Accumulated Depreciation And Depreciation Expense Are Classified Respectively As

Breaking News Today

Mar 12, 2025 · 6 min read

Table of Contents

Accumulated Depreciation and Depreciation Expense: Understanding the Key Differences

Understanding the difference between accumulated depreciation and depreciation expense is crucial for accurate financial reporting and effective business management. While both relate to the decline in an asset's value over time, they represent distinct concepts within a company's accounting system. This comprehensive guide will delve into the nature of each, their classification within financial statements, and the crucial role they play in reflecting a company's financial health.

What is Depreciation Expense?

Depreciation expense is the portion of an asset's cost that is allocated as an expense during a specific accounting period. It represents the systematic allocation of an asset's cost over its useful life, reflecting the decline in its value due to wear and tear, obsolescence, or other factors. Think of it as the yearly cost of using an asset. For instance, if a company buys a machine for $100,000 with a useful life of 10 years, the annual depreciation expense would be $10,000 ($100,000 / 10 years).

Key Characteristics of Depreciation Expense:

- Expense Account: Depreciation expense is recorded as an expense on the income statement. This directly reduces a company's net income for the period.

- Periodic Allocation: It's allocated systematically over the asset's useful life, not necessarily reflecting the actual decline in value.

- Matching Principle: Depreciation adheres to the matching principle of accounting, matching the cost of the asset with the revenue it generates over its useful life.

- Non-Cash Expense: Depreciation is a non-cash expense, meaning it doesn't involve an actual outflow of cash. It's a way of allocating the cost of an asset over time.

- Impact on Net Income: It directly impacts a company's net income, influencing key financial ratios and analyses.

Methods of Calculating Depreciation Expense:

Several methods exist for calculating depreciation expense, each with its own strengths and weaknesses:

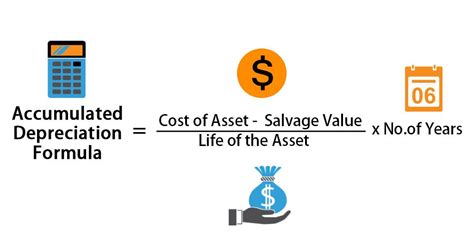

- Straight-Line Depreciation: This is the simplest method, allocating an equal amount of depreciation expense each year. The formula is: (Asset Cost - Salvage Value) / Useful Life.

- Declining Balance Depreciation: This method accelerates depreciation, allocating a higher expense in the early years of an asset's life and lower expense in later years. It uses a fixed depreciation rate multiplied by the asset's net book value (cost less accumulated depreciation) each year.

- Units of Production Depreciation: This method bases depreciation on the actual use of the asset. The depreciation expense is calculated by multiplying the depreciation rate per unit by the number of units produced during the year.

- Sum-of-the-Years'-Digits Depreciation: This accelerated depreciation method allocates a higher expense in the early years of an asset's life. The formula involves a fraction whose numerator is the remaining useful life and whose denominator is the sum of the years' digits.

What is Accumulated Depreciation?

Accumulated depreciation represents the total depreciation expense that has been recorded for an asset since it was put into service. It's a contra-asset account, meaning it reduces the value of an asset on the balance sheet. It's the cumulative effect of all depreciation expense recorded over the asset's life. Continuing with our machine example, after 3 years, the accumulated depreciation would be $30,000 ($10,000/year * 3 years).

Key Characteristics of Accumulated Depreciation:

- Contra-Asset Account: It's a contra-asset account, appearing on the balance sheet as a reduction of the asset's original cost.

- Cumulative Effect: It reflects the total depreciation recorded since the asset's acquisition.

- Balance Sheet Item: It's presented on the balance sheet, alongside the asset's original cost, to show the net book value.

- Net Book Value: The difference between the asset's original cost and accumulated depreciation is the asset's net book value, also known as carrying amount. This represents the asset's value as reported on the balance sheet.

- No Impact on Net Income: Unlike depreciation expense, accumulated depreciation doesn't directly impact net income. It's a balance sheet item.

Understanding the Relationship Between Depreciation Expense and Accumulated Depreciation:

The relationship between depreciation expense and accumulated depreciation is straightforward: accumulated depreciation is the sum of all depreciation expenses recorded for an asset to date. Each year's depreciation expense is added to the accumulated depreciation balance. This means that accumulated depreciation grows each year as long as the asset remains in use.

Example:

Let's assume a company purchased a piece of equipment for $50,000 with a useful life of 5 years and no salvage value. Using straight-line depreciation:

| Year | Depreciation Expense | Accumulated Depreciation | Net Book Value |

|---|---|---|---|

| 1 | $10,000 ($50,000/5) | $10,000 | $40,000 |

| 2 | $10,000 | $20,000 | $30,000 |

| 3 | $10,000 | $30,000 | $20,000 |

| 4 | $10,000 | $40,000 | $10,000 |

| 5 | $10,000 | $50,000 | $0 |

Classification of Accumulated Depreciation and Depreciation Expense

Depreciation Expense: This is classified as an expense on the income statement. It's included in the operating expenses section and directly impacts the calculation of net income. This makes it a critical element in assessing a company's profitability.

Accumulated Depreciation: This is classified as a contra-asset account on the balance sheet. It's presented alongside the asset's original cost to arrive at the net book value. This shows investors and stakeholders the asset's current carrying amount, reflecting the impact of depreciation over time.

Importance of Accurate Depreciation Calculations

Accurate depreciation calculations are essential for several reasons:

- Financial Reporting: Accurate depreciation figures are crucial for preparing accurate financial statements, ensuring compliance with accounting standards (like GAAP or IFRS).

- Tax Purposes: Depreciation is a tax-deductible expense, and accurate calculations can significantly impact a company's tax liability.

- Decision-Making: Accurate depreciation figures help management make informed decisions about asset replacement, capital investments, and other strategic initiatives.

- Asset Management: Tracking depreciation helps companies monitor the performance and condition of their assets, facilitating timely maintenance and replacements.

- Valuation: Accurate depreciation figures are essential in determining the fair market value of assets for purposes such as mergers, acquisitions, or asset sales.

Potential Pitfalls and Considerations

Several factors can influence depreciation calculations and require careful consideration:

- Useful Life: Determining the useful life of an asset accurately is crucial; an inaccurate estimation can significantly impact depreciation calculations.

- Salvage Value: Accurately estimating salvage value – the asset's value at the end of its useful life – is essential. A higher salvage value reduces annual depreciation expense.

- Changes in Circumstances: Changes in an asset's use, technological advancements, or unexpected wear and tear may necessitate adjustments to depreciation calculations.

- Consistency: Using the same depreciation method consistently across assets and accounting periods enhances comparability and reliability of financial statements.

Conclusion

Understanding the difference between accumulated depreciation and depreciation expense is fundamental to comprehending a company's financial health. While depreciation expense shows the cost allocated in a given period, accumulated depreciation reveals the total accumulated depreciation since the asset was acquired. Both are essential for accurate financial reporting, tax planning, and informed decision-making. By understanding these concepts and their interplay, businesses can ensure compliance, optimize their financial planning, and improve their overall operational efficiency. Consistent application of appropriate depreciation methods ensures the reliability of financial statements and supports transparent and credible financial communication to stakeholders.

Latest Posts

Latest Posts

-

Draw A Scatter Diagram That Might Represent Each Relation

May 09, 2025

-

You Are Providing Care For Mrs Bove

May 09, 2025

-

Display All The Comments In This Worksheet At Once

May 09, 2025

-

Dendrite Is To Axon As Is To

May 09, 2025

-

The Change In An Objects Position Is Called

May 09, 2025

Related Post

Thank you for visiting our website which covers about Accumulated Depreciation And Depreciation Expense Are Classified Respectively As . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.