Consumer Reports Requested By An Underwriter During The Application

Breaking News Today

Mar 28, 2025 · 6 min read

Table of Contents

Consumer Reports Requested by an Underwriter During the Application: A Comprehensive Guide

Applying for a loan, whether it's for a mortgage, auto loan, or personal loan, often involves a thorough vetting process by the lender. One crucial element of this process is the underwriter's review of your financial history. Increasingly, this includes requesting consumer reports, such as those from Equifax, Experian, and TransUnion. Understanding what these reports reveal, why underwriters request them, and how to prepare can significantly impact your chances of loan approval. This comprehensive guide will delve into the intricacies of consumer reports in the loan application process.

Understanding Consumer Reports

Consumer reports, also known as credit reports, are detailed summaries of your financial history. They are compiled by the three major credit bureaus – Equifax, Experian, and TransUnion – and contain information from various sources, including:

Key Components of a Consumer Report:

-

Personal Information: This includes your name, address, date of birth, and Social Security number. Accuracy is crucial; any discrepancies can delay or even derail the application process.

-

Credit Accounts: This section lists all your credit accounts, including credit cards, loans (mortgages, auto loans, personal loans), and installment plans. It details account balances, credit limits, payment history (showing on-time or late payments), and account opening dates. Late payments and defaults are severely detrimental to your credit score.

-

Public Records: This includes bankruptcies, foreclosures, tax liens, and judgments. These entries significantly impact your creditworthiness and can make securing loans challenging.

-

Inquiries: This section records instances where lenders or other businesses have checked your credit report. Too many inquiries in a short period can signal to lenders that you're actively seeking credit, which can negatively affect your score.

-

Credit Score: While not technically part of the report itself, the credit score is a numerical representation of your creditworthiness, derived from the information in your report. A higher credit score generally improves your chances of loan approval and secures better interest rates.

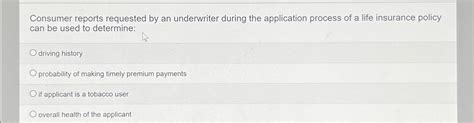

Why Underwriters Request Consumer Reports

Underwriters use consumer reports to assess your credit risk. They need to determine the likelihood of you repaying the loan as agreed. The information within the reports provides them with a comprehensive picture of your financial responsibility and stability. Specifically, they analyze:

Key Factors Underwriters Consider:

-

Payment History: A consistent history of on-time payments is a strong indicator of your reliability. Missed or late payments raise significant red flags.

-

Credit Utilization: This refers to the amount of credit you're using compared to your total available credit. High credit utilization (using a large portion of your available credit) suggests a higher risk.

-

Length of Credit History: A longer credit history, demonstrating responsible credit management over time, is generally viewed favorably.

-

Credit Mix: Having a mix of different types of credit accounts (e.g., credit cards, installment loans) can positively influence your credit score.

-

Recent Inquiries: A sudden surge in credit inquiries can suggest financial instability or desperation, impacting the underwriter's assessment.

-

Public Records: Bankruptcies, foreclosures, and judgments are serious negative indicators that demonstrate past financial difficulties.

How to Prepare for a Consumer Report Request

Preparing for a consumer report request involves proactively managing your finances and addressing any potential issues before applying for a loan. Here's a detailed strategy:

Proactive Steps to Improve Your Credit:

-

Check Your Credit Reports: Obtain your free credit reports annually from AnnualCreditReport.com. Review them meticulously for any errors or inaccuracies. Dispute any errors immediately with the respective credit bureau.

-

Pay Down Debt: Reducing your debt, especially high-interest debt, significantly improves your credit utilization ratio and strengthens your application.

-

Pay Bills On Time: Consistent on-time payments are paramount. Set up automatic payments to avoid late fees and negative impacts on your credit score.

-

Limit New Credit Applications: Avoid applying for multiple credit accounts in a short period, as this can negatively affect your credit score.

-

Address Negative Items: If you have negative items on your credit report, such as late payments or defaults, work to resolve them. This could involve contacting creditors to negotiate payment plans or seeking credit counseling.

-

Monitor Your Credit Score: Regularly track your credit score using free or paid services. This allows you to monitor your progress and identify areas for improvement.

Understanding the Impact of Consumer Reports on Loan Approval

The information contained in your consumer reports significantly influences the underwriter's decision. A strong credit profile, reflecting responsible financial management, increases your chances of approval and secures favorable loan terms. Conversely, a poor credit history can lead to:

Potential Outcomes Based on Credit Reports:

-

Loan Denial: If your credit score is too low or your credit report reveals significant negative information, the underwriter may deny your loan application.

-

Higher Interest Rates: Even with approval, a lower credit score typically results in higher interest rates, making the loan more expensive.

-

Stricter Loan Terms: Underwriters might impose stricter loan terms, such as a shorter repayment period or a larger down payment, to mitigate the perceived risk.

-

Reduced Loan Amounts: The lender might approve a smaller loan amount than initially requested, based on the perceived risk associated with your credit profile.

Beyond the Credit Report: Other Factors Considered

While consumer reports are a central component of the underwriting process, underwriters also consider other factors:

Additional Factors Influencing Loan Approval:

-

Income and Employment History: Stable income and consistent employment history are crucial indicators of your ability to repay the loan.

-

Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. A high DTI suggests a higher risk.

-

Assets and Liabilities: Underwriters assess your overall financial picture, including your assets (e.g., savings, investments) and liabilities (e.g., outstanding debts).

-

Loan Purpose: The purpose of the loan can influence the underwriter's assessment. For instance, a loan for a home purchase might be viewed differently than a loan for a vacation.

Navigating Challenges and Disputes

If you disagree with the information on your consumer report, you have the right to dispute it. Follow these steps:

Addressing Discrepancies and Errors:

-

Review Your Reports Carefully: Meticulously review each report for errors or inaccuracies.

-

File a Dispute: Submit a dispute directly to the credit bureau that reported the inaccurate information. Provide supporting documentation to substantiate your claim.

-

Follow Up: Follow up on the status of your dispute and ensure the credit bureau takes appropriate action to correct the errors.

-

Consider Professional Help: If you encounter difficulties resolving the dispute on your own, consider seeking assistance from a credit repair company or a consumer credit counselor.

Conclusion

Consumer reports play a pivotal role in the loan application process. Understanding their contents, why underwriters request them, and how to prepare for this crucial step is essential for a successful loan application. By proactively managing your finances, addressing any negative information on your credit report, and demonstrating responsible financial behavior, you can significantly increase your chances of loan approval and secure favorable terms. Remember, your credit report is a reflection of your financial health – take control of it, and it will work for you, not against you.

Latest Posts

Latest Posts

-

Describe The Symptoms And Treatment For Athletes Foot Quizlet

Mar 31, 2025

-

End Of Life Palliative Care And Hospice Care Quizlet

Mar 31, 2025

-

Economics Is Best Defined As The Study Of Quizlet

Mar 31, 2025

-

Citi Training Quizlet Social And Behavioral Research

Mar 31, 2025

-

Anatomy And Physiology 1 Exam 1 Quizlet

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Consumer Reports Requested By An Underwriter During The Application . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.