Cynthia Needs To Share A Financial Snapshot Of Her Company

Breaking News Today

Mar 25, 2025 · 6 min read

Table of Contents

Cynthia Needs to Share a Financial Snapshot of Her Company: A Comprehensive Guide

Cynthia, the CEO of a burgeoning startup, faces a crucial moment. She needs to present a financial snapshot of her company to potential investors. This isn't just about numbers; it's about storytelling, showcasing potential, and building trust. This comprehensive guide will walk Cynthia (and you) through creating a compelling and informative financial snapshot that will impress even the most discerning investor.

Understanding the Purpose of a Financial Snapshot

Before diving into the specifics, it's vital to understand why Cynthia needs this snapshot. It's not merely a report; it's a tool to achieve several key objectives:

- Attract Investment: The primary goal is to attract potential investors. A well-crafted snapshot highlights the company's financial health and growth prospects, making it an attractive investment opportunity.

- Secure Funding: Beyond attracting investors, the snapshot will be instrumental in securing the necessary funding to fuel the company's growth and expansion.

- Demonstrate Viability: It showcases the company's viability as a sustainable business, demonstrating its ability to generate revenue, manage expenses, and achieve profitability.

- Build Credibility: A clear and concise financial snapshot builds credibility and trust with potential investors, reinforcing the company's trustworthiness and commitment to transparency.

- Inform Decision-Making: The snapshot provides vital information for investors to make informed decisions about whether or not to invest in Cynthia's company.

Key Components of a Powerful Financial Snapshot

A compelling financial snapshot isn't just a jumble of numbers. It needs a structured approach, incorporating these key components:

1. Executive Summary: The Hook

This is the first impression, so it needs to be captivating. The executive summary should be concise (one page maximum) and highlight the most critical financial information. It should include:

- Company Overview: Briefly introduce the company, its mission, and its unique selling proposition (USP).

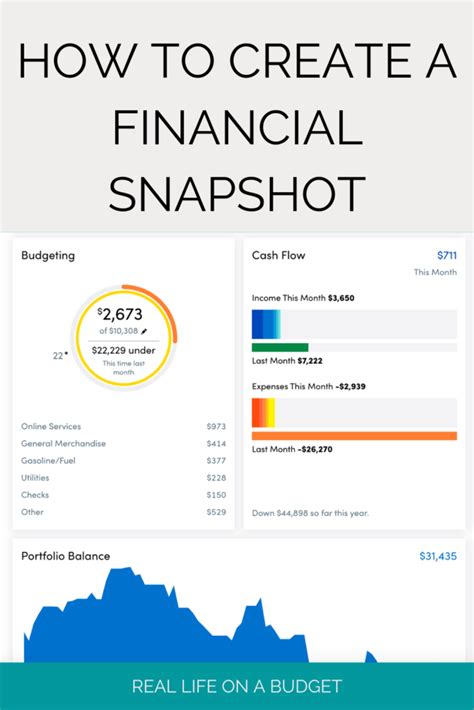

- Key Financial Highlights: Present the most important financial metrics, such as revenue growth, profitability, and key performance indicators (KPIs). Use strong visuals like charts and graphs to make the data more accessible.

- Investment Highlights: Clearly state the investment opportunity, including the amount of funding sought, the intended use of funds, and the expected return on investment (ROI).

- Call to Action: End with a clear call to action, inviting investors to learn more and schedule a meeting.

Example: "XYZ Corp, a leader in sustainable technology, is seeking $2 million in Series A funding to expand its market reach and accelerate product development. We've experienced 50% year-over-year revenue growth and are projecting profitability within the next 12 months. This investment represents a unique opportunity to participate in a rapidly growing market with significant potential for high returns."

2. Financial Statements: The Foundation

The core of the snapshot lies in the financial statements. These provide a detailed view of the company's financial performance. Essential statements include:

- Income Statement (Profit & Loss Statement): This statement shows the company's revenues, expenses, and profits over a specific period. It reveals the company's profitability and efficiency in managing costs. Key metrics include gross profit margin, operating profit margin, and net profit margin.

- Balance Sheet: This statement presents a snapshot of the company's assets, liabilities, and equity at a specific point in time. It illustrates the company's financial position and its ability to meet its obligations. Key ratios include current ratio, quick ratio, and debt-to-equity ratio.

- Cash Flow Statement: This statement tracks the movement of cash in and out of the company over a specific period. It reveals the company's ability to generate cash from operations, invest in growth, and meet its financial obligations. Key metrics include operating cash flow, investing cash flow, and financing cash flow.

Important Note: These statements should be audited or reviewed by a qualified accountant to ensure accuracy and credibility.

3. Key Performance Indicators (KPIs): The Metrics of Success

Beyond the traditional financial statements, including key performance indicators provides a more holistic view of the company's performance. KPIs should be relevant to the industry and the company's strategic goals. Examples include:

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer.

- Customer Lifetime Value (CLTV): The predicted revenue a customer will generate throughout their relationship with the company.

- Churn Rate: The rate at which customers cancel their subscriptions or stop using the company's products or services.

- Website Traffic: For online businesses, website traffic is a crucial indicator of reach and engagement.

- Conversion Rate: The percentage of website visitors who complete a desired action (e.g., making a purchase).

4. Market Analysis: The Big Picture

Investors want to see that Cynthia's company understands its market. This section should include:

- Market Size and Growth: Demonstrate the size of the target market and its growth potential.

- Competitive Landscape: Analyze the competitive landscape, highlighting the company's competitive advantages and strategies for differentiation.

- Market Share: Show the company's market share and its potential for future growth.

- Target Audience: Clearly define the target audience and explain why the company is well-positioned to serve their needs.

5. Funding Request and Use of Funds: The Investment Plan

This section clarifies how much funding Cynthia is seeking and how those funds will be used. Be specific and avoid vague statements. Provide a detailed breakdown of how the investment will contribute to the company's growth and profitability. For instance:

- Specific Expenses: Detail the intended use of funds, such as marketing campaigns, product development, hiring key personnel, or expanding operations.

- Timeline: Provide a clear timeline for the use of funds.

- Projected ROI: Provide a reasonable projection of the return on investment for potential investors.

6. Management Team: The Human Element

Investors invest in people as much as they invest in ideas. Showcase the experience and expertise of the management team. Include brief bios highlighting relevant experience and accomplishments.

7. Appendix: Supporting Documents

The appendix provides additional supporting documentation, such as detailed financial statements, market research reports, and letters of support.

Presentation and Delivery: Making it Count

The financial snapshot is only half the battle. The presentation and delivery are equally crucial.

- Visual Appeal: Use charts, graphs, and infographics to present the data in a clear and visually appealing way.

- Concise Language: Use clear and concise language, avoiding jargon and technical terms that might confuse investors.

- Storytelling: Frame the financial data within a compelling narrative that highlights the company's vision, mission, and potential for growth.

- Practice: Practice the presentation thoroughly to ensure a smooth and confident delivery.

- Q&A: Be prepared to answer questions from potential investors.

Cynthia's Success Story: Putting it All Together

By following these steps, Cynthia can create a compelling financial snapshot that showcases her company's potential and attracts the investment she needs. Remember, this is more than just numbers; it's a story of growth, innovation, and opportunity. A well-crafted financial snapshot is a powerful tool that can significantly increase Cynthia’s chances of securing funding and achieving her business goals. By focusing on clarity, accuracy, and a compelling narrative, Cynthia can transform a simple financial overview into a compelling investment opportunity. The key is to demonstrate a clear understanding of the financial health of her company, a well-defined path towards future growth, and a passionate team dedicated to its success. This combination will resonate strongly with potential investors, increasing the likelihood of a successful funding round. By showcasing a compelling vision, a solid financial foundation, and a dedicated team, Cynthia can effectively position her company for future success.

Latest Posts

Latest Posts

-

A Set Of Characters With The Same Design And Shape

Mar 26, 2025

-

The Main Therapeutic Goal Of Rebt Is To

Mar 26, 2025

-

Presence Of Chronic Suprapubic Catheter Icd 10

Mar 26, 2025

-

What Model Does An Antivirus Software Operate Off Of

Mar 26, 2025

-

The Jungle By Upton Sinclair Answer Key

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about Cynthia Needs To Share A Financial Snapshot Of Her Company . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.