An Appropriate Fiscal Policy For Severe Demand Pull Inflation Is

Breaking News Today

Mar 20, 2025 · 6 min read

Table of Contents

An Appropriate Fiscal Policy for Severe Demand-Pull Inflation

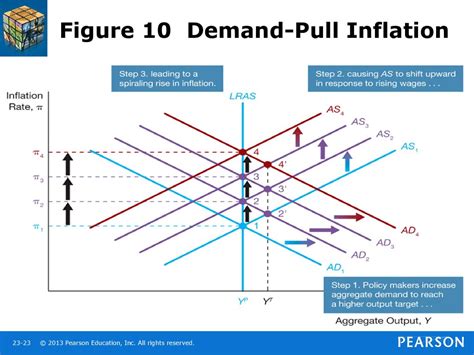

Demand-pull inflation, a persistent rise in the general price level caused by excessive aggregate demand exceeding the economy's capacity to produce goods and services, presents a significant challenge to macroeconomic stability. When this inflation becomes severe, it necessitates swift and decisive policy interventions to mitigate its damaging effects on economic growth, employment, and overall welfare. Fiscal policy, encompassing government spending and taxation, plays a crucial role in addressing this economic malady. This article delves into the appropriate fiscal policy responses to severe demand-pull inflation, exploring various strategies and their potential consequences.

Understanding the Dynamics of Severe Demand-Pull Inflation

Before diving into policy prescriptions, it's crucial to understand the underlying mechanisms driving severe demand-pull inflation. Several factors can contribute to this phenomenon:

Excessive Aggregate Demand: The core driver is an overheated economy where aggregate demand (total spending in the economy) significantly surpasses the economy's potential output. This excess demand puts upward pressure on prices across various sectors.

Supply-Side Constraints: Severe demand-pull inflation often exacerbates existing supply-side bottlenecks. Limited production capacity, labor shortages, or disruptions in supply chains amplify inflationary pressures, making price increases more persistent.

Wage-Price Spiral: As prices rise, workers demand higher wages to maintain their purchasing power. This, in turn, leads to increased production costs for businesses, further fueling price increases, creating a vicious cycle.

Inflationary Expectations: When individuals and businesses anticipate continued inflation, they may adjust their behavior accordingly. For instance, workers may demand even higher wage increases, and businesses may raise prices proactively, further accelerating inflation.

Appropriate Fiscal Policy Responses: The Case for Contractionary Policies

In the face of severe demand-pull inflation, the appropriate fiscal policy response is overwhelmingly contractionary. This means the government must actively reduce aggregate demand to bring it back in line with the economy's productive capacity. This can be achieved through several key strategies:

1. Reduced Government Spending: One of the most direct ways to curb aggregate demand is by reducing government spending. This involves cutting back on various government programs and initiatives. The specific areas targeted for spending cuts would depend on the government's priorities and the specific nature of the inflationary pressures. For example, cuts could be made to non-essential government projects, subsidies, or transfer payments.

Strategic Considerations: It's crucial to implement spending cuts strategically to minimize negative impacts on crucial sectors. For example, cutting spending on education or healthcare could have long-term detrimental effects on human capital development and overall productivity. Therefore, a careful assessment of the potential consequences of spending cuts in various sectors is essential.

2. Increased Taxation: Another effective tool for contractionary fiscal policy is increasing taxes. This reduces disposable income for households and businesses, leading to lower consumption and investment spending, thereby lowering aggregate demand. Various tax instruments can be employed, including income taxes, sales taxes, and corporate taxes.

Strategic Considerations: The choice of which taxes to increase depends on several factors, including the government's distributional goals and the elasticity of demand for various goods and services. For instance, increasing taxes on luxury goods might have a smaller impact on overall demand compared to increasing taxes on essential goods. Furthermore, the government should carefully consider the potential regressive impacts of certain tax increases on low-income households.

3. A Combination of Spending Cuts and Tax Increases: The most effective contractionary fiscal policy often involves a combination of both reduced government spending and increased taxation. This allows for a more balanced approach, distributing the burden of reducing aggregate demand more evenly across the economy. This synergistic effect can amplify the effectiveness of the policy response.

Strategic Considerations: The optimal combination of spending cuts and tax increases will vary depending on the specific economic circumstances and policy objectives. However, a carefully calibrated combination can minimize potential negative economic consequences while effectively combating inflation.

Implementing Contractionary Fiscal Policy Effectively: Key Considerations

While contractionary fiscal policy is generally the appropriate response to severe demand-pull inflation, its implementation requires careful consideration of several factors:

Timing and Gradualism: The timing and pace of implementing contractionary measures are critical. Too rapid a reduction in government spending or increase in taxes could trigger a recession, leading to job losses and economic hardship. A more gradual approach allows the economy to adjust more smoothly.

Transparency and Communication: Open communication with the public about the reasons for implementing contractionary fiscal policy and the expected outcomes is essential. This builds trust and cooperation and can help mitigate potential negative social and political consequences.

Targeting Specific Sectors: Instead of across-the-board cuts, the government may choose to target specific sectors contributing most significantly to the inflationary pressures. For example, if excessive demand for housing is driving inflation, the government might implement measures specifically targeting the housing market, such as stricter lending regulations.

Monitoring and Adjustment: Continuous monitoring of the economy's response to contractionary fiscal policy is crucial. If the policy proves too aggressive, leading to an economic slowdown, the government can adjust its approach. This adaptive approach ensures that the policy remains effective while minimizing unintended negative consequences.

Coordination with Monetary Policy: Effective management of inflation often requires a coordinated approach between fiscal and monetary policy. The central bank can complement contractionary fiscal policy by raising interest rates, further reducing aggregate demand and curbing inflationary pressures. This synergistic effect enhances the overall effectiveness of the inflation-control strategy.

Alternatives and Considerations: Supply-Side Policies

While contractionary fiscal policy is the primary response to demand-pull inflation, addressing supply-side constraints is equally important for achieving long-term price stability. Supply-side policies aim to increase the economy's productive capacity, thereby reducing inflationary pressures. These measures include:

- Investing in infrastructure: Improved infrastructure, such as transportation networks and energy systems, can enhance productivity and reduce production costs.

- Investing in education and training: A well-educated and skilled workforce contributes to higher productivity and reduces labor shortages.

- Deregulation: Reducing unnecessary regulations can stimulate competition and efficiency, leading to lower prices.

- Technological advancements: Encouraging innovation and technological advancements can improve productivity and reduce production costs.

These supply-side policies, while not directly addressing immediate demand-pull pressures, create a more robust and resilient economy in the long run, reducing vulnerability to future inflationary episodes. The synergy between contractionary fiscal policies addressing demand and supply-side policies boosting capacity forms a comprehensive strategy to curb severe demand-pull inflation.

Potential Risks and Challenges

Implementing contractionary fiscal policy also poses several challenges and risks:

- Political Resistance: Reducing government spending or increasing taxes can be politically unpopular, particularly if it impacts vulnerable segments of the population.

- Economic Slowdown: Aggressive contractionary measures can lead to an economic slowdown or even a recession, resulting in job losses and reduced economic growth.

- International Spillover Effects: A country's fiscal policy can have spillover effects on other countries, particularly if it affects international trade and investment flows.

Therefore, careful consideration of these risks is crucial, requiring a nuanced and adaptable approach to policy implementation.

Conclusion: A Balanced and Strategic Approach

Severe demand-pull inflation demands a strong and timely response. While contractionary fiscal policy, combining reduced government spending and increased taxation, is the primary tool, its implementation needs strategic planning, effective communication, and careful monitoring. A balanced approach, integrating this with supply-side policies aimed at boosting productive capacity, is crucial for achieving sustainable price stability and long-term economic prosperity. The goal is not merely to curb inflation but to do so without triggering a significant economic downturn, preserving the delicate balance between price stability and economic growth. This necessitates a nuanced understanding of the economic landscape, flexible policy adjustments, and robust communication to foster public trust and cooperation.

Latest Posts

Latest Posts

-

The Physical Examination Of A Sexual Assault Victim Should Be

Mar 21, 2025

-

All Of The Following Are Fat Soluble Vitamins Except

Mar 21, 2025

-

To Stay Safe When Riding In Traffic You Should

Mar 21, 2025

-

A Change In Demand Is Illustrated By The Curve Shifting

Mar 21, 2025

-

This Is A Compact Stem With Nodes And Internodes

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about An Appropriate Fiscal Policy For Severe Demand Pull Inflation Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.