Benefits For A Medicare Supplement Policy Quizlet

Breaking News Today

Mar 18, 2025 · 6 min read

Table of Contents

Benefits of a Medicare Supplement Policy: A Comprehensive Guide

Choosing the right Medicare coverage can feel overwhelming. While Original Medicare (Parts A and B) provides foundational coverage, it often leaves significant gaps in out-of-pocket expenses. This is where Medicare Supplement Insurance, also known as Medigap, steps in. This comprehensive guide explores the numerous benefits of a Medigap policy, helping you understand why it's a crucial consideration for many Medicare beneficiaries. We'll delve into the specifics, addressing common questions and clarifying the advantages that can significantly enhance your healthcare experience in retirement.

Understanding Medicare Supplement Insurance (Medigap)

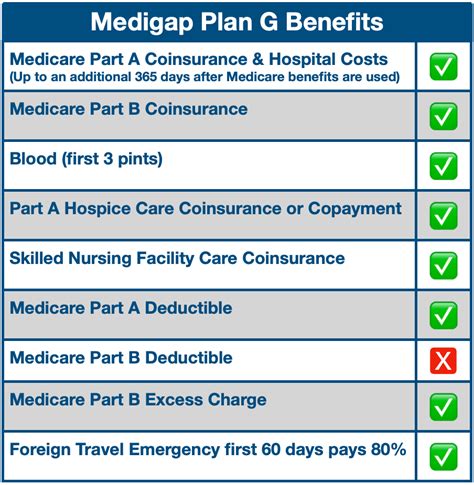

Medicare Supplement Insurance plans are offered by private insurance companies, not the government. They are designed to fill the gaps in Original Medicare's coverage, helping to reduce your out-of-pocket costs for healthcare services. These plans are standardized, meaning a Plan G in one state is essentially the same as a Plan G in another. However, premiums vary by company and location.

Key Features of Medigap Plans:

- Helps cover Medicare cost-sharing: This includes deductibles, copayments, and coinsurance.

- Covers services Original Medicare doesn't: Some plans may offer additional coverage not included in Original Medicare.

- Protects against rising healthcare costs: Medigap provides a safety net against escalating medical expenses, providing predictability to your healthcare budget.

- Standardized plans: This makes comparing plans easier, allowing you to focus on price and coverage differences rather than deciphering complex plan structures.

Exploring the Key Benefits of a Medicare Supplement Policy

The benefits of a Medicare Supplement policy extend beyond simply covering out-of-pocket expenses. They provide peace of mind and financial security in a crucial stage of life. Let's examine these benefits in detail:

1. Reduced Out-of-Pocket Costs: The Core Benefit

This is arguably the most significant advantage of Medigap. Original Medicare can leave you responsible for substantial out-of-pocket expenses, including:

- Part A Deductible: This is the deductible you pay for inpatient hospital care.

- Part B Deductible: This is the deductible you pay for doctor visits and other outpatient services.

- Part B Coinsurance: This is the percentage of the cost you pay after meeting your deductible.

- Excess charges: Some doctors can charge more than Medicare's approved amount; Medigap can help cover these excess charges.

A Medigap policy significantly reduces or eliminates these costs, providing financial protection against unexpected medical bills.

2. Predictability and Budget Control: Planning for Healthcare Expenses

Healthcare costs can be unpredictable. Medigap helps to create a more predictable budget by covering many of the expenses associated with healthcare services. This allows you to better plan for other expenses and enjoy financial security in retirement. Knowing your healthcare costs are largely covered allows for better financial planning and reduces stress.

3. Comprehensive Coverage: Beyond the Basics

While Original Medicare covers many essential services, it has limitations. Medigap can fill these gaps, offering more comprehensive coverage, including:

- Foreign travel emergency coverage: Some plans offer limited coverage for emergencies when traveling abroad.

- Skilled nursing facility care (Part A): Medigap can help cover the copayments for skilled nursing facility care after a hospital stay.

- Blood transfusions: Some plans cover the cost of blood transfusions, which can be expensive.

- Part B Excess Charges: Doctors can bill above Medicare’s approved amount; Medigap can help with this.

This expanded coverage means less financial risk associated with unexpected health events.

4. Peace of Mind and Reduced Financial Stress

Knowing you have a robust safety net for your healthcare costs can significantly reduce stress and anxiety. The peace of mind that comes with comprehensive coverage is invaluable, especially during retirement when unexpected health issues may arise. This can improve your overall well-being and quality of life.

5. Simplicity and Ease of Use: Navigating the Healthcare System

Medicare can be complicated to navigate. Medigap simplifies the process by reducing the number of bills and paperwork you need to manage. You have one insurer to deal with, rather than navigating Medicare and multiple providers.

6. Open Enrollment Period: A Crucial Time for Enrollment

The open enrollment period is a crucial time for enrolling in a Medicare Supplement plan. You have a guaranteed acceptance period starting at age 65, regardless of your health status. This ensures you can secure a plan without concerns about pre-existing conditions impacting your eligibility.

7. Lifetime Protection: Long-Term Financial Security

Unlike some other insurance plans, Medigap plans provide lifetime coverage, protecting you against rising healthcare costs throughout your retirement years. This long-term protection provides financial security and peace of mind as you age. It's a crucial investment in your future healthcare needs.

8. No Annual Limits on Benefits: Continuous Protection

Medigap plans do not impose annual limits on benefits. Unlike some other health plans, you are not limited to a certain amount of coverage per year. This ensures you'll continue receiving benefits regardless of how much healthcare you require.

9. Protection Against Pre-Existing Conditions: Peace of Mind

During the initial enrollment period, Medigap policies offer protection against pre-existing conditions. This ensures that if you develop a health problem, the policy will cover the associated costs without any exclusions. This is a very important consideration and a significant benefit for individuals with prior health concerns.

10. Choice of Doctors and Hospitals: Maintain Your Healthcare Preferences

Medigap allows you to maintain your choice of doctors and hospitals within the Medicare network. You are not confined to a specific network of providers. This freedom to choose your healthcare providers is a significant benefit, allowing you to continue seeing your preferred doctors.

Choosing the Right Medicare Supplement Plan: A Personalized Approach

Not all Medigap plans are created equal. Each plan (A through N) offers different levels of coverage. It's crucial to carefully compare plans based on your individual needs and budget. Factors to consider include:

- Your health status: If you have pre-existing conditions, some plans may be more suitable.

- Your healthcare spending habits: Consider your typical healthcare expenses to determine the level of coverage you need.

- Your budget: Premiums for Medigap plans vary; choose a plan that fits your financial capabilities.

- Your personal preferences: Consider factors like the ease of filing claims and customer service.

Understanding the Costs Associated with Medigap

While Medigap offers significant advantages, it's important to understand the costs involved:

- Monthly Premiums: These premiums vary by plan and insurance company. Shop around to compare rates.

- Initial Costs: You'll pay the premium immediately upon enrollment.

It's vital to carefully weigh the benefits against the costs to ensure the plan aligns with your financial situation and healthcare needs. A financial advisor can assist in this crucial decision-making process.

Conclusion: A Wise Investment for Secure Healthcare in Retirement

A Medicare Supplement policy is a wise investment for many Medicare beneficiaries. The reduced out-of-pocket costs, enhanced coverage, peace of mind, and long-term financial security make it a valuable consideration for ensuring a healthy and worry-free retirement. By carefully comparing plans and considering individual needs, you can find a Medigap policy that provides optimal protection and financial stability throughout your retirement years. Remember to consult with a licensed insurance agent to discuss your options and find the best fit for your circumstances. The benefits of a Medigap policy extend far beyond simple cost savings, offering invaluable peace of mind and security during a crucial life stage.

Latest Posts

Latest Posts

-

Cdl Combination Test Questions And Answers Pdf

Mar 18, 2025

-

Life Insurance Exam Questions And Answers Pdf

Mar 18, 2025

-

The Direct Carry Is Used To Transfer A Patient

Mar 18, 2025

-

The Emancipation Proclamation Of January 1 1863 Quizlet

Mar 18, 2025

-

These Cards Will Get You Drunk Quizlet

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Benefits For A Medicare Supplement Policy Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.