared to IPOs, it still fundamentally involves new securities being created and sold by the issuer for the first time.

Scenario 5: Buying and Selling Options Contracts

Purchasing or selling call or put options on already existing stocks is a secondary market transaction. The underlying assets remain the same; you are simply trading the right to buy or sell at a predetermined price in the future. This doesn't create new securities; it's a derivative transaction based on existing ones.

Scenario 6: Buying Mutual Funds

When you purchase shares of a mutual fund, you're essentially investing in a portfolio of existing securities. The fund manager may buy and sell securities within the fund's portfolio, but these are secondary market transactions. Your purchase of fund shares themselves are often considered secondary market transactions as you are purchasing shares that already exist. However, if the mutual fund issues new shares, that would be a primary market transaction.

The Importance of Understanding Primary Market Transactions

Understanding the distinction between primary and secondary markets is pivotal for several reasons:

-

Investment Strategy: Knowing whether you're investing in the primary or secondary market informs your investment strategy. Primary market investments offer the potential for higher returns but also carry greater risk. Secondary market investments offer more liquidity and typically lower risk.

-

Company Funding: Primary market transactions are vital for companies seeking to raise capital for expansion, research and development, or other strategic initiatives. Without primary markets, many businesses would struggle to obtain the necessary funding.

-

Economic Growth: Primary markets play a crucial role in economic growth by channeling capital to businesses and governments, fostering innovation and development.

-

Regulatory Oversight: Primary market offerings are subject to stringent regulations to protect investors and maintain market integrity. Understanding these regulations is important for both issuers and investors.

Conclusion: Identifying the Primary Market

Identifying a primary market transaction hinges on recognizing the issuance of new securities and the direct flow of funds to the issuing entity. While investment banks often participate, the fundamental characteristic remains the creation and initial sale of securities. By understanding these core principles and applying them to different scenarios, you can confidently differentiate between primary and secondary market transactions. Remember, this understanding is a cornerstone of financial literacy, crucial for both investment success and a comprehensive grasp of the broader financial landscape.

Latest Posts

Latest Posts

-

Which Is Not An Aspect Of Individual Sports

Mar 20, 2025

-

Osha Enforces The Guidelines Developed By The Cdc For

Mar 20, 2025

-

When Driving A Truck Or Suv You Should

Mar 20, 2025

-

A Nurse Is Caring For A Client Who Has Schizophrenia

Mar 20, 2025

-

El Tomate Se Introdujo A Europa Como Planta Ornamental

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about Which One Of The Following Is A Primary Market Transaction . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.