A Trial Balance Will Not Balance If

Breaking News Today

Mar 25, 2025 · 6 min read

Table of Contents

A Trial Balance Will Not Balance: Common Causes and Troubleshooting

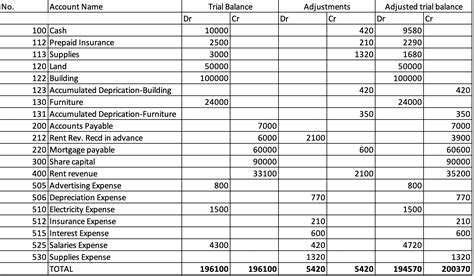

A trial balance is a crucial accounting report summarizing all debit and credit balances in a general ledger. Its primary purpose is to ensure the fundamental accounting equation (Assets = Liabilities + Equity) remains balanced. However, a trial balance that doesn't balance – meaning the total debits don't equal the total credits – signals an error somewhere in the accounting process. This isn't just an inconvenience; it indicates a problem that needs immediate attention before financial statements can be prepared accurately. This comprehensive guide delves into the common reasons why a trial balance might fail to balance and provides practical troubleshooting steps.

Understanding the Trial Balance and its Importance

Before examining the reasons for imbalance, it's essential to understand the trial balance's function. The trial balance is a snapshot of the general ledger accounts at a specific point in time. Each account's debit or credit balance is listed, and the totals of all debit balances should precisely equal the totals of all credit balances. This equality confirms that the double-entry bookkeeping system – the foundation of accounting – is functioning correctly. If the trial balance doesn't balance, it means an error exists within the accounting records. This error can range from a simple transposition error to more complex issues requiring significant investigation.

Common Reasons Why a Trial Balance Won't Balance

Numerous factors can lead to a trial balance imbalance. These can be broadly classified into errors of:

1. Principle: Errors Affecting the Basic Accounting Equation

These are the most fundamental errors. They directly impact the accounting equation, making it impossible for the trial balance to balance.

-

Incorrect Posting of Transactions: This is the most frequent cause. This involves posting debits or credits to the wrong accounts, posting to the incorrect side of an account (debit instead of credit, or vice versa), or omitting postings entirely. For instance, recording a payment to a supplier as a debit to the supplier's account and a credit to cash is incorrect. It should be a debit to the expense account and a credit to cash. Such errors directly violate the accounting equation.

-

Errors in Journal Entries: Mistakes during the initial recording of transactions in the journal, such as incorrect amounts, wrong account names, or missed entries, inevitably lead to trial balance discrepancies. Thorough review and checking are essential here to catch these issues before posting.

-

Transposition Errors: A common type of numerical error where digits are switched (e.g., writing 123 as 132 or 213). This type of mistake is often subtle and requires careful scrutiny to detect.

-

Slide Errors: Similar to transposition errors, this involves misplacing the decimal point, leading to incorrect values. For example, entering $12.30 as $123.00.

2. Omission: Errors of Leaving Out Entries

These are characterized by overlooking critical information.

-

Omitting Journal Entries: Failing to record a transaction in the general journal means it won't be posted to the ledger, resulting in an unbalanced trial balance.

-

Omitting Posting of Entries: Even if correctly journalized, failing to post the entries to the respective ledger accounts will also create an imbalance.

3. Compensation: Errors Where Mistakes Cancel Each Other Out (Partially or Fully)

While these errors might seem less severe, they can mask other, more significant problems. The fact that they "cancel each other out" in the trial balance doesn’t mean they are not serious.

- Errors that Compensate: Two or more errors may offset each other, leading to a balanced trial balance even though individual errors exist. This can create a false sense of security, as underlying issues remain unaddressed. Imagine a double entry is missed in one journal entry, but a similar error is made in another entry in the opposite direction; the trial balance may balance, but the financial statements will still be inaccurate. This is why reviewing individual journal entries is important.

4. Principle and Omission Combined: Multiple Errors

This is often a complex scenario.

- Combination of Errors: A mixture of principle and omission errors creates a difficult troubleshooting task, since the total error can involve both incorrect account postings and complete absence of entries. This calls for a systematic review of all journal entries and ledger postings.

Troubleshooting Steps: How to Find and Fix the Errors

When faced with a trial balance imbalance, systematic troubleshooting is essential. Don't panic! Follow these steps:

1. Verify the Trial Balance: Double-check the accuracy of the trial balance itself. Ensure all accounts are included, and the balances are correctly transferred from the general ledger. Simple mistakes like addition errors can be easily overlooked. Use a calculator or spreadsheet to independently verify the totals.

2. Analyze the Difference: Calculate the difference between total debits and total credits. This difference indicates the magnitude of the error. If the difference is divisible by 2, a transposition error is a likely culprit. If divisible by 9, a slide error is more probable.

3. Review Recent Transactions: Focus on transactions recorded around the period of the imbalance. Look for any unusual entries or entries that seem out of place.

4. Examine Journal Entries: Carefully review all journal entries for accuracy. Check the account names, amounts, and debit/credit postings. Look for any omissions or entries with incorrect amounts. This step requires painstaking attention to detail.

5. Reconcile Ledger Accounts: Compare the ledger balances to the trial balance amounts for each account. Discrepancies here pinpoint the source of the error.

6. Use a Spreadsheet: Spreadsheets are incredibly useful for organizing the data and performing calculations to track the errors. You can cross-reference the journal entries with ledger accounts easily within a spreadsheet, making the process more efficient.

7. Seek External Assistance: If the imbalance persists after thorough investigation, it is advisable to seek help from an experienced accountant. They can bring a fresh perspective and expertise to identify hidden errors.

Preventing Future Trial Balance Imbalances

Prevention is always better than cure. Here are some proactive measures:

-

Develop Strong Internal Controls: Implement robust systems for recording, verifying, and reviewing transactions. This includes checks and balances and a clear separation of duties.

-

Regular Reconciliation: Regularly reconcile bank statements, supplier accounts, and other key accounts to ensure accuracy and identify discrepancies promptly.

-

Use Accounting Software: Reliable accounting software can automate many aspects of the bookkeeping process, reducing manual errors and providing error detection tools.

-

Training and Development: Ensure accounting staff receive proper training on bookkeeping procedures, double-entry accounting, and the use of accounting software.

-

Regular Backups: Back up your accounting data regularly to prevent data loss due to system failures or accidental deletion.

Conclusion: The Importance of Accuracy in Accounting

An unbalanced trial balance signifies a break in the fundamental principles of accounting. While initially frustrating, resolving the imbalance is crucial for generating accurate financial statements and maintaining the integrity of the financial records. A systematic approach to troubleshooting, combined with proactive preventive measures, is key to maintaining balanced and reliable accounting records. The meticulous nature of accounting requires constant vigilance and attention to detail to ensure accuracy and consistency in all financial reporting. The effort invested in resolving a trial balance imbalance is a significant investment in the overall reliability and trustworthiness of your financial statements. Ignoring these errors can lead to incorrect decision-making, tax issues, and significant financial consequences.

Latest Posts

Latest Posts

-

Rn Targeted Medical Surgical Endocrine Online Practice 2019

Mar 26, 2025

-

When Preparing The Bank Deposit Currency Is

Mar 26, 2025

-

You Are Coupling A Tractor To A Semi Trailer

Mar 26, 2025

-

Which Of These Is A Nonsteroid Hormone

Mar 26, 2025

-

When You Evaluate An Online Document For Sponsorship You Should

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about A Trial Balance Will Not Balance If . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.