Which Statement Below Correctly Explains What Merchandise Inventory Is

Breaking News Today

Mar 26, 2025 · 7 min read

Table of Contents

- Which Statement Below Correctly Explains What Merchandise Inventory Is

- Table of Contents

- Which Statement Below Correctly Explains What Merchandise Inventory Is?

- Defining Merchandise Inventory: The Heart of Retail and Resale

- Types of Merchandise Inventory: A Closer Look

- 1. Goods Available for Sale:

- 2. Goods in Transit:

- 3. Goods on Consignment:

- 4. Damaged or Obsolete Goods:

- 5. Returned Goods:

- The Importance of Merchandise Inventory in Accounting

- Inventory Costing Methods: Choosing the Right Approach

- Inventory Management and its Impact on Business Success

- Conclusion: Mastering Merchandise Inventory for Business Success

- Latest Posts

- Latest Posts

- Related Post

Which Statement Below Correctly Explains What Merchandise Inventory Is?

Understanding merchandise inventory is crucial for businesses of all sizes. It's a core component of the financial statements and directly impacts profitability, cash flow, and overall business health. This comprehensive guide will delve into the definition of merchandise inventory, explore different types, discuss its importance in accounting, and address common misconceptions. We’ll also examine how to accurately value inventory and the impact of inventory management on a company's success.

Defining Merchandise Inventory: The Heart of Retail and Resale

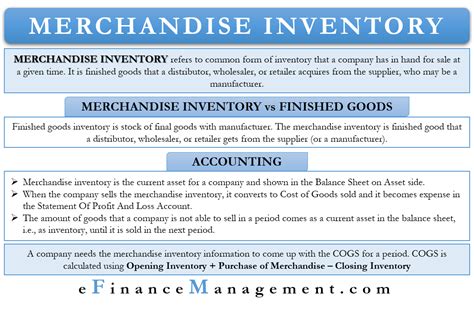

The most accurate statement explaining merchandise inventory is: Merchandise inventory represents goods purchased for resale to customers in the ordinary course of business. This definition highlights the key characteristic: the intention to sell, not to use in production. It differentiates merchandise inventory from other types of inventory, such as raw materials (used in manufacturing) or work-in-progress (partially finished goods).

Let's break this down further:

- Goods: This refers to tangible products held for sale. It encompasses a wide range, from single items to complex assemblies.

- Purchased: The goods are acquired from external suppliers, not produced internally.

- For Resale: This distinguishes merchandise inventory from other assets. The primary purpose is to generate revenue through sales.

- Ordinary Course of Business: This implies the goods are regularly sold as part of the company’s normal operations.

Incorrect Statements & Common Misconceptions:

Several statements might seem similar but fundamentally misunderstand merchandise inventory:

- "Merchandise inventory is anything a company owns." This is incorrect. A company owns many assets beyond inventory, such as buildings, equipment, and cash.

- "Merchandise inventory is only finished goods." While finished goods are indeed part of merchandise inventory for retailers, it’s not limited to that. A retailer might also hold goods in transit or goods returned by customers, all of which would be considered inventory.

- "Merchandise inventory is only relevant for large corporations." The concept of merchandise inventory is vital for businesses of all sizes, from small online retailers to multinational corporations. Accurate inventory management is essential for profitability regardless of scale.

- "Merchandise inventory is the same as raw materials." Raw materials are used in production, not sold directly to customers. They are a different type of inventory used in manufacturing businesses.

Types of Merchandise Inventory: A Closer Look

Understanding the different types of merchandise inventory is crucial for accurate accounting and effective inventory management. These categories often overlap, and a company may hold inventory in several states simultaneously.

1. Goods Available for Sale:

This encompasses all the goods a company possesses that are intended for sale. This includes:

- Beginning Inventory: The value of inventory at the start of an accounting period.

- Purchases: Goods acquired during the accounting period. This includes transportation costs (freight-in) if they are a significant portion of the purchase price.

- Net Purchases: This calculation adjusts gross purchases for purchase returns, allowances, and discounts received. It gives a more accurate picture of the net cost of goods acquired.

2. Goods in Transit:

These are goods that have been shipped by the supplier but have not yet reached the buyer's warehouse or store. Ownership is often determined by the shipping terms (FOB shipping point or FOB destination).

3. Goods on Consignment:

These are goods that belong to one company but are held and sold by another. The consignee (the company holding the goods) doesn’t own them and only receives a commission on sales. The consignor (the owner) maintains ownership until the goods are sold.

4. Damaged or Obsolete Goods:

These are goods that have been damaged, become outdated, or are no longer saleable at their original price. They still form part of the inventory until they are written off. Companies must account for the potential loss in value associated with these items.

5. Returned Goods:

These are goods that customers have returned to the seller. They are generally inspected and, if deemed saleable, re-entered into the inventory.

The Importance of Merchandise Inventory in Accounting

Accurate accounting for merchandise inventory is essential for several reasons:

-

Determining Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold during a period. For merchandising businesses, COGS is calculated using the beginning inventory, purchases, and ending inventory. The formula is: Beginning Inventory + Purchases - Ending Inventory = Cost of Goods Sold. COGS is a critical figure for calculating gross profit and net income.

-

Calculating Gross Profit: Gross profit is calculated by subtracting COGS from revenue. A higher gross profit indicates better pricing strategies and efficient cost management of inventory.

-

Financial Statement Reporting: Inventory is reported as a current asset on the balance sheet. The value of inventory impacts the company's liquidity and overall financial position.

-

Inventory Turnover Ratio: This ratio measures how efficiently a company is managing its inventory. A high turnover ratio suggests efficient inventory management, while a low ratio might indicate slow-moving or obsolete inventory.

-

Tax Implications: Inventory valuation directly affects a company's taxable income. Different inventory costing methods (discussed below) can lead to variations in reported income and tax liabilities.

Inventory Costing Methods: Choosing the Right Approach

There are several methods for determining the cost of goods sold and the value of ending inventory. The choice depends on the company's industry, inventory characteristics, and management preferences. The most common methods include:

-

First-In, First-Out (FIFO): This method assumes that the oldest inventory items are sold first. During periods of inflation, FIFO generally leads to a higher net income because the cost of goods sold is lower (using older, cheaper costs). This can result in higher taxes.

-

Last-In, First-Out (LIFO): This method assumes that the newest inventory items are sold first. During periods of inflation, LIFO generally leads to a lower net income because the cost of goods sold is higher (using newer, more expensive costs). This can result in lower taxes. LIFO is not permitted under IFRS.

-

Weighted-Average Cost: This method calculates the average cost of all inventory items available for sale during the period. This average cost is then used to determine the cost of goods sold and the value of ending inventory. This method simplifies accounting and reduces the impact of price fluctuations.

Inventory Management and its Impact on Business Success

Effective inventory management is critical for maximizing profitability and minimizing losses. Key aspects include:

-

Demand Forecasting: Accurately predicting future demand helps companies optimize inventory levels and avoid stockouts or excessive inventory buildup.

-

Order Management: Efficient order management processes ensure timely procurement of goods, minimizing stockouts and related losses.

-

Inventory Control Systems: These systems track inventory levels, monitor stock movement, and provide alerts when stock falls below reorder points.

-

Storage and Handling: Proper storage and handling procedures minimize damage, spoilage, and obsolescence.

-

Regular Stocktaking: Physical inventory counts help reconcile inventory records with actual stock levels, identifying discrepancies and ensuring accuracy.

-

Waste Reduction: Implementing strategies to reduce waste minimizes losses and improves efficiency.

-

Technology Integration: Utilizing technologies like barcode scanners, RFID tags, and inventory management software provides real-time visibility into inventory levels and movements.

Conclusion: Mastering Merchandise Inventory for Business Success

Merchandise inventory is a vital asset for any business involved in buying and selling goods. Understanding its definition, different types, and accounting implications is paramount for accurate financial reporting and informed decision-making. Choosing the appropriate inventory costing method and implementing effective inventory management strategies are crucial for optimizing profitability, improving efficiency, and ensuring the long-term success of the business. By carefully managing inventory, businesses can minimize losses, maximize sales, and maintain a healthy financial position. Continuous monitoring, analysis, and adaptation of inventory management strategies are essential to stay ahead of market changes and maintain a competitive advantage. The key takeaway is that merchandise inventory isn't just about what's on the shelves; it's a crucial element of overall business strategy and financial health.

Latest Posts

Latest Posts

-

Explain The Difference Between Symmetry And Asymmetry

Mar 29, 2025

-

A Persons Metabolism Remains Constant Throughout Life

Mar 29, 2025

-

What Type Of Rider Would Be Added To An Accident

Mar 29, 2025

-

You Have Completed 2 Minutes Of Cpr

Mar 29, 2025

-

Match Each Event With The Appropriate Stage Of Meiosis

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about Which Statement Below Correctly Explains What Merchandise Inventory Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.