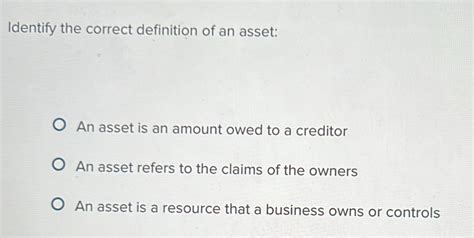

Identify The Correct Definition Of An Asset

Breaking News Today

Mar 24, 2025 · 5 min read

Table of Contents

Identifying the Correct Definition of an Asset: A Comprehensive Guide

Understanding the precise definition of an asset is fundamental to accounting, finance, and business management. While the concept seems straightforward, nuances exist that can significantly impact financial reporting and decision-making. This comprehensive guide will delve into the various facets of asset definition, exploring different perspectives and addressing common misconceptions. We'll explore the key characteristics that define an asset, examine different types of assets, and highlight the importance of accurate asset identification.

What is an Asset? A Multifaceted Definition

At its core, an asset is a resource controlled by an entity as a result of past events and from which future economic benefits are expected to flow to the entity. This seemingly simple definition encapsulates several critical elements:

-

Resource: An asset must be something of value, tangible or intangible, that the entity possesses or controls. This could range from physical property like land and buildings to intellectual property like patents and copyrights.

-

Control: The entity must have the power to obtain the future economic benefits from the asset. This control doesn't necessarily mean outright ownership; it could be through lease agreements or other forms of control.

-

Past Events: The asset must have arisen from a past transaction or event. This excludes future expectations or potential benefits that haven't yet materialized.

-

Future Economic Benefits: The primary reason for classifying something as an asset is the expectation of future economic benefits. These benefits could be monetary (like cash inflows) or non-monetary (like increased efficiency or improved brand reputation).

Delving Deeper: Key Characteristics of Assets

Several key characteristics further refine the understanding of what constitutes an asset:

1. Measurability:

An asset must be measurable in monetary terms. This allows for accurate financial reporting and valuation. While some assets, like intangible assets, can be challenging to value precisely, there must be a reasonable basis for assigning a monetary value.

2. Identifiability:

The asset must be identifiable, meaning it can be distinguished from other assets and liabilities. This can be easily achieved for tangible assets but might require more sophisticated methods for intangible assets.

3. Ownership or Control:

While outright ownership is common, it's crucial to note that control is the primary criterion. The entity must have the power to direct the use of the asset and obtain the resulting economic benefits. Lease agreements, for instance, grant control without transferring ownership.

4. Expected Future Benefits:

The potential for future economic benefits is paramount. If an asset is not expected to generate future benefits, it's unlikely to be classified as an asset. The expectation of future benefits should be realistic and based on reasonable assumptions.

Categorizing Assets: A Taxonomy of Resources

Assets are broadly categorized into different types, each with its own characteristics and accounting treatments:

1. Current Assets:

These are assets expected to be converted into cash or used up within one year or the operating cycle, whichever is longer. Examples include:

- Cash and Cash Equivalents: Readily available cash and highly liquid short-term investments.

- Accounts Receivable: Money owed to the entity by customers for goods or services sold on credit.

- Inventories: Goods held for sale in the ordinary course of business.

- Prepaid Expenses: Expenses paid in advance, such as insurance premiums or rent.

2. Non-Current Assets (Long-Term Assets):

These are assets not expected to be converted into cash or used up within one year or the operating cycle. They are further sub-categorized into:

-

Property, Plant, and Equipment (PP&E): Tangible assets used in the production or supply of goods or services. Examples include land, buildings, machinery, and vehicles. These assets are typically depreciated over their useful lives.

-

Intangible Assets: Non-physical assets with economic value. Examples include patents, copyrights, trademarks, and goodwill. These assets are often amortized over their useful lives.

-

Investments: Assets held for investment purposes, such as stocks, bonds, and other securities. These assets are typically valued at fair market value.

-

Other Non-Current Assets: This category encompasses assets that don't neatly fit into the other categories, such as long-term receivables or deferred tax assets.

Misconceptions and Common Errors in Asset Identification

Several misconceptions can lead to inaccurate asset identification and flawed financial reporting:

-

Confusing Expenses with Assets: Expenses are costs incurred in generating revenue, while assets are resources expected to provide future benefits. Failing to distinguish between these two can lead to overstated profits and understated expenses.

-

Ignoring Intangible Assets: The value of intangible assets, like brand recognition or intellectual property, is often underestimated. Accurate identification and valuation of these assets are crucial for a complete financial picture.

-

Improper Valuation: Assigning inaccurate values to assets, especially intangible assets, can distort financial statements and mislead stakeholders. Proper valuation methods, considering factors such as market conditions and future projections, are essential.

-

Lack of Proper Documentation: Insufficient documentation regarding asset acquisition, usage, and disposal can lead to confusion and inaccuracies in financial records. Detailed records are necessary for proper asset management and compliance.

The Importance of Accurate Asset Identification

Accurate asset identification is crucial for several reasons:

-

Reliable Financial Reporting: Accurate asset identification is the foundation of reliable financial statements. Misidentifying or misvaluing assets can lead to misleading information for investors, creditors, and other stakeholders.

-

Effective Decision-Making: Accurate asset information empowers businesses to make informed decisions regarding investment, financing, and resource allocation. Knowing the true value and potential of assets is vital for strategic planning.

-

Tax Compliance: Accurate asset identification is crucial for calculating taxes accurately. Misclassifying assets can lead to penalties and legal repercussions.

-

Improved Asset Management: Properly identifying and categorizing assets allows for better tracking, monitoring, and management of the entity's resources. This can lead to increased efficiency and reduced costs.

Conclusion: A Foundation for Sound Financial Practices

The accurate definition and identification of assets are cornerstones of sound financial practices. By understanding the key characteristics, different categories, and potential pitfalls, businesses can ensure the integrity of their financial reporting, facilitate informed decision-making, and maintain compliance with accounting standards. Continuous review and improvement of asset identification processes are essential for long-term financial health and success. The detailed exploration provided in this guide offers a robust foundation for achieving this goal. Remember, the value of an asset lies not only in its present worth but also in its potential to generate future economic benefits. Understanding this dynamic relationship is key to maximizing the return on investment and ensuring sustainable growth. Careful consideration of all aspects of asset definition will safeguard the financial integrity and long-term prosperity of any entity.

Latest Posts

Latest Posts

-

You May Have Found Your Purpose If

Mar 26, 2025

-

Insert A Built In Bibliography Without A Preformatted Heading

Mar 26, 2025

-

A Three Phase Induction Motor May Have

Mar 26, 2025

-

The Crucible Act 3 Questions And Answers Pdf

Mar 26, 2025

-

Which Is Considered A Good Conductor Milady

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about Identify The Correct Definition Of An Asset . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.