When A Policyowner Cash Surrenders A Universal Life Insurance Policy

Breaking News Today

Mar 29, 2025 · 6 min read

Table of Contents

When a Policyowner Cash Surrenders a Universal Life Insurance Policy

Universal life (UL) insurance policies offer flexibility and control to policyholders, allowing them to adjust their premiums and death benefit over time. However, understanding the implications of surrendering a UL policy is crucial. This comprehensive guide explores the scenarios leading to cash surrender, its financial consequences, and alternative options to consider.

Understanding Universal Life Insurance

Before delving into cash surrenders, let's briefly review the core aspects of universal life insurance. UL policies are a type of permanent life insurance, meaning they offer lifelong coverage as long as premiums are paid. They differ from term life insurance, which covers a specific period. The key features of a UL policy include:

- Flexible Premiums: Policyholders can adjust their premium payments within certain limits, allowing for greater financial flexibility.

- Cash Value Accumulation: A portion of the premium goes towards building cash value, which grows tax-deferred. This cash value can be accessed through loans or withdrawals.

- Adjustable Death Benefit: In many cases, the death benefit can be increased or decreased, though this often depends on the policy's cash value and the insurer's rules.

- Transparency: UL policies typically provide detailed statements showing the policy's cash value, death benefit, and fees.

Reasons for Cash Surrendering a Universal Life Policy

Several factors might prompt a policyowner to surrender their universal life policy for its cash value. Understanding these motivations is key to assessing the overall financial wisdom of the decision.

Financial Hardship:

This is perhaps the most common reason. Unexpected expenses, job loss, or medical emergencies can leave individuals with limited financial resources, forcing them to liquidate assets, including their life insurance policy's cash value.

Unforeseen Circumstances:

Life throws curveballs. A major home repair, a child's unexpected educational expenses, or significant debt can deplete savings and lead to the surrender of a UL policy to access funds.

Change in Financial Goals:

As life circumstances change, so too do financial goals. A policyowner might decide that the death benefit is no longer necessary or that the funds invested in the policy could be better utilized elsewhere, such as for retirement or a down payment on a property.

Policy Lapse:

If a policyowner consistently fails to pay premiums, the policy will lapse. This often results in the forfeiture of the cash value, highlighting the importance of consistent premium payments. While technically not a voluntary surrender, the outcome is the same: loss of coverage and potential loss of cash value.

Dissatisfaction with Policy Performance:

Some policyowners might be disappointed with the growth rate of their policy's cash value, especially if the policy's underlying investment options haven't performed well. This can lead to the decision to surrender the policy and invest the funds elsewhere.

Financial Consequences of Cash Surrender

Cash surrendering a universal life policy has significant financial implications that must be carefully considered. These consequences can be substantial and may outweigh the immediate need for cash.

Loss of Death Benefit:

The most obvious consequence is the loss of the death benefit. This means that upon the policyowner's death, their beneficiaries will not receive the designated payout.

Tax Implications:

The cash value received upon surrender may be subject to taxes. While the cash value itself grows tax-deferred, any earnings exceeding the premiums paid will be taxed as ordinary income. This can result in a significant tax liability, reducing the net amount received.

Loss of Potential Growth:

Surrendering a policy means forfeiting the potential for future growth of the cash value. Over time, the cash value can accumulate significantly, particularly if the policy is held for many years. This potential future value is lost when the policy is surrendered.

Fees and Charges:

Many UL policies include surrender charges, which are fees assessed when the policy is surrendered early. These charges can significantly reduce the net amount received. The amount of the surrender charge typically decreases over time, with some policies having no surrender charges after a certain number of years.

Impact on Future Insurance Needs:

Surrendering a UL policy means losing the permanent life insurance coverage it provides. Securing new coverage at an older age will likely be more expensive, if it's even possible, due to increased health risks and higher premiums.

Alternatives to Cash Surrender

Before surrendering your universal life policy, carefully consider these alternatives:

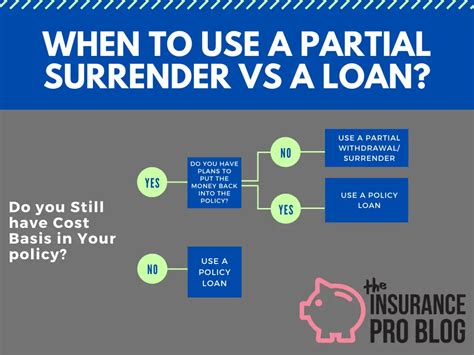

Policy Loans:

Taking a loan against the policy's cash value can provide immediate access to funds without surrendering the policy. Interest is usually charged on the loan, but the death benefit remains intact, and the loan can often be repaid without penalty.

Partial Withdrawals:

Some UL policies allow partial withdrawals of the cash value. This allows for accessing funds while preserving a portion of the cash value and maintaining the death benefit. However, withdrawals may reduce the cash value and could impact future growth.

Premium Adjustments:

If facing temporary financial difficulties, adjusting the premium payments might be a viable option. Lowering premium payments temporarily can help manage cash flow while maintaining the policy's coverage. However, this might affect the cash value growth and may result in a policy lapse if premiums aren't paid for an extended period.

Re-evaluate Financial Goals:

Consider whether your original financial goals are still relevant. Perhaps you could adjust your spending or find other ways to meet your financial needs without surrendering your policy.

Seek Professional Advice:

Consulting a financial advisor is crucial before making any decisions. They can help assess your financial situation, evaluate the implications of surrendering the policy, and explore alternative strategies that align with your long-term goals.

When Cash Surrender Might Be Justified

While generally not recommended unless absolutely necessary, there are some situations where cash surrendering a universal life policy might be the most appropriate course of action:

- Significant and Irrecoverable Debt: If facing crippling debt that threatens financial stability, using the policy's cash value to address this debt may be a necessary step.

- Critical Medical Expenses: When facing extremely high medical bills that cannot be covered otherwise, using the policy's cash value might be justified to ensure access to critical care.

- Complete Change in Life Circumstances: A significant change such as retirement, or relocation could justify a review and possible surrender of the policy if no longer necessary or beneficial.

- Poor Policy Performance: If the underlying investment options of the policy have consistently underperformed and there’s no possibility of recovery, a switch might be financially advantageous.

However, even in these cases, it's vital to carefully weigh the pros and cons and explore all alternative options before proceeding with a cash surrender.

Conclusion

Cash surrendering a universal life insurance policy should be a carefully considered decision with significant financial implications. It results in the loss of the death benefit and potential future cash value growth, along with possible tax liabilities and surrender charges. Before making this decision, thoroughly explore alternatives such as policy loans, partial withdrawals, and premium adjustments. Consulting with a qualified financial advisor is essential to understand the full ramifications and determine the most appropriate course of action for your specific circumstances. Remember that the decision to surrender a UL policy is permanent and irreversible, so careful deliberation and professional advice are vital.

Latest Posts

Latest Posts

-

California Vle Study Material Veterinary Law Exam

Apr 01, 2025

-

An Individual Who Is Blood Type Ab Negative Can Quizlet

Apr 01, 2025

-

Which Of The Following Is Considered A Federal Record

Apr 01, 2025

-

How Is An Etf Similar To A Closed End Fund Quizlet

Apr 01, 2025

-

Which Colour Of The Rainbow Has The Shortest Wavelength

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about When A Policyowner Cash Surrenders A Universal Life Insurance Policy . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.