Capital One Outage: Users Report Issues

Breaking News Today

Jan 22, 2025 · 5 min read

Table of Contents

Capital One Outage: Users Report Widespread Issues

Capital One, a major financial institution, experienced a significant outage on [Insert Date of Outage], leaving numerous customers unable to access their accounts and services. The disruption sparked widespread frustration and concern among users who reported a variety of problems, from online banking difficulties to difficulties using Capital One's mobile app. This article delves into the details of the outage, exploring the reported issues, Capital One's response, and the broader implications of such widespread service disruptions.

The Extent of the Outage: A Nationwide Disruption?

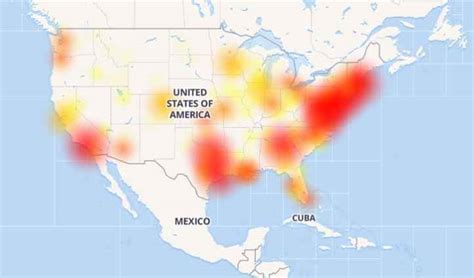

Reports of Capital One service disruptions flooded social media platforms like Twitter and Facebook, with users from across the country detailing their experiences. The outage appeared to be widespread, affecting both online and mobile banking platforms. Many users reported being unable to log in to their accounts, while others experienced difficulties accessing account balances, transaction history, or making payments. Some reported that the Capital One website displayed error messages, while others found the app unresponsive or crashing.

The sheer volume of complaints indicated a significant problem impacting a substantial portion of Capital One's customer base. This widespread nature of the outage underscores the vulnerability of even large financial institutions to technological glitches and the potential for far-reaching consequences. The timing of the outage, [mention time of day if relevant, e.g., during peak banking hours], likely exacerbated the frustration and inconvenience felt by affected customers.

Specific Issues Reported by Users

The reported issues were not uniform. Some users faced only temporary difficulties logging in, while others experienced persistent problems throughout the outage period. A common complaint involved the Capital One mobile app, with many users reporting that it was crashing repeatedly or failing to load altogether. The website also experienced significant slowdowns or complete unavailability for many users. In addition to these access issues, some users also reported problems with making payments, transferring funds, or accessing customer service.

- Inability to log in: This was arguably the most common problem reported, affecting a large number of Capital One customers.

- App crashes and malfunctions: The Capital One mobile app, a critical access point for many users, experienced widespread crashes and malfunctions.

- Website unavailability: The Capital One website was unavailable or extremely slow for many users, hindering access to online banking services.

- Payment processing failures: Some users reported being unable to make payments due to the outage.

- Customer service inaccessibility: The difficulties accessing online services were compounded by the inability to reach customer service representatives for assistance.

Capital One's Response: Acknowledgment and Mitigation Efforts

Capital One eventually acknowledged the outage via social media and its website, although the initial response time was a source of criticism for some customers. The company issued updates providing information about the situation and assuring users that they were working to resolve the issue. While the specific cause of the outage was not immediately revealed, the company's statements suggested that they were investigating the root cause and implementing corrective measures.

The speed and effectiveness of Capital One's response will undoubtedly influence customer perception of the company's reliability and preparedness for such events. A swift and transparent response can mitigate negative impacts, while a delayed or inadequate response can exacerbate customer frustration and damage the company's reputation.

Analyzing Capital One's Communication Strategy

Capital One's communication during the outage will be carefully scrutinized by both customers and industry analysts. Transparency is key in such situations. Openly communicating the nature of the problem, the steps being taken to address it, and providing regular updates can help manage customer expectations and prevent the spread of misinformation. Conversely, a lack of communication or a delayed response can fuel negative sentiment and damage the company's image. The company's subsequent actions, particularly any compensation or measures to prevent future outages, will also be crucial in shaping public perception.

The Broader Implications: Trust, Security, and Financial Stability

Outage events like this highlight the importance of robust IT infrastructure and disaster recovery planning for financial institutions. The reliance on digital banking services by consumers makes such outages particularly disruptive. The inconvenience extends beyond mere access to accounts; it can impact time-sensitive transactions, payments, and overall financial management. This disruption can cause significant stress and inconvenience to customers, particularly those who rely heavily on online banking services for daily financial operations.

Moreover, the potential for security breaches during outages adds another layer of concern. While there were no reported security breaches associated with this particular outage, the vulnerability of systems during periods of disruption raises questions about the security measures in place. This emphasizes the need for financial institutions to prioritize both system reliability and data security.

Long-Term Impacts on Consumer Confidence

The long-term impact of this Capital One outage on consumer confidence remains to be seen. Repeat outages or a lack of effective remediation could erode consumer trust in the institution, leading to potential customer churn and reputational damage. The company's actions in the aftermath of the outage, including communication strategies, compensation measures, and improvements to its infrastructure, will play a crucial role in shaping future customer perceptions and maintaining long-term loyalty.

Conclusion: Learning from the Capital One Outage

The Capital One outage served as a stark reminder of the vulnerabilities inherent in digital banking and the critical importance of robust systems and effective crisis management. The experience highlights the need for financial institutions to prioritize investing in resilient infrastructure, developing comprehensive disaster recovery plans, and maintaining open communication with customers during service disruptions. The lasting impact of this outage will depend on Capital One's response, including its transparency, its commitment to remediation, and its ability to regain customer trust. The incident also underscores the need for users to have backup plans for accessing their finances, such as alternative methods of payment or access to physical branches, in case of future outages. Regularly reviewing financial account statements and monitoring for any unauthorized activity remains crucial regardless of the service provider.

Latest Posts

Latest Posts

-

Sporting Officials Are Typically Responsible For

Mar 14, 2025

-

Managers At Amazon Are Usingdecentralized Control To Manage These Employees

Mar 14, 2025

-

The Effects Of Inflation Are Seen In

Mar 14, 2025

-

Generally Accepted Accounting Principles Gaap Wants Information To Have

Mar 14, 2025

-

What Holds Phospholipids Together In A Bilayer Formation

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about Capital One Outage: Users Report Issues . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.