3.03 Quiz: Health And Life Insurance 3

Breaking News Today

Mar 20, 2025 · 7 min read

Table of Contents

3.03 Quiz: Health and Life Insurance 3: A Comprehensive Guide

This comprehensive guide delves deep into the intricacies of health and life insurance, providing a thorough understanding of the concepts tested in a hypothetical "3.03 Quiz." We'll cover key definitions, crucial distinctions between different policy types, and practical applications to solidify your knowledge. This in-depth analysis will equip you to confidently navigate the complexities of insurance planning.

Understanding Health Insurance: The Basics

Health insurance is a contract between you and an insurance company, where the company agrees to pay a portion of your medical expenses in exchange for regular premium payments. It's a crucial safety net, protecting you from potentially devastating financial burdens associated with illness or injury.

Key Terms in Health Insurance:

- Premium: The recurring payment you make to maintain your insurance coverage.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Copay: A fixed fee you pay for a medical service, like a doctor's visit.

- Coinsurance: The percentage of costs you share with your insurer after meeting your deductible.

- Out-of-Pocket Maximum: The maximum amount you'll pay for covered services in a plan year. Once you reach this limit, your insurance covers 100% of costs.

- Network: A group of healthcare providers (doctors, hospitals) contracted with your insurance company to provide services at negotiated rates. Using in-network providers generally leads to lower out-of-pocket costs.

- Pre-existing Condition: A health issue you had before enrolling in a health insurance plan. The Affordable Care Act (ACA) in many countries prohibits insurers from denying coverage or charging higher premiums based on pre-existing conditions. However, specific rules and waiting periods may still apply depending on your location and plan.

- Health Savings Account (HSA): A tax-advantaged savings account used to pay for eligible medical expenses. HSAs are often coupled with high-deductible health plans.

- Flexible Spending Account (FSA): Similar to an HSA, but funds aren't rolled over year to year. Unused funds are forfeited at the end of the plan year.

Types of Health Insurance Plans:

Understanding different plan types is crucial for choosing the best fit for your needs and budget. Here are some common variations:

- HMO (Health Maintenance Organization): Typically requires choosing a primary care physician (PCP) who acts as a gatekeeper, referring you to specialists within the network. Generally, the most affordable option but offers limited choice of providers outside the network.

- PPO (Preferred Provider Organization): Offers greater flexibility, allowing you to see specialists without a referral. However, costs are usually higher when using out-of-network providers.

- EPO (Exclusive Provider Organization): Similar to an HMO, but you typically have no out-of-network benefits.

- POS (Point of Service): Combines features of HMOs and PPOs, offering a degree of flexibility with potentially higher costs for out-of-network care.

- HDHP (High Deductible Health Plan): Characterized by a high deductible, lower premiums, and often paired with an HSA.

Choosing the right health insurance plan requires careful consideration of your healthcare needs, budget, and preferred level of flexibility.

Understanding Life Insurance: Protecting Your Loved Ones

Life insurance provides a financial safety net for your beneficiaries (family, dependents) in the event of your death. The policy pays out a death benefit, which can help cover expenses like funeral costs, outstanding debts, mortgage payments, and provide financial security for your family.

Key Terms in Life Insurance:

- Policyholder: The person who purchases the life insurance policy.

- Beneficiary: The person or entity who receives the death benefit upon the policyholder's death.

- Death Benefit: The amount of money paid to the beneficiary upon the policyholder's death.

- Premium: The regular payment made to maintain the life insurance policy.

- Face Value: Another term for the death benefit.

- Cash Value (for permanent policies): A savings component that builds up over time within the policy. This can be borrowed against or withdrawn.

- Term Life Insurance: Provides coverage for a specific period (term), after which the policy expires. Generally, the most affordable type of life insurance.

- Permanent Life Insurance: Offers lifelong coverage, and typically includes a cash value component. Examples include whole life, universal life, and variable life insurance.

Types of Life Insurance:

-

Term Life Insurance: The simplest and most affordable type. Provides coverage for a specified period (e.g., 10, 20, or 30 years). If you die within the term, the death benefit is paid to your beneficiary. If you outlive the term, the policy expires.

-

Whole Life Insurance: Provides lifelong coverage and builds cash value that grows tax-deferred. Premiums are typically fixed and higher than term life insurance.

-

Universal Life Insurance: Offers flexibility in premium payments and death benefit adjustments. Cash value grows based on interest rates, offering some potential for investment growth.

-

Variable Life Insurance: Allows you to invest the cash value component in different sub-accounts, potentially offering higher returns but also higher risk.

Choosing the right life insurance policy hinges on your individual circumstances, risk tolerance, and financial goals. Factors to consider include your age, health, financial obligations, and the needs of your beneficiaries.

Navigating the Hypothetical "3.03 Quiz": Putting it All Together

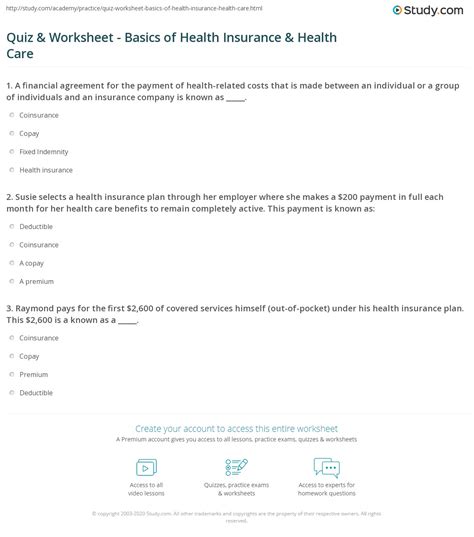

A hypothetical "3.03 Quiz" on health and life insurance would likely test your understanding of the key concepts discussed above. Here are some sample questions and how to approach them:

Sample Question 1: What is the difference between a deductible and a copay in health insurance?

Answer: A deductible is the amount you pay out-of-pocket before your insurance coverage begins. A copay is a fixed fee you pay for a medical service, regardless of whether you've met your deductible.

Sample Question 2: Explain the key differences between term life insurance and whole life insurance.

Answer: Term life insurance provides coverage for a specific period, and is generally more affordable. Whole life insurance provides lifelong coverage and builds cash value, but comes with higher premiums.

Sample Question 3: What is a Health Savings Account (HSA), and what type of health insurance plan is it typically associated with?

Answer: An HSA is a tax-advantaged savings account used to pay for eligible medical expenses. It's typically associated with high-deductible health plans (HDHPs).

Sample Question 4: You are comparing two health insurance plans: Plan A has a lower premium but a higher deductible, while Plan B has a higher premium but a lower deductible. What factors should you consider when deciding which plan is right for you?

Answer: Consider your health history, anticipated healthcare needs, and budget. If you are generally healthy and expect few medical expenses, Plan A might be more economical. If you anticipate higher healthcare costs or prefer lower out-of-pocket expenses, Plan B might be a better choice, despite the higher premium.

Sample Question 5: What is the role of a beneficiary in a life insurance policy?

Answer: The beneficiary is the designated person or entity who receives the death benefit upon the death of the policyholder.

By understanding these key concepts and practicing with similar questions, you can confidently tackle any quiz or real-world situation involving health and life insurance. Remember that consulting with a qualified insurance professional is always recommended to ensure you choose the best policy to meet your specific needs.

Advanced Considerations: Beyond the Basics

While the core concepts are vital, a deeper understanding necessitates exploring these advanced topics:

-

Employer-Sponsored Insurance: Many employers offer health insurance as an employee benefit. Understanding your options and the enrollment process is crucial.

-

Medicare and Medicaid: These government-sponsored programs provide health insurance for seniors and low-income individuals, respectively. Understanding eligibility requirements and benefits is vital for those who qualify.

-

Insurance Regulations and Consumer Protections: Familiarize yourself with relevant insurance regulations in your area, which can provide important consumer protections.

-

Long-Term Care Insurance: This specialized insurance helps cover the costs of long-term care, such as nursing homes or assisted living facilities. It's a valuable consideration as we age.

-

Disability Insurance: Protects your income if you become disabled and unable to work. This can be crucial for financial security.

Successfully navigating the world of health and life insurance requires ongoing learning and adaptation. By staying informed and actively engaging with these topics, you can make informed decisions that protect your financial well-being and the future of your loved ones. Remember, this information is for educational purposes only and should not substitute advice from a qualified insurance professional.

Latest Posts

Latest Posts

-

The Common Cold Hepatitis And Measles Are Examples Of

Mar 20, 2025

-

Ati Rn Comprehensive Online Practice 2023 A

Mar 20, 2025

-

What Is The Best Definition Of The Term Characterization

Mar 20, 2025

-

Match Each Picture With The Correct Stage Of Mitosis

Mar 20, 2025

-

Amazon Day 1 Final Exam Answers Pdf

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about 3.03 Quiz: Health And Life Insurance 3 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.