A Job Cost Sheet Contains Blank______ The Job.

Breaking News Today

Mar 15, 2025 · 6 min read

Table of Contents

A Job Cost Sheet Contains Blank Estimates and Actuals for the Job

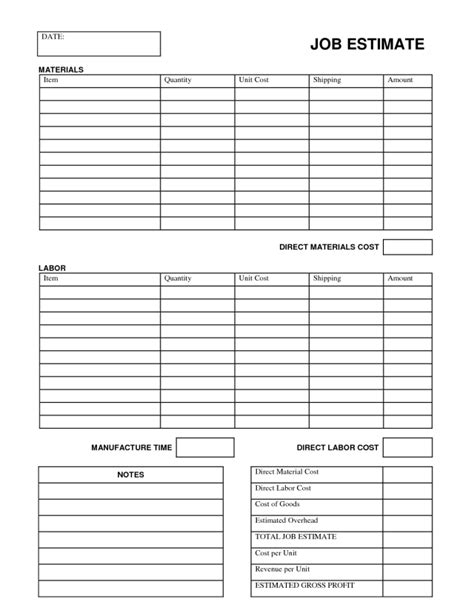

A job cost sheet is a crucial document in project management and cost accounting. It's a detailed record of all costs associated with a specific project or job, from its inception to completion. Understanding its components is vital for effective budgeting, cost control, and profitability analysis. One of the most important features of a job cost sheet is its inclusion of blank spaces for both estimated and actual costs. Let's delve deeper into why this is critical and what other vital information you'll find on a comprehensive job cost sheet.

The Importance of Blank Spaces for Estimates and Actuals

The blank spaces on a job cost sheet dedicated to both estimated and actual costs are not merely empty fields; they are the foundation upon which accurate project costing is built. Here’s why:

1. Facilitating Accurate Budgeting and Forecasting

Before a job even starts, the job cost sheet allows for a detailed breakdown of anticipated expenses. These estimated costs are crucial for:

- Winning Bids: Accurate estimations are vital for submitting competitive bids and securing contracts. Underestimating can lead to losses, while overestimating can make your bid uncompetitive.

- Resource Allocation: Budgeting helps determine the resources (materials, labor, equipment) needed for the project. This ensures efficient allocation and prevents resource shortages.

- Profitability Assessment: By comparing estimated costs with projected revenue, you can assess the potential profitability of the job before committing resources.

2. Tracking Actual Costs and Identifying Variances

As the job progresses, the blank spaces for actual costs are filled in. This real-time data allows for:

- Monitoring Progress: Comparing actual costs against estimated costs at various stages reveals whether the project is on track or requires corrective action.

- Variance Analysis: Significant deviations between estimated and actual costs highlight areas of concern. This allows for timely intervention to control expenses and prevent cost overruns.

- Identifying Inefficiencies: Tracking actual costs helps pinpoint inefficiencies in processes, materials usage, or labor allocation. This knowledge informs future projects and process improvement initiatives.

3. Supporting Data-Driven Decision-Making

The combination of estimated and actual cost data on the job cost sheet empowers informed decision-making. For example:

- Change Orders: Actual cost tracking may reveal unforeseen challenges requiring change orders. The job cost sheet provides a transparent record of these changes and their associated costs.

- Project Optimization: Analyzing variances between estimated and actual costs enables adjustments to project plans and resource allocation to maximize efficiency and minimize costs.

- Future Project Planning: The historical data from completed projects stored on job cost sheets serve as a valuable resource for estimating the costs of future similar projects. This ensures more accurate forecasting and budgeting.

Key Elements of a Comprehensive Job Cost Sheet

A well-designed job cost sheet encompasses much more than just spaces for estimated and actual costs. Here’s a breakdown of the key elements:

1. Job Identification and Description

- Job Number: A unique identifier for each project, essential for tracking and organization.

- Client Name: Clearly identifies the client for whom the job is being performed.

- Job Description: A concise but thorough description of the work to be done. This includes specifications, deliverables, and any unique requirements.

- Start and End Dates: The planned start and completion dates of the project.

2. Estimated Costs

This section breaks down the estimated costs into various categories:

- Direct Materials: The cost of raw materials, components, and supplies directly used in the job. This should include detailed itemized lists with quantities and unit costs.

- Direct Labor: The cost of labor directly involved in the production or service delivery. This section typically includes hours worked by each employee at their respective hourly rates.

- Overhead Costs: Indirect costs associated with the job, such as rent, utilities, administrative salaries, and equipment depreciation. These costs are often allocated to projects based on a predetermined overhead rate.

- Subcontractor Costs (if applicable): Estimated costs for any subcontracted work involved in the project.

3. Actual Costs

This section mirrors the estimated costs section, but records the actual expenditures incurred during the project. It's crucial to maintain meticulous records of all expenses, supporting documentation, and receipts.

- Direct Materials: Actual quantities used and their costs. Variances between estimated and actual quantities should be noted and explained.

- Direct Labor: Actual hours worked by each employee and their associated costs. Overtime, if any, should be clearly indicated.

- Overhead Costs: Actual indirect costs incurred. These may deviate from the estimated amounts, and any variances should be explained.

- Subcontractor Costs (if applicable): Actual costs paid to subcontractors.

4. Profitability Analysis

Once the job is complete, the job cost sheet allows for a comprehensive profitability analysis:

- Total Estimated Cost: The sum of all estimated costs.

- Total Actual Cost: The sum of all actual costs.

- Profit/Loss: The difference between the revenue generated and the total actual cost. A positive value indicates profit, while a negative value indicates a loss.

- Profit Margin: The profit expressed as a percentage of the revenue. This metric provides valuable insight into the profitability of the job.

5. Notes and Comments Section

A dedicated section for notes and comments is essential for capturing any relevant information that doesn’t neatly fit into other categories:

- Change Orders: Record of any changes to the original scope of work, including the reasons, approvals, and associated costs.

- Challenges Encountered: Notes on any unforeseen problems, delays, or issues encountered during the project.

- Solutions Implemented: Description of actions taken to address any challenges or deviations from the original plan.

Software Solutions for Job Costing

While manual job cost sheets are still used in some settings, numerous software solutions simplify the process and offer advanced features:

- Automated Cost Tracking: Many software programs automate the tracking of expenses, minimizing manual data entry and reducing errors.

- Real-Time Reporting: Real-time access to data and reports allows for prompt identification of cost overruns and facilitates timely corrective actions.

- Advanced Analytics: Software can provide advanced analytics, including variance analysis, profitability forecasts, and trend identification.

Conclusion: The Job Cost Sheet – A Cornerstone of Project Success

The job cost sheet, with its crucial blank spaces for both estimated and actual costs, is more than just a document; it's a dynamic tool for successful project management. By meticulously documenting both anticipated and actual expenses, businesses can effectively plan, control costs, and ultimately maximize profitability. The comprehensive data captured allows for informed decision-making, continuous improvement, and a foundation for accurate forecasting in future projects. Investing in robust job cost tracking—whether through manual processes or sophisticated software solutions—is crucial for maintaining a healthy financial picture and achieving long-term business success. Remember, accurate and detailed job cost sheets are instrumental in transforming projects from potential risks into profitable realities.

Latest Posts

Latest Posts

-

If Your Driver License Is Suspended You May Drive Only

Mar 15, 2025

-

Lack Of Knowledge Of The Driving Laws Is

Mar 15, 2025

-

Fluctuations In The Phosphorus Cycle In Aquatic Ecosystems

Mar 15, 2025

-

In Many States A Minor May Be Treated

Mar 15, 2025

-

How Many Hydrogen Atoms Can Be Attached To Carbon B

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about A Job Cost Sheet Contains Blank______ The Job. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.