Franchising Is Typically Done By Cooperatives. Partnerships. Llc Corporations.

Breaking News Today

Mar 14, 2025 · 6 min read

Table of Contents

Franchising: A Deep Dive into Cooperative, Partnership, and LLC Structures

Franchising, a powerful business model allowing expansion through licensing, thrives under various legal structures. While sole proprietorships can engage in franchising, the complexities and risks often necessitate more robust structures like cooperatives, partnerships, and LLCs. This article delves into the nuances of each, comparing their suitability for franchisors, highlighting advantages and disadvantages, and offering considerations for choosing the right fit.

Franchising and its Legal Structures: An Overview

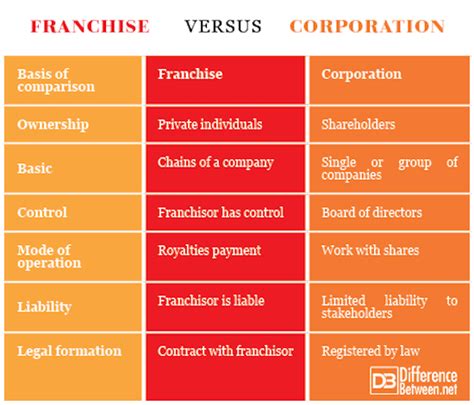

Franchising involves a franchisor granting a franchisee the right to operate a business under its established brand, system, and trademarks. This arrangement offers franchisors rapid expansion with reduced financial risk, while franchisees benefit from established brand recognition and operational support. The legal structure of the franchisor significantly impacts this relationship, influencing liability, taxation, management, and overall operational efficiency. Let's examine three prominent structures: cooperatives, partnerships, and LLCs.

1. Franchising by Cooperatives

Cooperatives, characterized by member ownership and democratic control, offer a unique framework for franchising. While less common than other structures, cooperative franchising presents distinct advantages and disadvantages.

Advantages of Cooperative Franchising:

- Shared Resources and Expertise: Cooperatives pool resources and knowledge, providing franchisees with access to collective bargaining power, shared marketing campaigns, and specialized expertise in areas like procurement and training. This collaborative environment fosters mutual support and strengthens the overall franchise network.

- Democratic Governance: Decision-making is democratic, giving franchisees a voice in the direction of the cooperative and the franchise system. This participatory approach can foster loyalty, commitment, and a stronger sense of ownership among franchisees.

- Focus on Social and Economic Goals: Many cooperatives prioritize social responsibility and economic sustainability alongside profit generation. This can attract franchisees aligned with these values, contributing to a strong brand image and reputation.

- Potential Tax Advantages: Certain cooperative structures may enjoy tax benefits compared to traditional corporations, leading to potentially higher profits that can be distributed to members (franchisees).

Disadvantages of Cooperative Franchising:

- Complex Governance: The democratic nature can slow down decision-making processes, hindering agility and responsiveness to market changes. Consensus-building can be time-consuming and challenging.

- Limited Capital: Raising capital can be more challenging for cooperatives compared to corporations, limiting expansion potential. Securing external funding may require demonstrating a strong track record and robust financial model.

- Internal Conflicts: Differing opinions and priorities among members can lead to internal conflicts and disagreements, potentially affecting operational efficiency and franchisee satisfaction.

- Lack of Flexibility: The collaborative structure can make it difficult to adapt quickly to changing market dynamics or implement necessary changes to the franchise model.

2. Franchising by Partnerships

Partnerships, involving two or more individuals sharing ownership and liability, provide another avenue for franchising. Different types of partnerships exist, each impacting liability and management.

Advantages of Partnership Franchising:

- Shared Resources and Expertise: Similar to cooperatives, partnerships combine the resources and skills of multiple partners, improving financial stability and expanding operational capabilities. This synergy strengthens the franchise system.

- Simplified Structure: Compared to corporations, partnerships typically involve simpler setup and administrative procedures, reducing costs and complexity.

- Flexibility: Partnerships usually offer greater flexibility in management and decision-making compared to more formal corporate structures.

- Tax Advantages (in some cases): Depending on the type of partnership, tax benefits might exist, passing profits directly to partners without corporate-level taxation. However, the partners are taxed on their individual shares of the partnership's income.

Disadvantages of Partnership Franchising:

- Unlimited Liability (in general partnerships): General partners typically face unlimited liability, meaning personal assets are at risk to cover business debts. This risk can be significant, limiting the attractiveness of the structure for many. Limited partnerships offer some protection to limited partners, but general partners still bear the burden.

- Disputes among Partners: Conflicts between partners are common, potentially leading to operational disruptions and legal battles. Clear agreements and strong communication are crucial for success.

- Limited Capital: Raising capital can be challenging, potentially hindering expansion efforts.

- Lack of Continuity: The partnership can dissolve upon the death or withdrawal of a partner, creating uncertainty for the franchise system.

3. Franchising by LLCs (Limited Liability Companies)

LLCs, combining the benefits of partnerships and corporations, offer a popular and flexible structure for franchising.

Advantages of LLC Franchising:

- Limited Liability: Members enjoy limited liability, protecting personal assets from business debts. This shielding from risk makes LLCs attractive for franchisors.

- Flexible Management: LLCs offer flexibility in management structure, allowing members to manage operations directly or appoint managers.

- Tax Flexibility: LLCs typically offer pass-through taxation, avoiding double taxation, but some can elect to be taxed as corporations. This flexibility caters to various tax strategies.

- Easier Setup and Administration: Compared to corporations, LLCs generally have simpler formation and administrative requirements.

- Attractive to Investors: The combination of limited liability and pass-through taxation makes LLCs more attractive to potential investors.

Disadvantages of LLC Franchising:

- State-Specific Regulations: LLC regulations vary significantly by state, requiring careful consideration of specific rules and requirements.

- Potential for Complexity: While simpler than corporations, LLCs can become complex, particularly with multiple members or significant growth.

- Limited Life: In some jurisdictions, an LLC might have a limited lifespan, requiring renewal or conversion to ensure continuity.

- Self-Employment Taxes: Members often face self-employment taxes, impacting their overall income.

Choosing the Right Structure: Key Considerations

The choice of legal structure for a franchisor depends on several key factors:

- Liability Protection: The level of personal liability protection desired significantly influences the choice. LLCs generally provide the strongest protection.

- Tax Implications: The impact of taxation on the business's profitability is crucial. Consider the tax implications of each structure and potential long-term financial benefits.

- Management Structure: Consider the desired level of control and involvement in day-to-day management. Partnerships and LLCs offer greater flexibility.

- Fundraising Capacity: The ability to attract investment and raise capital plays a crucial role in expansion plans. Corporations generally have an easier time securing larger investments.

- Long-Term Goals: Consider the franchisor's long-term goals, growth strategies, and potential succession planning.

Conclusion: Navigating the Franchise Landscape

Cooperatives, partnerships, and LLCs each present unique advantages and disadvantages for franchisors. The optimal choice hinges on a thorough assessment of the franchisor's specific needs, risk tolerance, long-term vision, and legal landscape. Consulting with legal and financial professionals is crucial to make an informed decision aligned with the franchisor's objectives and ensuring the long-term success and stability of the franchise network. Careful planning and a clear understanding of the legal implications are crucial for successful franchise development and management. Remember to carefully review and understand the legal requirements and regulations specific to your jurisdiction, as these can significantly affect your choice of legal structure. Thorough due diligence and expert guidance will help navigate the complexities of franchising and selecting the most suitable legal structure for your enterprise.

Latest Posts

Latest Posts

-

A Networking Standard For Very Short Range Wireless Connections

Mar 14, 2025

-

A Debit Balance In Manufacturing Overhead Means Overhead Was

Mar 14, 2025

-

La Madre De Mi Madre Es Mi

Mar 14, 2025

-

Describe The Kind Of Family Your Author Came From

Mar 14, 2025

-

Industrialists During The 1920s Were Worried About

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about Franchising Is Typically Done By Cooperatives. Partnerships. Llc Corporations. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.