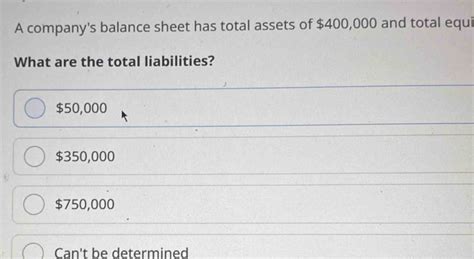

A Company's Balance Sheet Has Total Assets Of $400 000

Breaking News Today

Mar 19, 2025 · 6 min read

Table of Contents

Decoding a Company's Balance Sheet: A Deep Dive into $400,000 in Total Assets

A company's balance sheet is a fundamental financial statement offering a snapshot of its financial health at a specific point in time. It presents a crucial equation: Assets = Liabilities + Equity. Knowing that a company boasts total assets of $400,000 provides a starting point for analysis, but it's merely the tip of the iceberg. To truly understand the company's financial position, we need to delve deeper into the composition of those assets, as well as its liabilities and equity.

Understanding the Balance Sheet Equation

Before we dissect the $400,000 figure, let's reinforce the core principle: the accounting equation. This equation, Assets = Liabilities + Equity, is the bedrock of double-entry bookkeeping. It signifies that everything a company owns (assets) is financed either by what it owes to others (liabilities) or by what its owners have invested (equity).

-

Assets: These are resources controlled by the company as a result of past events and from which future economic benefits are expected to flow to the entity. Examples include cash, accounts receivable (money owed to the company), inventory, property, plant, and equipment (PP&E), and intangible assets (patents, copyrights).

-

Liabilities: These are present obligations of the company arising from past events, the settlement of which is expected to result in an outflow of resources embodying economic benefits. Examples include accounts payable (money owed by the company), salaries payable, loans payable, and deferred revenue.

-

Equity: This represents the residual interest in the assets of the company after deducting all its liabilities. For a corporation, this is often referred to as shareholders' equity and includes contributed capital (money invested by shareholders) and retained earnings (accumulated profits).

Analyzing the $400,000 Total Assets

With the foundational understanding in place, let's explore the potential scenarios that could lead to $400,000 in total assets. Remember, there are countless combinations of assets that could result in this figure. We'll examine a few possible compositions to illustrate the diversity and implications.

Scenario 1: Asset-Heavy Business

Imagine a company primarily focused on manufacturing or construction. Their $400,000 in assets might be heavily weighted towards:

- Property, Plant, and Equipment (PP&E): A significant portion, perhaps $250,000, could be tied up in factory buildings, machinery, and equipment. This suggests a capital-intensive business model with substantial investments in long-term assets.

- Inventory: Another large chunk, say $100,000, could represent raw materials, work-in-progress, and finished goods. This indicates a considerable production volume or a reliance on inventory for sales.

- Cash and Accounts Receivable: The remaining $50,000 might be spread between cash on hand and accounts receivable (money owed by customers). This reveals the company's immediate liquidity position and its credit policies with clients.

Implications: A company with this asset structure faces higher fixed costs due to PP&E depreciation. Inventory management becomes crucial, as excess inventory can tie up capital and lead to obsolescence. The level of accounts receivable suggests the effectiveness of the company's credit and collection processes.

Scenario 2: Service-Oriented Business

Consider a service-based company, like a consulting firm or a software development company. Their $400,000 in assets might be distributed differently:

- Cash and Cash Equivalents: A substantial amount, perhaps $150,000, might be held as cash reserves, providing financial flexibility. This highlights a robust cash flow and financial prudence.

- Accounts Receivable: A significant portion, maybe $100,000, might be tied up in outstanding invoices from clients. This showcases the company's revenue generation capabilities but also the potential for bad debts.

- Other Current Assets: The remaining $150,000 could include prepaid expenses, marketable securities, and other minor assets. This showcases diversity, but the specific components need further analysis.

Implications: A service-oriented company relies less on physical assets. Its success hinges on its service offerings and ability to collect payments from clients. The high level of accounts receivable might necessitate improved collection procedures. The substantial cash position indicates financial health and growth potential.

Scenario 3: A Blend of Assets

A more balanced company might show a mix of assets:

- PP&E: $100,000 (representing moderate investment in physical assets)

- Inventory: $50,000 (suggesting a moderate level of production or retail)

- Accounts Receivable: $75,000 (indicating a relatively healthy credit profile)

- Cash and Cash Equivalents: $75,000 (displaying moderate liquidity)

- Intangible Assets: $100,000 (representing brand value, software licenses, or patents).

Implications: This balanced approach shows diversification, reducing reliance on any single asset type. Analyzing the specific components of intangible assets is crucial for assessing the long-term value and growth potential of the company.

The Importance of Liability and Equity Analysis

Knowing the asset composition is only half the picture. To gain a complete understanding of the company's financial status, we must examine its liabilities and equity. The $400,000 asset figure must be viewed in conjunction with these elements.

Let's illustrate with examples:

Example A: $400,000 Assets, $100,000 Liabilities, $300,000 Equity

This signifies a financially strong company with a substantial equity base. The relatively low liability indicates minimal debt burden, suggesting a healthy financial position.

Example B: $400,000 Assets, $300,000 Liabilities, $100,000 Equity

This shows a different scenario. The high liability level indicates significant debt financing. While the company possesses assets, it's heavily leveraged, posing potential risks in case of economic downturn or reduced revenue.

Example C: $400,000 Assets, $200,000 Liabilities, $200,000 Equity

This represents a balanced approach with an equal split between liabilities and equity. The company utilizes both debt and equity financing, which can offer advantages and risks.

Analyzing Liquidity and Solvency

Beyond the basic accounting equation, the balance sheet provides insights into a company's:

-

Liquidity: This refers to its ability to meet its short-term obligations (due within a year). A higher ratio of current assets (cash, accounts receivable, inventory) to current liabilities (accounts payable, salaries payable) suggests better liquidity.

-

Solvency: This gauges its ability to meet its long-term obligations. The ratio of total assets to total liabilities provides insights into solvency. A higher ratio demonstrates stronger solvency.

Limitations of the Balance Sheet

It’s crucial to acknowledge that the balance sheet provides a static view of the company's financial position at a specific point in time. It does not capture the dynamism of business operations over time. Other financial statements, such as the income statement and cash flow statement, are needed to obtain a more comprehensive understanding of financial performance and cash flow dynamics. Furthermore, the balance sheet values may not always reflect market values, especially for intangible assets.

Conclusion: The $400,000 Context

A $400,000 total asset figure, without further analysis of the asset composition, liabilities, and equity, provides limited insight into a company's financial health. To gain a complete picture, a thorough examination of all components of the balance sheet is necessary, alongside a review of the income statement and cash flow statement. Understanding the interplay of assets, liabilities, and equity, coupled with liquidity and solvency ratios, provides a holistic perspective on a company's financial standing. The analysis should also consider the industry the company operates in and compare its financial performance with competitors. Only through comprehensive analysis can you accurately assess the true meaning of the $400,000 total asset figure and the overall financial strength of the business.

Latest Posts

Latest Posts

-

The Security Classification Guide States Cpl Rice

Mar 19, 2025

-

Your Coworker Was Teleworking When The Agency

Mar 19, 2025

-

What Is The Difference Between Transcription And Translation

Mar 19, 2025

-

Drag The Labels To The Appropriate Location In The Figure

Mar 19, 2025

-

Which Of These Is Not A Potential Indicator

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about A Company's Balance Sheet Has Total Assets Of $400 000 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.