Generally Accepted Accounting Principles Gaap Wants Information To Have

Breaking News Today

Mar 14, 2025 · 6 min read

Table of Contents

Generally Accepted Accounting Principles (GAAP): What Information Does It Want?

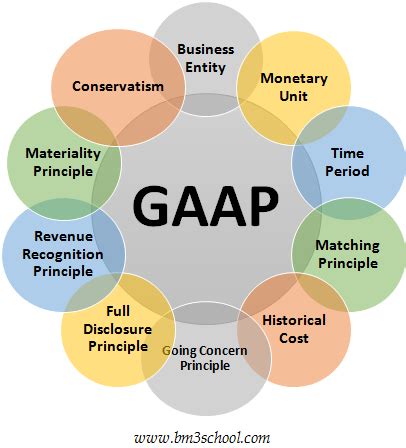

Generally Accepted Accounting Principles (GAAP) are a common set of accounting rules, standards, and procedures issued by the Financial Accounting Standards Board (FASB). These standards ensure that companies' financial statements are presented accurately and consistently, allowing investors, creditors, and other stakeholders to make informed decisions. But what specific information does GAAP demand? The answer is multifaceted, encompassing a wide range of financial data presented in a structured and standardized manner. This article delves deep into the core requirements of GAAP, examining the essential information it seeks to capture and why this information is crucial for transparency and accountability.

The Foundation: Faithful Representation and Relevance

At the heart of GAAP lies the principle of faithful representation. This means that the information presented in financial statements must accurately reflect the economic reality of the business. It should be complete, neutral (free from bias), and free from material error. This is further enhanced by the principle of relevance, meaning the information should be capable of influencing the economic decisions of users. Without these two foundational principles, the entire structure of GAAP becomes meaningless.

Key Elements of Faithful Representation:

- Completeness: All necessary information must be disclosed. Omitting relevant data, even unintentionally, violates this principle. This includes not only numerical data but also qualitative information like significant business events or changes in accounting policies.

- Neutrality: Information should be presented objectively, without favoring any specific stakeholder group. This prevents the manipulation of financial statements to portray a more favorable picture than reality.

- Freedom from error: While perfect accuracy is an ideal, material errors must be avoided. A material error is one that could influence the decisions of users. Thorough internal controls and auditing processes are vital in preventing and detecting such errors.

Key Aspects of Relevance:

- Predictive value: The information should help users predict future outcomes. For example, consistent profitability over several years can be predictive of future profitability.

- Confirmatory value: The information should confirm or correct prior expectations. For instance, if a company reported significant losses, it could confirm previous concerns about its financial health.

- Materiality: Only information significant enough to influence the decisions of users needs to be disclosed. Insignificant details can be omitted to avoid cluttering the financial statements.

The Core Financial Statements: A Deep Dive

GAAP mandates the preparation of several core financial statements. These statements, when taken together, provide a comprehensive view of a company's financial position and performance.

1. Balance Sheet: A Snapshot in Time

The balance sheet presents a company's financial position at a specific point in time. It adheres to the fundamental accounting equation: Assets = Liabilities + Equity. GAAP requires detailed information about:

- Assets: These are resources controlled by the company as a result of past events and from which future economic benefits are expected to flow. This includes current assets (cash, accounts receivable, inventory), and non-current assets (property, plant, and equipment, intangible assets). GAAP mandates specific valuation methods for each asset type, ensuring consistency and comparability.

- Liabilities: These are present obligations of the company arising from past events, the settlement of which is expected to result in an outflow of resources embodying economic benefits. This includes current liabilities (accounts payable, short-term debt) and non-current liabilities (long-term debt, deferred revenue). Accurate reporting of liabilities is critical for assessing a company's solvency.

- Equity: This represents the residual interest in the assets of the entity after deducting all its liabilities. It reflects the owners' stake in the company. For corporations, this includes common stock, retained earnings, and other comprehensive income.

2. Income Statement: Performance Over Time

The income statement reports a company's financial performance over a specific period. It summarizes revenues, expenses, and the resulting net income or loss. GAAP dictates how various items are recognized and measured, ensuring consistency. Key components include:

- Revenues: Inflows of assets or settlements of liabilities that result from the ordinary activities of an entity. GAAP specifies criteria for revenue recognition, ensuring that revenue is recognized when it is earned, not necessarily when cash is received.

- Expenses: Outflows of assets or incurrences of liabilities that result from the ordinary activities of an entity. Matching principle dictates that expenses are recognized in the same period as the revenues they helped generate.

- Net Income (or Loss): The difference between total revenues and total expenses. This is a crucial indicator of a company's profitability. GAAP requires disclosure of significant components of net income, allowing users to analyze the drivers of profitability.

3. Statement of Cash Flows: Tracking Cash Movements

The statement of cash flows tracks the movement of cash both into and out of a company during a specific period. It categorizes cash flows into three main activities:

- Operating activities: Cash flows related to the company's day-to-day operations.

- Investing activities: Cash flows related to the acquisition and disposal of long-term assets.

- Financing activities: Cash flows related to the company's financing activities, such as debt issuance and equity financing.

GAAP requires a clear and detailed presentation of cash flows, enabling users to assess a company's liquidity and solvency.

4. Statement of Changes in Equity: Tracking Equity Fluctuations

The statement of changes in equity reconciles the beginning and ending balances of equity accounts. It details the changes in equity during the period, including:

- Net income (or loss): Added to retained earnings.

- Dividends paid: Subtracted from retained earnings.

- Other comprehensive income: Items that affect equity but are not included in net income.

Beyond the Core Statements: Additional Disclosures

GAAP demands more than just the core financial statements. Companies must also provide supplementary information to enhance the transparency and usefulness of the financial reports. This includes:

- Notes to the financial statements: These notes provide detailed explanations of the accounting policies used, significant judgments made, and other relevant information not presented in the core statements. They are crucial for understanding the context of the financial data.

- Management's discussion and analysis (MD&A): This section provides management's perspective on the company's performance and financial condition. It offers insights into the future outlook and key risks facing the business.

- Auditor's report: An independent auditor's assessment of the fairness and accuracy of the financial statements. This provides assurance to users that the financial information is reliable.

The Importance of GAAP Compliance

Adherence to GAAP is not merely a compliance exercise; it's crucial for the proper functioning of capital markets. Consistent application of these principles ensures:

- Comparability: Investors can compare the financial performance and position of different companies.

- Transparency: Financial information is readily understandable and accessible to all stakeholders.

- Accountability: Companies are held responsible for the accuracy and reliability of their financial reporting.

- Trust and confidence: Compliance with GAAP fosters trust and confidence in the capital markets, attracting investment and facilitating economic growth.

Challenges and Evolution of GAAP

While GAAP provides a robust framework, it faces ongoing challenges:

- Complexity: The rules can be complex and difficult to interpret, requiring specialized expertise.

- Cost of compliance: Adhering to GAAP can be expensive, particularly for smaller companies.

- Evolutionary nature: GAAP is constantly evolving to reflect changes in the business environment and accounting practices. Keeping up with these changes is an ongoing challenge.

The continued evolution of GAAP reflects a commitment to improving the quality and relevance of financial reporting. The ongoing efforts to simplify certain aspects while maintaining a strong emphasis on transparency and accountability aim to maintain the integrity and trust in financial information for all stakeholders. Understanding the detailed requirements of GAAP remains critical for both preparers and users of financial statements in ensuring a reliable and trustworthy financial ecosystem.

Latest Posts

Latest Posts

-

Which Statement Is Not True About Bacteria

May 09, 2025

-

Swing Dancing Began At The In Harlem

May 09, 2025

-

Which Statement Is True Of Both Mortgages And Auto Loans

May 09, 2025

-

All Summer In A Day Plot Elements

May 09, 2025

-

To Reduce The Risk Of Lead Exposure Employers Should

May 09, 2025

Related Post

Thank you for visiting our website which covers about Generally Accepted Accounting Principles Gaap Wants Information To Have . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.