Capital One Outage Impacts Deposits

Breaking News Today

Jan 22, 2025 · 5 min read

Table of Contents

Capital One Outage Impacts Deposits: Understanding the Fallout and Protecting Yourself

Capital One, a major financial institution, experienced a significant outage recently, leaving many customers unable to access their accounts and impacting deposit availability. This widespread disruption highlighted the vulnerability of digital banking systems and the potential consequences for consumers. This article delves into the details of the outage, explores its impact on deposits, and offers advice on how to protect yourself in similar situations.

Understanding the Capital One Outage

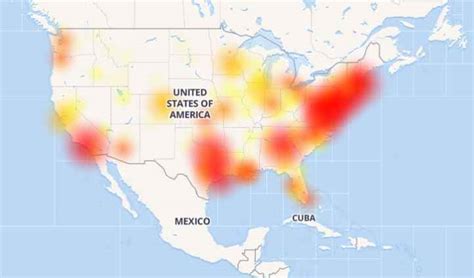

The recent Capital One outage wasn't a minor glitch; it was a significant event that affected a large number of customers. Reports indicated widespread issues with online banking, mobile apps, and even ATM access. The specific cause of the outage varied in reports, ranging from technical difficulties to planned maintenance gone wrong. Regardless of the root cause, the impact was the same: customers were locked out of their accounts and unable to access their funds.

Key Impacts of the Outage:

- Inability to Access Funds: This was perhaps the most significant impact. Customers couldn't make online transfers, pay bills, or even check their account balances.

- Disruption to Transactions: Scheduled payments might have been missed, causing late fees or other penalties. Attempts to make new transactions were unsuccessful.

- Customer Service Backlog: The outage overwhelmed Capital One's customer service lines, leaving many frustrated customers waiting for extended periods to resolve their issues.

- Loss of Confidence: The outage shook the confidence of some customers in Capital One's ability to securely manage their finances. This erosion of trust can be detrimental to a financial institution's reputation.

- Impact on Businesses: Businesses relying on Capital One for their financial transactions also faced significant disruptions, potentially impacting their operations and cash flow.

The Impact on Deposits: Were Funds at Risk?

While the outage caused significant inconvenience, it's crucial to address the question on many customers' minds: were their deposits at risk? The short answer is likely no. FDIC insurance typically covers deposits in member banks, and Capital One is a member. This means that even if there were technical issues preventing access, the underlying funds were likely secure.

However, the inability to access funds during the outage created significant anxiety and uncertainty. Many customers worried about the potential loss of money, especially those who needed access to funds for essential expenses. This underscores the importance of having contingency plans in place.

Protecting Yourself from Future Outages

Experiencing a major banking outage is unsettling. Taking steps to mitigate the impact of future disruptions can provide peace of mind and better financial management.

Proactive Strategies:

- Diversify Your Banking: Don't keep all your eggs in one basket. Spread your funds across multiple banks or financial institutions. This helps to minimize the impact of a single institution's outage.

- Maintain Emergency Funds: Always keep a readily accessible emergency fund in a separate account, preferably a different bank. This provides a safety net during unexpected disruptions.

- Use Multiple Payment Methods: Relying solely on online or mobile banking can leave you vulnerable during outages. Consider using physical checks or debit cards for essential transactions.

- Regularly Check Your Accounts: Develop a routine of regularly checking your account balances and transactions, even outside of scheduled payment times. This helps to quickly identify any discrepancies.

- Monitor Bank Communication: Pay close attention to official communications from your bank, especially during periods of reported outages or system maintenance.

- Understand Your Bank's Contingency Plans: Familiarize yourself with your bank's procedures for handling outages and how they would communicate with customers in such situations.

- Consider Offline Banking Options: For crucial payments, consider using offline methods like visiting a branch or using a check.

- Backup Your Financial Information: Securely store important financial information like account numbers, contact information, and passwords offline.

- Update Contact Information: Keep your contact information up-to-date with your bank to ensure you receive timely notifications during outages.

Learning from the Capital One Outage

The Capital One outage serves as a valuable lesson for both consumers and financial institutions. For consumers, it highlighted the importance of financial preparedness and diversification. For banks, it underscored the need for robust, resilient systems and effective communication during crises.

The Importance of Robust Cybersecurity Measures

While the exact cause of the Capital One outage might not have been a cybersecurity breach in this particular instance, it’s crucial to acknowledge the increased reliance on digital banking systems and the ever-present threat of cyberattacks. Robust cybersecurity measures are paramount for preventing data breaches and service disruptions. Banks need to invest heavily in secure infrastructure and employ cutting-edge security protocols to protect customer data and maintain service availability. This includes regular security audits, employee training on cybersecurity best practices, and multi-layered security defenses to prevent unauthorized access and data breaches.

Long-Term Implications and Regulatory Response

The Capital One outage, along with similar incidents at other financial institutions, might prompt regulatory scrutiny and potential changes to regulations governing financial services. The industry may see a push for greater transparency regarding system outages, improved communication strategies during disruptions, and enhanced cybersecurity standards. This would be beneficial to both consumers and the financial institutions themselves, ultimately fostering greater confidence and stability within the system.

Conclusion:

The Capital One outage serves as a stark reminder of the importance of being prepared for unexpected disruptions in the digital age. By diversifying financial strategies, maintaining emergency funds, and understanding the potential vulnerabilities of online banking, consumers can mitigate the risks associated with such events. Financial institutions must, in turn, prioritize robust security measures and transparent communication to maintain customer trust and ensure the smooth functioning of their services. The future of banking increasingly relies on digital infrastructure; therefore, the focus on resilience, security, and communication must remain a top priority.

Latest Posts

Latest Posts

-

A List Of Accounts Used By A Business

Mar 13, 2025

-

Conductor Is To Baton As Judge Is To

Mar 13, 2025

-

Letrs Unit 3 Session 5 Check For Understanding

Mar 13, 2025

-

De Que Color Es El Tutu De Alicia Alonso

Mar 13, 2025

-

Which Of The Following Statements Is Not True About Alcohol

Mar 13, 2025

Related Post

Thank you for visiting our website which covers about Capital One Outage Impacts Deposits . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.