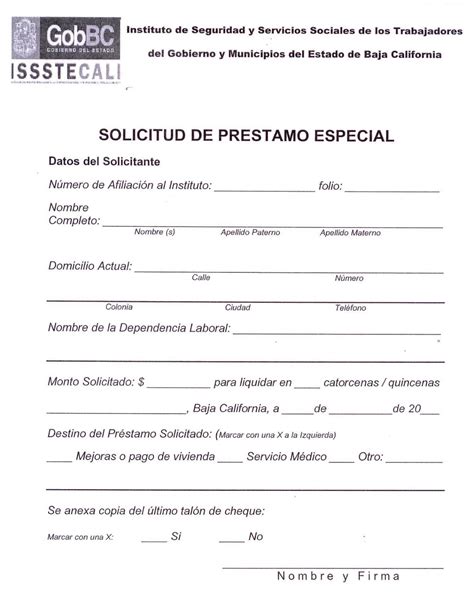

Debemos Llenar Este Formulario Cuando Solicitemos El Préstamo.

Breaking News Today

Mar 27, 2025 · 6 min read

Table of Contents

We Must Fill Out This Form When Applying for a Loan: A Comprehensive Guide

Applying for a loan can feel overwhelming. Navigating the paperwork, understanding the terms, and ensuring you meet all the requirements can be a daunting task. However, one crucial step often overlooked is the meticulous completion of the loan application form. This seemingly simple document is the cornerstone of your loan application, and failing to fill it out accurately and completely can significantly impact your chances of approval. This comprehensive guide will delve into the importance of accurately completing loan application forms, the common types of information requested, and tips for a successful application.

The Crucial Role of the Loan Application Form

The loan application form serves as the primary communication tool between you and the lender. It’s more than just a piece of paper; it’s a detailed snapshot of your financial situation, character, and creditworthiness. Lenders use this information to assess your risk and determine whether you're a suitable candidate for a loan. A poorly completed form can lead to delays, rejections, or even requests for additional information, delaying the process and potentially jeopardizing your chances of securing the loan.

Why Accuracy is Paramount: Inaccurate information can be detrimental. Lenders verify the details provided, and any discrepancies can raise red flags, leading to a rejection of your application. Providing false information is not only unethical but also illegal and can have severe consequences. Accuracy ensures a smooth and efficient application process.

Common Information Requested on Loan Application Forms

Loan application forms vary depending on the lender and the type of loan you are applying for. However, certain common elements are consistently present. These include:

Personal Information:

- Full Legal Name: Ensure the name you provide matches your official identification documents precisely.

- Date of Birth: Accurate date of birth is essential for verification purposes.

- Social Security Number (SSN) or National Identification Number: This is crucial for credit checks and background verification.

- Current Address: Provide your current, verifiable address where you have resided for a significant period. Lenders may require proof of residency.

- Contact Information: Include accurate phone numbers and email addresses for timely communication.

- Employment Information: This often includes your employer's name, address, phone number, your job title, length of employment, and your annual salary. Consistent employment history is a positive factor.

Financial Information:

- Income Details: Detailed income information, including salary, bonuses, and other sources of income, is vital to demonstrate your ability to repay the loan. Tax returns or pay stubs are often requested as supporting documents.

- Expenses: Lenders want to assess your debt-to-income ratio. Listing your monthly expenses, such as rent, utilities, and other debts, helps them gauge your ability to manage loan repayments.

- Assets: Information about your assets, including savings accounts, investments, and property ownership, provides insight into your financial stability.

- Existing Debts: A complete list of your current debts, including credit card balances, personal loans, and mortgages, is necessary. This demonstrates your overall debt burden.

- Credit History: Lenders will often pull your credit report to assess your credit score and payment history. A good credit score significantly increases your chances of approval.

Loan-Specific Information:

- Loan Amount Requested: Clearly state the exact amount you need.

- Loan Purpose: Specify how you intend to use the loan funds. This helps lenders assess the risk associated with the loan.

- Repayment Terms: Indicate your preferred repayment schedule, such as the loan term (duration) and the frequency of payments.

- Collateral (if applicable): If the loan requires collateral (security), provide details about the asset being offered as security.

Tips for Successfully Completing Your Loan Application Form

- Read the instructions carefully: Before you begin, thoroughly read all instructions and guidelines provided with the application form.

- Use a pen with black or blue ink: Avoid using pencils or other colored inks as they can be difficult to read and may not be accepted.

- Print clearly and legibly: Illegible handwriting can lead to delays and confusion.

- Double-check for accuracy: Before submitting the form, review your answers carefully to ensure accuracy. Any errors could delay or even jeopardize your application.

- Gather all necessary supporting documents: Have all required supporting documents readily available to avoid delays in the application process. This usually includes proof of income, address, and identity.

- Be honest and transparent: Providing false information can have serious consequences. Honesty is always the best policy.

- Seek assistance if needed: If you have any questions or difficulties understanding the form, don't hesitate to seek assistance from the lender or a financial advisor.

- Keep a copy for your records: Make a copy of the completed application form for your records. This can be helpful in case of any discrepancies or disputes.

- Follow up: After submitting your application, follow up with the lender to check on the status of your application.

Understanding Different Loan Types and Their Application Processes

The specific information required on a loan application form varies depending on the type of loan you are seeking. Here's a brief overview:

Personal Loans: These unsecured loans typically require information about your income, expenses, debt, and credit history. Lenders assess your creditworthiness based on this information.

Mortgages: Mortgage applications are considerably more extensive, requiring detailed financial information, property information, and employment history. Lenders will conduct a thorough appraisal of the property and verify your income and creditworthiness.

Auto Loans: Auto loan applications require information about your income, employment, credit history, and the vehicle you intend to purchase. Lenders will also assess the value of the vehicle.

Student Loans: Student loan applications require information about your enrollment status, expected graduation date, and your financial need. Co-signers are often required, and their financial information will also be needed.

The Importance of Supporting Documentation

Your loan application form is only one piece of the puzzle. Supporting documentation plays a crucial role in verifying the information you have provided. This documentation ensures the lender has the necessary evidence to support their assessment of your creditworthiness and ability to repay the loan. Commonly requested supporting documents include:

- Proof of income: Pay stubs, tax returns, W-2 forms, or bank statements demonstrating regular income.

- Proof of address: Utility bills, bank statements, or rental agreements showing your current address.

- Proof of identity: Driver's license, passport, or other government-issued identification.

- Bank statements: Statements showing your bank balances and transaction history.

- Tax returns: To verify your income and expenses.

- Employment verification: A letter from your employer confirming your employment status and income.

Conclusion: A Meticulous Approach to Loan Applications

Completing a loan application form accurately and thoroughly is a critical step in securing a loan. It’s a reflection of your financial responsibility and attention to detail. By understanding the information requested, gathering the necessary supporting documentation, and meticulously completing the form, you significantly increase your chances of loan approval. Remember, a well-prepared application demonstrates your commitment and responsibility, showcasing you as a low-risk borrower. Taking the time to complete this process accurately and completely is an investment in your financial future. Avoid shortcuts; thoroughness is key to a successful loan application.

Latest Posts

Latest Posts

-

When Is The Best Time To Check For Identification

Mar 30, 2025

-

The Things They Carried Summary By Chapter

Mar 30, 2025

-

Explain Why Water Is A Polar Molecule

Mar 30, 2025

-

Post World War I Recovery Crash Course European History

Mar 30, 2025

-

Where Can A Food Worker Wash Her Hands

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about Debemos Llenar Este Formulario Cuando Solicitemos El Préstamo. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.