Add The Profit Sharing Field To The Pivot Table

Breaking News Today

Mar 26, 2025 · 5 min read

Table of Contents

Adding a Profit Sharing Field to Your Pivot Table: A Comprehensive Guide

Pivot tables are powerful tools in data analysis, allowing you to summarize and analyze large datasets efficiently. However, their default functionality might not always cater to every specific analytical need. One common requirement is incorporating a calculated field for profit sharing, a crucial aspect of financial reporting and business analysis. This comprehensive guide will walk you through the process of adding a profit sharing field to your pivot table, covering various scenarios and best practices.

Understanding Profit Sharing Calculations

Before diving into the pivot table itself, let's clarify the fundamentals of profit sharing calculations. The specific formula varies depending on the business's structure and agreement. Common approaches include:

- Percentage of Profit: A fixed percentage of the total profit is distributed among participants. For example, 10% of the net profit might be allocated for profit sharing.

- Tiered System: Different percentages are applied based on profit levels. This approach incentivizes higher performance. For instance, 5% for profits up to $100,000 and 10% for profits exceeding that amount.

- Formula-Based Sharing: A more complex formula might be used, factoring in factors like individual contributions, tenure, or performance metrics.

Understanding your specific profit sharing calculation is crucial for accurately implementing it within the pivot table.

Preparing Your Data for Pivot Table Analysis

The accuracy and efficiency of your pivot table depend heavily on the structure and quality of your source data. Ensure your data is organized in a tabular format with clear column headers. Essential columns typically include:

- Sales: Revenue generated from sales activities.

- Costs: Expenses incurred in generating revenue.

- Profit: The difference between sales and costs (Sales - Costs).

- Participant: The individual or entity entitled to profit sharing.

- Allocation Percentage (Optional): If a tiered system or individual allocation percentages are used, include this column.

Example Data Structure:

| Participant | Sales | Costs | Profit | Allocation Percentage |

|---|---|---|---|---|

| John Doe | $10,000 | $4,000 | $6,000 | 0.10 |

| Jane Doe | $15,000 | $6,000 | $9,000 | 0.10 |

| Peter Jones | $20,000 | $8,000 | $12,000 | 0.10 |

Adding the Profit Sharing Field: Step-by-Step Guide

Once your data is prepared, follow these steps to add the profit sharing field to your pivot table:

-

Create the Pivot Table: Select your data range and choose "Insert" -> "PivotTable." Choose where you want to place the pivot table (new worksheet or existing one).

-

Add Necessary Fields: Drag the relevant fields to the appropriate areas of the PivotTable Fields pane:

- Rows:

Participant(to show individual profit shares). - Values:

Profit(to show the total profit per participant).

- Rows:

-

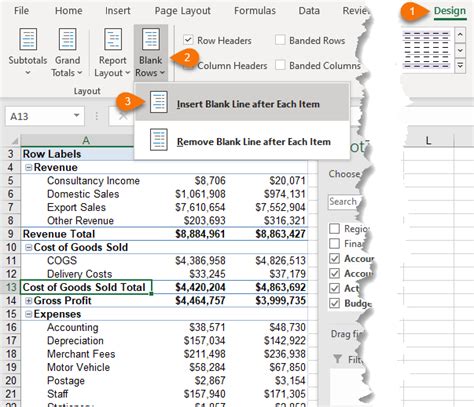

Add the Calculated Field: This is where we create the profit sharing field. Click on "Analyze" (or "Options" depending on your Excel version) -> "Fields, Items, & Sets" -> "Calculated Field."

-

Define the Calculated Field: A dialog box will appear. Name your new field (e.g., "Profit Share"). In the "Formula" box, enter the appropriate formula based on your profit sharing calculation.

Examples:

- Percentage of Profit (10%):

=Profit*0.1 - Tiered System (using IF): This requires a more complex formula. Let's assume 5% for profits up to $10,000 and 10% for profits above:

=IF(Profit<=10000, Profit*0.05, Profit*0.1) - Formula Incorporating Allocation Percentage:

=Profit*['Allocation Percentage'](This assumes you have an "Allocation Percentage" column in your data).

- Percentage of Profit (10%):

-

Add the Calculated Field to the Pivot Table: Click "Add" and the new "Profit Share" field will appear in the PivotTable Fields pane. Drag it to the "Values" area.

-

Format the Results: Format the "Profit Share" column to display currency appropriately.

Handling Complex Profit Sharing Scenarios

The examples above cover relatively simple scenarios. More complex calculations might involve:

- Multiple Profit Centers: If profits are generated from various sources, you might need to incorporate additional fields to segment profit shares accordingly.

- Cumulative Profit Sharing: This may require additional calculated fields and potentially VBA scripting for advanced calculations across periods.

- Dynamic Allocation: If allocation percentages change frequently, consider using a separate table to manage these percentages and linking it to your pivot table via VLOOKUP or INDEX/MATCH functions.

Advanced Techniques for Enhanced Analysis

Once the basic profit sharing field is added, you can further enhance your analysis:

- Using Slicers and Filters: Add slicers to filter the results based on participants or time periods. This allows for flexible and interactive data exploration.

- Adding Calculated Items: Create calculated items within the pivot table to compare different profit sharing scenarios or analyze subsets of participants.

- Data Validation: Implement data validation in the source data to prevent errors and ensure data accuracy.

- Charting: Visualize your profit sharing data using charts and graphs. Bar charts, pie charts, and line charts can provide valuable insights.

Troubleshooting and Best Practices

- Formula Errors: Double-check your formulas for syntax errors. Make sure you are referencing the correct fields.

- Data Inconsistencies: Inconsistent data in your source data can lead to incorrect calculations. Clean and validate your data before creating the pivot table.

- Performance Issues: With very large datasets, pivot tables might become slow. Optimize your data structure and consider using Power Pivot for improved performance.

- Data Refresh: Regularly refresh your pivot table to ensure you're working with the most current data.

Conclusion: Empowering Data-Driven Decision Making with Profit Sharing Pivot Tables

Adding a profit sharing field to your pivot table provides a powerful way to analyze and manage profit distribution effectively. By understanding the nuances of profit sharing calculations and employing the techniques outlined in this guide, you can create insightful and dynamic reports that drive informed business decisions. Remember that the key is careful data preparation and a clear understanding of your specific profit sharing formula. Mastering these techniques will empower you to leverage the full potential of pivot tables for complex financial analysis. Through the use of calculated fields, filters, and charts, you can create a robust and visually appealing report that provides actionable insights into your profit sharing strategy. The ability to analyze these financial dynamics is critical for fair distribution and effective business strategy, fostering a more productive and engaged workforce. Regularly review and refine your methods to ensure your profit sharing system remains fair, transparent, and aligned with your business goals.

Latest Posts

Latest Posts

-

Describe The Three Properties Of Language Systems

Mar 29, 2025

-

Nikki Was Walking Around A Department Store

Mar 29, 2025

-

Obra Was Passed As A Response To

Mar 29, 2025

-

When A Policyowner Cash Surrenders A Universal Life Insurance Policy

Mar 29, 2025

-

The Probability Distribution Of Is Called A Distribution

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about Add The Profit Sharing Field To The Pivot Table . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.