An Employee Requested That The Balance Of Her 401k

Breaking News Today

Mar 30, 2025 · 5 min read

Table of Contents

Employee Request to Access 401(k) Balance: A Comprehensive Guide

Accessing your 401(k) balance before retirement is a significant financial decision with potential tax and penalty implications. This comprehensive guide explores the various scenarios surrounding an employee's request to access their 401(k) funds, outlining the rules, exceptions, and potential consequences. We'll delve into the reasons behind such requests, the legal framework governing early withdrawals, and strategic advice for navigating this complex process.

Understanding 401(k) Plans and Early Withdrawal Penalties

A 401(k) plan is a retirement savings account offered by many employers. Contributions, often matched by the employer, grow tax-deferred, meaning you don't pay taxes on the contributions or investment earnings until you withdraw them in retirement. The power of compounding returns over time is a key advantage of 401(k)s. However, accessing these funds before retirement typically comes with penalties.

The Tax Implications of Early Withdrawal

Before age 59 1/2, withdrawing from your 401(k) usually results in a 10% early withdrawal penalty, in addition to paying income tax on the amount withdrawn. This effectively reduces your already diminished savings. This penalty serves as a strong incentive to leave the money invested until retirement.

Exceptions to the Early Withdrawal Penalty

While penalties are the norm for early 401(k) withdrawals, several exceptions exist:

- Hardship Withdrawals: The IRS allows for hardship withdrawals under specific circumstances, such as:

- Medical Expenses: Unreimbursed medical expenses for yourself, your spouse, or your dependents.

- Prevent Eviction or Foreclosure: Payments to prevent losing your home.

- Tuition and Education Expenses: Payments for your education or that of your dependents.

- Burial Expenses: Covering funeral costs for yourself, your spouse, or your dependents.

- Domestic Abuse: If you're a victim of domestic abuse, you may be able to withdraw funds without penalty.

- Birth or Adoption Expenses: Expenses related to the birth or adoption of a child.

- Death: If the account holder passes away, the beneficiary can withdraw the funds without penalty.

- Disability: If you are declared permanently disabled, you may be eligible for penalty-free withdrawals.

- Qualified Domestic Relations Order (QDRO): In divorce proceedings, a QDRO allows for the transfer of a portion of the 401(k) assets to the spouse.

Important Note: Each of these exceptions has specific requirements and documentation needed to qualify. Consulting with a qualified financial advisor or tax professional is crucial to ensure you meet these requirements and avoid unintended consequences.

Reasons Employees Request 401(k) Balance Access

Employees request access to their 401(k) balances for a variety of reasons, often driven by unexpected financial hardship or life-altering events. These include:

- Unexpected Medical Expenses: Major illnesses or accidents can quickly deplete savings, forcing employees to consider accessing their 401(k) to cover treatment, medication, or rehabilitation. This often constitutes a legitimate hardship withdrawal.

- Job Loss and Unemployment: Losing a job can be financially devastating, leading to unemployment and potential housing instability. Accessing 401(k) funds may be a last resort to cover essential expenses.

- Emergency Home Repairs: Unexpected major home repairs, such as roof damage or plumbing issues, can strain finances, prompting a need for quick access to funds.

- Debt Consolidation: High-interest debt can become overwhelming. While not usually a sanctioned reason for a hardship withdrawal, some individuals might consider it a necessary evil.

- Financial Mismanagement: Poor financial planning or mismanagement can lead to insufficient funds to cover unexpected expenses, resulting in a need to access retirement savings.

Navigating the 401(k) Withdrawal Process

Requesting a 401(k) withdrawal typically involves these steps:

- Review Plan Documents: Carefully examine your 401(k) plan documents for specifics on withdrawals, penalties, and applicable exceptions.

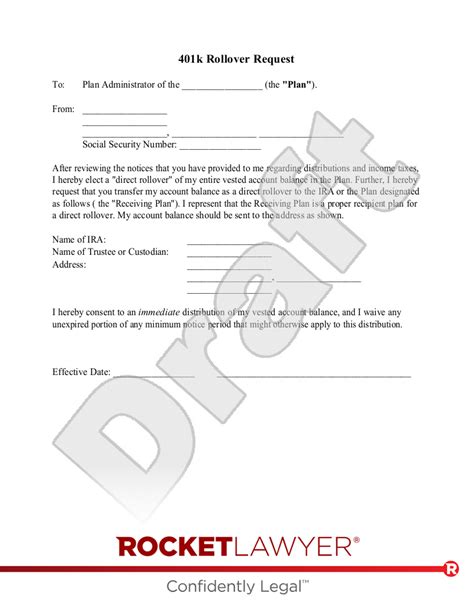

- Submit a Formal Request: Complete the necessary forms provided by your plan administrator, detailing the reason for the withdrawal. This usually requires substantial documentation supporting your claim.

- Provide Supporting Documentation: Gather all supporting documents required, such as medical bills, eviction notices, or proof of job loss. The more comprehensive your documentation, the better your chances of approval.

- Understand Tax Implications: Clearly understand the tax implications of the withdrawal, including the potential 10% early withdrawal penalty and income tax liability.

- Consult a Financial Advisor: Seek professional advice from a qualified financial advisor or tax professional before making a decision. They can provide personalized guidance based on your specific circumstances and help you weigh the pros and cons of early withdrawal.

Alternative Strategies to Consider

Before taking the drastic step of accessing your 401(k) funds, consider these alternative strategies:

- Loan Against Your 401(k): Many 401(k) plans allow for loans against your accumulated balance. This allows you to access funds while maintaining ownership, and interest payments are repaid to yourself. However, defaulting on a 401(k) loan can trigger tax implications similar to early withdrawals.

- Emergency Savings: Build an emergency fund to cover unexpected expenses. This financial cushion can prevent the need to access your retirement savings.

- Budgeting and Debt Management: Create a realistic budget and explore debt management strategies to improve your financial situation. This could include debt consolidation, credit counseling, or negotiating with creditors.

- Seeking Financial Assistance: Explore options for financial assistance through government programs, non-profit organizations, or family and friends.

Long-Term Implications of Early 401(k) Withdrawals

Withdrawing from your 401(k) early can have significant long-term implications:

- Reduced Retirement Savings: This is the most obvious consequence. The sooner you withdraw, the less time your money has to grow and compound.

- Lower Retirement Income: Early withdrawals drastically reduce your retirement nest egg, resulting in a lower standard of living during retirement.

- Increased Tax Burden: The additional income tax and early withdrawal penalty increase your overall tax burden, further reducing your savings.

- Potential Impact on Future Savings Habits: Early withdrawals can negatively impact future saving habits, making it harder to recover from the financial setback.

Conclusion

Accessing your 401(k) balance before retirement is a critical decision with far-reaching consequences. Understanding the rules, exceptions, and potential penalties is crucial. Thorough planning, professional advice, and exploring alternative strategies are essential before making this decision. Carefully weigh the short-term relief against the potential long-term financial ramifications. Remember, preserving your retirement savings is a key priority for a secure and comfortable future. Prioritize exploring all alternative options before resorting to early withdrawal. The consequences of premature 401(k) access often outweigh the immediate benefits.

Latest Posts

Latest Posts

-

Dod Personnel Who Suspect A Coworker Of Possible Espionage

Apr 01, 2025

-

From A Security Perspective The Best Rooms Are Directly

Apr 01, 2025

-

Software Lab Simulation 21 1 Linux File System

Apr 01, 2025

-

Which Of The Following Drugs Is Not A Sedative Hypnotic

Apr 01, 2025

-

Advanced Hardware Lab 1 1 Identify Internal Parts Of A Computer

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about An Employee Requested That The Balance Of Her 401k . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.