Describe The Order In Which A Company Prepares Financial Statements

Breaking News Today

Mar 20, 2025 · 6 min read

Table of Contents

The Order of Preparing Financial Statements: A Comprehensive Guide

Preparing financial statements is a crucial process for any company, large or small. These statements provide a snapshot of a company's financial health, allowing stakeholders like investors, creditors, and management to make informed decisions. Understanding the order in which these statements are prepared is key to ensuring accuracy and efficiency. While the presentation order is standardized, the preparation order often follows a different sequence, dictated by the inherent dependencies between them. This article will delve into the precise order a company typically follows when preparing its financial statements and explain the reasoning behind this sequence.

The Importance of Order in Financial Statement Preparation

The order of preparing financial statements is not arbitrary. It's a carefully structured process designed to ensure accuracy and consistency. Each statement relies on information derived from previous ones, creating a chain of dependencies. Jumping ahead without completing the foundational statements can lead to errors and inconsistencies that can significantly impact the reliability of the entire set. Imagine trying to bake a cake without first mixing the batter – the result would be disastrous. Similarly, preparing financial statements out of order can lead to a flawed financial picture.

The Standard Order of Presentation: A Quick Overview

Before diving into the preparation order, let's quickly review the standard order in which financial statements are presented:

-

Income Statement: This statement summarizes a company's revenues and expenses over a specific period (e.g., a quarter or a year) to determine its net income or net loss.

-

Statement of Retained Earnings (or Statement of Changes in Equity): This statement shows the changes in a company's retained earnings over a specific period. It begins with the beginning balance of retained earnings, adds net income (or subtracts net loss), subtracts dividends paid, and arrives at the ending balance of retained earnings. For companies with more complex equity structures, a Statement of Changes in Equity is used, encompassing all equity accounts.

-

Balance Sheet: This statement provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It reflects the accounting equation: Assets = Liabilities + Equity.

-

Statement of Cash Flows: This statement summarizes the cash inflows and outflows of a company over a specific period, categorized into operating, investing, and financing activities. It shows how a company generates and uses its cash.

-

Notes to the Financial Statements: These notes provide detailed explanations and disclosures that supplement the main financial statements. They offer context and clarify any complexities or ambiguities.

The Actual Order of Preparation: A Step-by-Step Guide

While the presentation order is standardized, the preparation order is often different and more logical for accounting purposes. Here's the typical sequence:

1. Income Statement Preparation: Laying the Foundation

The journey begins with preparing the Income Statement. This is because the Income Statement provides crucial information needed for subsequent statements. Specifically, the net income calculated on the Income Statement is a key input for the Statement of Retained Earnings.

-

Detailed Revenue Recognition: Accurately recognizing revenue is paramount. This involves applying relevant accounting standards (like IFRS 15 or ASC 606) to ensure that revenue is recorded when it's earned, not necessarily when cash is received. This detailed process often involves analyzing various contracts, sales transactions, and performance obligations.

-

Expense Matching: Expenses are carefully matched to the revenues they helped generate. This principle of accrual accounting ensures that a fair representation of profitability is presented. This involves identifying and classifying various expenses, including cost of goods sold, operating expenses, interest expenses, and taxes.

-

Calculating Net Income (or Loss): Once all revenues and expenses are accounted for, the net income (or net loss) is calculated. This crucial figure is then carried forward to the next statement.

2. Statement of Retained Earnings (or Statement of Changes in Equity): Building on the Income Statement

With the net income from the Income Statement in hand, the Statement of Retained Earnings (or Statement of Changes in Equity) is next. This statement relies directly on the net income figure to determine the ending balance of retained earnings.

-

Beginning Retained Earnings: The process starts by identifying the beginning balance of retained earnings from the previous period's financial statements.

-

Adding Net Income (or Subtracting Net Loss): The net income (or net loss) calculated on the Income Statement is added to (or subtracted from) the beginning balance.

-

Subtracting Dividends: Dividends paid to shareholders during the period are subtracted from the balance.

-

Calculating Ending Retained Earnings: The final step calculates the ending balance of retained earnings, which becomes a crucial component of the Balance Sheet.

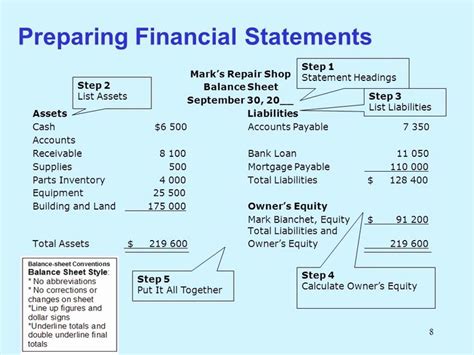

3. Balance Sheet Preparation: The Core Financial Position

The Balance Sheet is typically prepared next, utilizing information gathered during the preparation of both the Income Statement and Statement of Retained Earnings. It provides a snapshot of the company's financial health at a specific point in time.

-

Assets: Assets are listed in order of liquidity, reflecting their ease of conversion to cash. This involves verifying and updating asset balances, considering depreciation and amortization for fixed assets.

-

Liabilities: Liabilities are categorized and listed based on their maturity dates. This includes short-term liabilities (like accounts payable) and long-term liabilities (like bonds payable).

-

Equity: The equity section includes the ending balance of retained earnings (from the Statement of Retained Earnings) and other equity accounts, such as common stock and additional paid-in capital. The Balance Sheet ensures the accounting equation (Assets = Liabilities + Equity) is balanced.

4. Statement of Cash Flows: Tracking Cash Movements

The Statement of Cash Flows is prepared after the Balance Sheet. While not directly dependent on the Balance Sheet for its core calculations, the Statement of Cash Flows heavily relies on information gathered while preparing the other statements. Understanding the changes in various accounts (e.g., accounts receivable, accounts payable, inventory) is critical for properly classifying cash flows.

-

Operating Activities: These activities focus on cash flows related to the company's day-to-day operations, such as cash collected from customers and cash paid to suppliers.

-

Investing Activities: These activities involve cash flows related to investments, such as purchasing property, plant, and equipment (PP&E) or acquiring other businesses.

-

Financing Activities: These activities involve cash flows related to financing the business, such as issuing debt, repaying debt, and issuing or repurchasing equity.

-

Reconciliation: The statement is reconciled to ensure the change in cash balance aligns with the beginning and ending cash balances shown on the Balance Sheet.

5. Notes to the Financial Statements: Providing Context and Detail

Finally, the Notes to the Financial Statements are prepared. These notes provide crucial context and explanations for the figures presented in the main financial statements. They are integral to a complete understanding of the company's financial performance and position.

-

Accounting Policies: The notes disclose the accounting methods used by the company, such as inventory valuation methods, depreciation methods, and revenue recognition policies.

-

Significant Disclosures: They provide detailed information on significant transactions, events, and uncertainties, such as lawsuits, contingent liabilities, and significant changes in accounting estimates.

-

Segment Reporting: For larger companies, segment reporting is often included in the notes, providing information about the performance of different operating segments within the company.

Conclusion: A Harmonious Financial Picture

The preparation of financial statements is a systematic process, with a logical flow designed to ensure accuracy and reliability. Understanding the order in which these statements are typically prepared – Income Statement, Statement of Retained Earnings/Changes in Equity, Balance Sheet, Statement of Cash Flows, and finally, the Notes – is essential for both preparers and users of financial statements. Following this order minimizes errors and provides a clear, consistent, and comprehensive picture of a company's financial health. This meticulous approach is crucial for informed decision-making by all stakeholders involved.

Latest Posts

Latest Posts

-

The Purpose Of The Vfc Site Visit Is To

Mar 20, 2025

-

Which Is The Central Focus Of Persecutory Delusions

Mar 20, 2025

-

What Is Included In All Vascular Injection Procedures

Mar 20, 2025

-

Select The Best Definition For Finger Angle

Mar 20, 2025

-

A Numerical Outcome Of A Probability Experiment Is Called

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about Describe The Order In Which A Company Prepares Financial Statements . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.