A Company Bought A Computer For 1500 Quizlet

Breaking News Today

Mar 31, 2025 · 6 min read

Table of Contents

A Company Bought a Computer for $1500: A Deep Dive into the Implications

The seemingly simple statement – "A company bought a computer for $1500" – opens a door to a surprisingly complex world of accounting, business strategy, and technological implications. While the initial transaction might appear straightforward, a closer examination reveals a multitude of factors influencing this seemingly mundane purchase. This article will delve into the multifaceted aspects of this scenario, exploring the financial, operational, and strategic considerations involved.

The Financial Implications: More Than Just $1500

The $1500 purchase price is only the tip of the iceberg when it comes to the financial implications. Several key accounting principles and considerations come into play:

1. Capital Expenditure vs. Revenue Expenditure

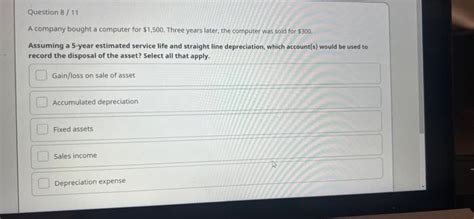

The first crucial distinction is whether the computer is classified as a capital expenditure (CAPEX) or a revenue expenditure (OPEX). This classification significantly impacts how the purchase is recorded on the company's financial statements.

-

Capital Expenditure: If the computer has a useful life of more than one year and contributes to the long-term value of the business (e.g., enhancing productivity, enabling new business opportunities), it's considered a capital expenditure. It's recorded as an asset on the balance sheet and depreciated over its useful life. Depreciation reflects the gradual decrease in the computer's value over time. Various depreciation methods exist (straight-line, declining balance, etc.), each impacting the expense recognized each year.

-

Revenue Expenditure: If the computer's useful life is less than one year or it's primarily for short-term operational needs, it's a revenue expenditure. It's expensed entirely in the year of purchase, directly impacting the company's income statement.

The $1500 price point suggests it's likely a capital expenditure, given the typical lifespan of business computers. However, the specific nature of the computer and its intended use would ultimately determine its classification.

2. Depreciation and Amortization

As mentioned earlier, if the computer is classified as a capital expenditure, the company must depreciate its value over its useful life. This process systematically allocates the cost of the asset over its estimated lifespan. Several factors influence the depreciation calculation:

- Useful Life: How long the company expects the computer to remain functional and useful.

- Salvage Value: The estimated value of the computer at the end of its useful life.

- Depreciation Method: The accounting method used to calculate the annual depreciation expense (straight-line, double-declining balance, units of production, etc.).

The choice of depreciation method can impact the company's reported income and tax liability. A method that accelerates depreciation (like double-declining balance) results in higher depreciation expense in the early years, reducing taxable income.

3. Tax Implications

The purchase of the computer might also have tax implications. Depending on the country and specific tax laws, the purchase may be partially or fully deductible as a business expense (in the case of revenue expenditure) or through depreciation deductions (in the case of capital expenditure). Understanding these tax implications is crucial for optimizing the company's tax burden.

4. Return on Investment (ROI)

The $1500 investment needs to generate a positive return on investment. This requires assessing the computer's contribution to increased productivity, efficiency gains, revenue generation, or cost savings. Key performance indicators (KPIs) should be established to track the computer's impact on the business and determine its overall ROI.

Operational Implications: Impact on Productivity and Efficiency

The acquisition of a new computer impacts the company's day-to-day operations in several ways:

1. Enhanced Productivity

A modern computer with sufficient processing power, memory, and storage can significantly boost employee productivity. Faster processing speeds, improved multitasking capabilities, and reliable performance lead to quicker task completion and overall increased output.

2. Improved Efficiency

The new computer might enable the use of advanced software and applications, streamlining workflows and automating tasks. This can lead to significant efficiency gains, reducing the time and resources required for various business processes.

3. Technological Advancement

The new computer could bring the company up-to-date with the latest technology, allowing access to more advanced software and tools. This can provide a competitive advantage, leading to better decision-making, improved product development, and enhanced customer service.

4. Potential for Downtime

While the new computer is intended to increase productivity, there's always a risk of downtime due to technical issues, software malfunctions, or hardware failures. The company needs to have contingency plans in place to minimize the disruption caused by such events, including backup systems, IT support, and data recovery procedures.

Strategic Implications: Long-Term Business Objectives

The seemingly small purchase of a $1500 computer can have significant strategic implications for the company:

1. Alignment with Business Goals

The purchase should align with the company's overall business objectives and strategic goals. For instance, if the company is aiming to expand its online presence, the new computer might be vital for enhancing its e-commerce capabilities. If the company is focusing on data analytics, a more powerful computer may be crucial for handling large datasets.

2. Competitive Advantage

The new computer might contribute to a competitive advantage by enabling the company to adopt new technologies, improve efficiency, and enhance the quality of its products or services. This could lead to increased market share and profitability.

3. Employee Empowerment

Providing employees with modern and reliable tools like a new computer can empower them to perform their tasks more effectively and contribute more significantly to the company's success. This investment in employee resources can lead to higher job satisfaction and reduced employee turnover.

4. Scalability and Future Growth

The choice of computer should consider the company's future growth plans. A more powerful computer might provide greater scalability, enabling the company to handle increasing workloads and data volumes as it expands.

Conclusion: A Holistic View of a $1500 Investment

The purchase of a $1500 computer, while seemingly insignificant on its own, represents a strategic investment with far-reaching implications. Its financial impact is determined by its classification as CAPEX or OPEX, the chosen depreciation method, and associated tax benefits. Operationally, it can boost productivity, streamline workflows, and enhance efficiency. Strategically, it should contribute to achieving broader business goals, creating a competitive advantage, empowering employees, and facilitating future growth. A comprehensive analysis of these multifaceted aspects is crucial for maximizing the return on this investment and ensuring alignment with the company's overall objectives. Careful consideration of all these factors ensures that the seemingly small expenditure of $1500 contributes meaningfully to the company's long-term success. The key is not just the purchase itself but the strategic planning and implementation that follow, ensuring the computer truly delivers a strong return on investment.

Latest Posts

Latest Posts

-

Clostridium Difficile Associated Diarrhea Is Usually Preceded By

Apr 02, 2025

-

Modifying Your Personal Action Plan Can Impede Personal Fitness Goals

Apr 02, 2025

-

If You Need To Download Something For A Class First

Apr 02, 2025

-

In Florida Deceptive Advertising Is Considered To Be

Apr 02, 2025

-

Indicate Which Muscle Is Highlighted In The Image

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about A Company Bought A Computer For 1500 Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.