A Renewable Term Life Insurance Policy Can Be Renewed Quizlet

Breaking News Today

Mar 18, 2025 · 7 min read

Table of Contents

A Renewable Term Life Insurance Policy Can Be Renewed: A Comprehensive Guide

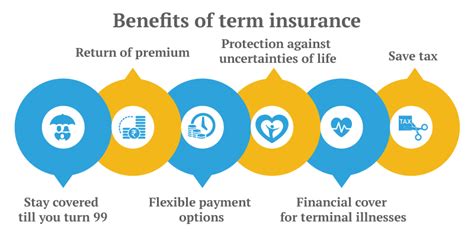

Term life insurance, a cornerstone of financial planning, offers affordable coverage for a specified period. But what happens when that term expires? Understanding the nuances of renewable term life insurance is crucial. This comprehensive guide delves deep into the intricacies of renewable term life insurance, addressing common questions, dispelling misconceptions, and empowering you to make informed decisions about your financial future.

What is Renewable Term Life Insurance?

Renewable term life insurance provides a safety net, offering a defined period of coverage at a set premium. The key feature distinguishing it from other term life policies is its renewability. Upon expiration of the initial term, the policyholder has the option to renew the coverage for another term, usually with the same face value (death benefit).

This renewability offers valuable flexibility and peace of mind. It allows you to maintain coverage without undergoing a new medical underwriting process, crucial as health conditions can change over time. This is particularly beneficial for individuals who anticipate potential health issues that could impact future insurability.

Key Features of Renewable Term Life Insurance:

- Guaranteed Renewability: This is the defining characteristic. The insurer must renew the policy at the end of the term, regardless of your health status.

- Increased Premiums: While renewability is a major advantage, it typically comes with increased premiums. As you age, the risk of mortality increases, leading to higher costs for the insurer, which are then reflected in your premiums.

- No New Medical Exam: This is a significant benefit. Renewing does not require you to undergo a new medical examination or answer health questionnaires, preserving your coverage even if your health has deteriorated.

- Fixed Death Benefit: The death benefit (the amount paid to beneficiaries upon death) usually remains the same at each renewal, though this can vary by policy.

Understanding the Renewal Process: A Step-by-Step Guide

The renewal process is typically straightforward. Most insurers provide clear instructions within the policy documents. However, it's crucial to understand the key steps involved:

1. Notification:

Insurers generally send notifications several months before the policy's expiration date. This notification will outline the renewal options, including the increased premium.

2. Review and Decision:

Carefully review the renewal offer, paying close attention to the new premium amount and any changes to policy terms. Consider your financial situation and insurance needs before making a decision.

3. Renewal Application:

If you decide to renew, you’ll typically need to complete a short application form, affirming your intent to continue coverage. This form usually does not require medical information.

4. Premium Payment:

After submitting the renewal application, you’ll need to pay the increased premium to maintain your coverage. Make sure to pay on time to avoid any lapse in coverage.

Renewable Term vs. Other Term Life Insurance Options:

Understanding the differences between renewable term and other term life insurance options is crucial for choosing the right policy for your needs.

Renewable Term vs. Non-Renewable Term Life Insurance:

- Non-renewable term life insurance offers coverage for a specific period only, with no option to renew. Upon expiration, the policy terminates, and you either need to secure a new policy (potentially facing a new medical underwriting process) or remain uninsured.

Renewable Term vs. Convertible Term Life Insurance:

- Convertible term life insurance allows you to convert your term life policy into a permanent life insurance policy (like whole life or universal life) without undergoing a new medical examination. This provides an alternative option if your needs change over time. Note that convertible policies often have higher premiums than non-convertible renewable term policies.

Why Choose Renewable Term Life Insurance?

Renewable term life insurance offers several distinct advantages:

- Affordability: Initially, renewable term policies are often more affordable than permanent life insurance options. This makes them particularly attractive to individuals with limited budgets.

- Flexibility: The ability to renew your coverage without medical underwriting provides significant flexibility, accommodating changing life circumstances and health conditions.

- Peace of Mind: Knowing you have an option to continue coverage at the end of your initial term provides valuable peace of mind. This is particularly beneficial for individuals who may anticipate health issues that could make it difficult to secure new insurance in the future.

- Simplicity: Renewable term policies are typically straightforward and easy to understand, simplifying the decision-making process.

When Renewable Term Life Insurance Might Not Be the Best Fit:

While renewable term life insurance offers several advantages, it may not always be the best choice for everyone. It's important to weigh its limitations:

- Increasing Premiums: The premiums increase with each renewal, eventually becoming quite expensive, particularly in later years. This can make it less affordable over the long term.

- No Cash Value: Renewable term life insurance policies do not accumulate cash value. This means there is no money to borrow against or withdraw from the policy during your lifetime. This contrasts with permanent life insurance, which builds cash value over time.

Factors to Consider Before Purchasing a Renewable Term Life Insurance Policy:

Before purchasing a renewable term life insurance policy, carefully consider the following factors:

- Your Age: The younger you are when you purchase the policy, the lower your initial premiums will be.

- Your Health: Your health status impacts premium pricing, though renewability negates the need for re-underwriting upon renewal.

- Your Financial Goals: Determine how much coverage you need and how long you need it.

- Your Future Needs: Consider whether you might need a policy with a cash value component later in life.

Frequently Asked Questions (FAQs) about Renewable Term Life Insurance:

Q: How long can I renew a renewable term life insurance policy?

A: Most policies allow for renewal until a certain age, typically 70 or 75, but this varies by insurer and policy. Some policies may offer renewal indefinitely, subject to premium increases.

Q: Are there any limits on how many times I can renew?

A: The number of renewals is typically not explicitly limited, as long as you pay the premiums. However, the increasing premiums might make renewal impractical after several terms.

Q: What happens if I don't renew my policy?

A: If you do not renew your policy by the expiration date, your coverage will lapse, and you will no longer be insured.

Q: Can I change the death benefit when I renew my policy?

A: While some policies allow for adjustments, it's not always guaranteed. You might need to apply for a new policy with the desired death benefit.

Q: Will my health affect the renewal process?

A: Your health will not affect your ability to renew, as no further medical underwriting is required. However, your age and the length of the renewal term will impact the premium amount.

Q: Can I cancel my renewable term life insurance policy before it expires?

A: Yes, you can usually cancel your policy at any time. However, you will not receive a refund of any past premiums, unless the policy includes a specific provision for refunds.

Q: Are there different types of renewable term life insurance policies?

A: Yes, policies can differ in terms of length of initial terms, renewal age limits, premium increases at renewal, and other features. It's important to compare policies from different insurers to find the best fit for your needs.

Conclusion: Making the Right Choice

Choosing the right life insurance policy is a critical financial decision. Renewable term life insurance offers a compelling solution for many, providing affordable coverage with the flexibility of guaranteed renewability. However, it is essential to weigh its advantages against potential limitations, particularly concerning increasing premiums and the absence of cash value. By carefully considering your financial goals, health status, and future needs, you can make an informed decision that safeguards your financial future and provides peace of mind for you and your loved ones. Remember to thoroughly compare policy options from different insurers to secure the most suitable coverage.

Latest Posts

Latest Posts

-

Describe The Continuous Nature Of The Physical Fitness Concept

Mar 18, 2025

-

High Levels Of Cholesterol Can First Lead Directly To

Mar 18, 2025

-

True Or False Professional And Technical Communication Is Research Oriented

Mar 18, 2025

-

Which Best Describes The Terrorist Planning Cycle

Mar 18, 2025

-

Cdl Combination Test Questions And Answers Pdf

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about A Renewable Term Life Insurance Policy Can Be Renewed Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.