Changes In Consumption And Gross Investment Can

Breaking News Today

Mar 16, 2025 · 6 min read

Table of Contents

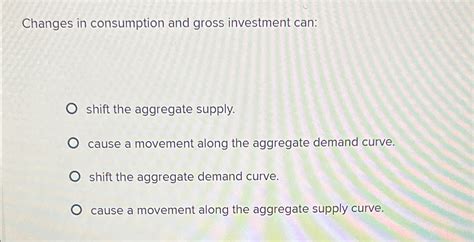

Changes in Consumption and Gross Investment: A Deep Dive into Economic Fluctuations

Changes in consumption and gross investment are fundamental drivers of economic growth and fluctuation. Understanding their interplay is crucial for policymakers, businesses, and economists alike. This article delves deep into the dynamics of consumption and investment, exploring their individual impacts and their combined effects on the overall economy. We'll examine the factors influencing these key macroeconomic variables, analyze their cyclical behavior, and explore the implications for economic stability and growth.

Understanding Consumption

Consumption, representing the largest component of GDP in most economies, refers to the total spending by households on goods and services. This includes durable goods (e.g., cars, appliances), non-durable goods (e.g., food, clothing), and services (e.g., healthcare, education). Consumer spending is driven by several key factors:

Factors Influencing Consumption

-

Disposable Income: This is the most significant determinant. Higher disposable income (income after taxes and transfers) generally leads to higher consumption, reflecting a positive relationship. The marginal propensity to consume (MPC), representing the proportion of additional income spent on consumption, plays a critical role.

-

Consumer Confidence: Optimistic consumer sentiment about the future economy boosts consumption, while pessimism leads to restraint. Surveys measuring consumer confidence provide valuable insights into future spending patterns.

-

Interest Rates: Higher interest rates increase borrowing costs, making it more expensive to finance purchases, especially for durable goods. This can dampen consumption, particularly for interest-sensitive items like houses and cars.

-

Wealth Effects: Changes in asset values (e.g., housing, stocks) impact household wealth. Increases in wealth often lead to higher consumption, a phenomenon known as the wealth effect. Conversely, a decline in wealth can trigger a reduction in spending.

-

Government Policies: Fiscal policies, such as tax cuts or government spending programs, can stimulate consumption by boosting disposable income. Conversely, tax increases or spending cuts can reduce consumption.

-

Inflation: High inflation erodes purchasing power, potentially leading to reduced consumption if wages don't keep pace. Unexpected inflation can also create uncertainty, further dampening consumer spending.

The Role of Gross Investment

Gross investment encompasses spending on capital goods (e.g., machinery, equipment, buildings) and additions to inventories. It's a crucial driver of long-term economic growth, contributing to increased productivity and capacity.

Factors Influencing Gross Investment

-

Profit Expectations: Businesses invest when they anticipate future profitability. Positive expectations about future demand and economic conditions encourage investment, while negative expectations deter it.

-

Interest Rates: Similar to consumption, higher interest rates raise the cost of borrowing for investment projects, discouraging investment. Low interest rates make borrowing cheaper and stimulate investment.

-

Technological Change: Technological advancements create opportunities for investment in new and more efficient capital goods. This can lead to a surge in investment as businesses upgrade their equipment and processes.

-

Government Policies: Tax incentives, subsidies, and regulations can significantly influence investment decisions. Favorable policies encourage investment, while unfavorable policies can discourage it.

-

Capacity Utilization: When existing capacity is fully utilized, businesses are more likely to invest in expanding their production capacity. Low capacity utilization can suppress investment.

-

Economic Growth: Strong economic growth generally leads to higher investment as businesses expand to meet increased demand. Recessions often see a sharp decline in investment.

The Interplay of Consumption and Investment

Consumption and investment are interconnected, influencing each other through various channels. For instance, increased investment can lead to job creation and higher wages, boosting disposable income and consumption. Conversely, strong consumer demand can encourage businesses to invest in expanding production capacity.

Multiplier Effect

Changes in consumption and investment have a multiplier effect on the overall economy. An initial increase in investment, for example, leads to increased income for workers involved in producing capital goods. These workers then spend a portion of their additional income (MPC), creating further demand and income for others. This process repeats, generating a larger overall increase in economic activity than the initial investment.

Accelerator Effect

The accelerator effect describes the relationship between changes in consumer demand and investment. When consumer demand increases significantly, businesses respond by increasing investment to expand production capacity. Conversely, a decline in consumer demand can lead to a sharp reduction in investment as businesses scale back production.

Consumption and Investment in Economic Cycles

Consumption and investment exhibit different behaviors across different phases of the business cycle.

During Economic Expansions

During economic expansions (periods of sustained economic growth), both consumption and investment typically rise. High consumer confidence, increasing disposable income, and favorable business expectations drive this upward trend. The multiplier and accelerator effects amplify the growth, leading to a self-sustaining expansion.

During Economic Recessions

Recessions are marked by a decline in economic activity. Consumer confidence falls, disposable income decreases, and businesses cut back on investment due to pessimistic expectations. The multiplier and accelerator effects work in reverse, amplifying the downward spiral. Consumption falls sharply as unemployment rises and consumer spending is constrained. Investment plummets as businesses delay or cancel expansion projects and focus on cost-cutting measures.

Policy Implications

Understanding the dynamics of consumption and investment is vital for designing effective macroeconomic policies. Governments can use fiscal and monetary policies to influence these variables and stabilize the economy.

Fiscal Policy

Fiscal policy involves government spending and taxation. During recessions, governments can stimulate the economy by increasing government spending (e.g., infrastructure projects) or cutting taxes to boost disposable income and consumption. This expansionary fiscal policy aims to counteract the decline in private investment and consumption.

Monetary Policy

Monetary policy, implemented by central banks, involves controlling interest rates and the money supply. During recessions, central banks can lower interest rates to encourage borrowing and investment. This expansionary monetary policy makes it cheaper for businesses to invest and consumers to borrow for purchases. Conversely, during periods of inflation, central banks may raise interest rates to curb excessive consumption and investment.

The Importance of Forecasting

Accurate forecasting of consumption and investment is crucial for both policymakers and businesses. Economists use various econometric models and leading indicators to predict future trends. These forecasts inform policy decisions and allow businesses to make informed investment and production decisions.

Conclusion: A Complex Interplay

Changes in consumption and gross investment are intrinsically linked and exert powerful influences on the overall economy. Understanding their interplay, the factors driving them, and their cyclical behavior is essential for navigating economic fluctuations and fostering sustainable growth. Effective macroeconomic policies must consider these intertwined dynamics to manage economic stability and promote prosperity. Further research into the complexities of consumer behavior and business investment decisions remains crucial for improving economic forecasting and policymaking. The intricate relationship between these two macroeconomic components continues to be a core area of study for economists and policymakers globally, constantly evolving as new data emerges and economic conditions shift. Therefore, ongoing analysis and adaptation of policy responses are essential to maintain economic health and growth.

Latest Posts

Latest Posts

-

How Large Can A Small Group Be

Mar 16, 2025

-

The Process Of Lysing A Cell Results In

Mar 16, 2025

-

The Great Man Theories Focused On Identification Of

Mar 16, 2025

-

Which Of The Following Would Increase Cardiac Output

Mar 16, 2025

-

Which Of The Following Is A Capital Resource

Mar 16, 2025

Related Post

Thank you for visiting our website which covers about Changes In Consumption And Gross Investment Can . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.