In Pure Competition Producers Compete Exclusively On The Basis Of

Breaking News Today

Mar 19, 2025 · 7 min read

Table of Contents

In Pure Competition, Producers Compete Exclusively on the Basis of Price

Pure competition, also known as perfect competition, is a theoretical market structure characterized by a large number of buyers and sellers, homogeneous products, free entry and exit, and perfect information. In this idealized model, producers compete exclusively on the basis of price. While this sounds simplistic, understanding the dynamics of pure competition reveals crucial insights into how markets function, even if perfectly competitive markets are rare in the real world. This article delves deep into the price-centric competition within pure competition, examining its implications for producers, consumers, and the overall market efficiency.

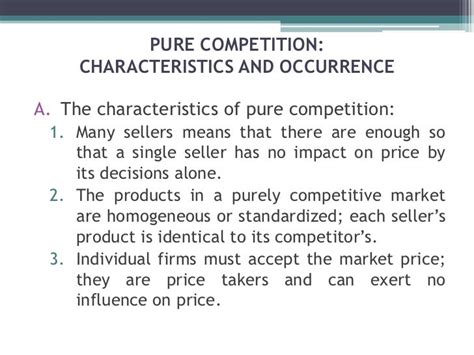

The Defining Characteristics of Pure Competition

Before diving into the price competition, let's solidify the defining characteristics that create this unique market environment:

-

Large Number of Buyers and Sellers: No single buyer or seller can significantly influence the market price. Each participant is a "price taker," meaning they must accept the prevailing market price. This contrasts with monopolies or oligopolies where individual firms have market power.

-

Homogeneous Products: The products offered by different producers are essentially identical. Consumers see no meaningful difference between the products offered by various firms, focusing solely on price. Think of agricultural commodities like wheat or corn – one bushel is largely indistinguishable from another.

-

Free Entry and Exit: Firms can easily enter or exit the market without facing significant barriers. This ensures that profits attract new entrants, increasing competition and driving prices down, while losses encourage firms to leave, reducing supply and potentially raising prices.

-

Perfect Information: Buyers and sellers have complete and equal access to all relevant information, including prices, product quality, and production costs. This eliminates informational asymmetries that could distort competition.

-

No Non-Price Competition: This is the core of our discussion. In pure competition, firms cannot differentiate their products through advertising, branding, or other non-price strategies. Competition is solely focused on offering the lowest possible price.

Price as the Sole Competitive Weapon

Given these characteristics, price becomes the only variable firms can control to attract consumers. They can't improve product quality (it's already homogeneous), offer better customer service (it's standardized), or use clever marketing (it's ineffective in a market with perfect information). This forces producers into a relentless pursuit of cost efficiency to maintain profitability at the prevailing market price.

The Importance of Cost Efficiency

In a purely competitive market, a firm's survival hinges on its ability to minimize its average total cost (ATC). This involves optimizing inputs, employing efficient production techniques, and securing favorable deals with suppliers. Firms that can achieve lower average costs than their competitors will earn greater profits, even if they charge the same price.

The Role of Supply and Demand

The market price in pure competition is determined by the interaction of market supply and market demand. The market supply curve represents the total quantity of the good supplied by all firms at various price levels, while the market demand curve reflects the total quantity demanded by all consumers at different prices. The equilibrium price is where these two curves intersect – the point where the quantity supplied equals the quantity demanded. Individual firms have no influence on this equilibrium price; they simply accept it.

Profit Maximization in Pure Competition

Individual firms in pure competition aim to maximize their profits. However, their ability to influence price is limited. To understand their profit-maximizing behavior, we need to consider marginal cost (MC) and marginal revenue (MR).

-

Marginal Cost (MC): The additional cost of producing one more unit of output.

-

Marginal Revenue (MR): The additional revenue from selling one more unit of output. In pure competition, the marginal revenue is equal to the market price (MR = P) because firms are price takers.

A firm maximizes its profit by producing the quantity where MC = MR = P. If MC < MR, the firm can increase its profit by producing more. If MC > MR, the firm can increase its profit by producing less. This point represents the optimal output level for the firm.

Short-Run and Long-Run Equilibrium

The equilibrium in a purely competitive market differs in the short run and the long run due to the free entry and exit condition.

Short-Run Equilibrium

In the short run, some firms might earn economic profits (profits above normal profits), while others may incur losses. This depends on the firm's efficiency relative to the market price. Firms with lower average total costs than the market price will earn positive economic profits, whereas those with higher average total costs will experience economic losses. However, all firms will continue to produce as long as their price exceeds their average variable cost (AVC).

Long-Run Equilibrium

In the long run, economic profits attract new firms into the market, increasing the market supply and driving down the price. This process continues until economic profits are eliminated – the point where the price equals the minimum average total cost (ATC). Conversely, economic losses lead to firms exiting the market, decreasing supply and eventually increasing the price until losses are eliminated and normal profits are restored. The long-run equilibrium in pure competition is characterized by:

-

Zero economic profits: Firms earn only normal profits (the minimum return necessary to keep them in business).

-

Price equals minimum ATC: The market price reflects the lowest possible cost of production.

-

Allocative efficiency: Resources are allocated optimally, producing the quantity of goods and services that society desires at the lowest possible cost.

The Significance of Pure Competition

Despite its rarity in the real world, the model of pure competition serves as a valuable benchmark for understanding market behavior. It highlights the efficiency gains that can arise from intense price competition, illustrating a situation where:

-

Consumers benefit: They receive goods and services at the lowest possible price.

-

Resources are efficiently allocated: Production occurs at the lowest possible cost, maximizing societal welfare.

-

Innovation is potentially stimulated: While not directly incentivized by price competition alone, firms under pressure might innovate to reduce their costs further.

Limitations of the Pure Competition Model

It's crucial to acknowledge the limitations of the pure competition model:

-

Homogeneous products are rare: Most real-world markets involve products with some degree of differentiation.

-

Perfect information is unrealistic: Buyers and sellers rarely have access to all relevant information.

-

Free entry and exit are often restricted: Government regulations, high capital costs, or other barriers can impede entry or exit.

-

Non-price competition is common: Firms often differentiate themselves through branding, advertising, or customer service.

Real-World Examples (Approximations)

While perfectly competitive markets are theoretical, some markets exhibit characteristics that approximate pure competition:

-

Agricultural markets: Certain agricultural commodities, like wheat or corn, come close to fulfilling the conditions of pure competition due to the large number of producers and the homogeneity of the product.

-

Online marketplaces for standardized products: Certain online platforms facilitate the trade of standardized goods, approaching pure competition in terms of information availability and low barriers to entry for sellers.

However, even in these examples, significant deviations from pure competition exist. For instance, brand recognition, geographical factors, and information asymmetries can influence market dynamics.

Conclusion

Pure competition, while a theoretical ideal, provides a valuable framework for understanding the role of price in market competition. The model highlights the efficiency gains associated with intense price competition, but it’s equally important to recognize its limitations in capturing the complexity of real-world markets. By understanding pure competition, we can gain insights into market behavior and appreciate the ways in which actual markets deviate from this idealized scenario, revealing the intricate interplay of price and non-price factors that shape market outcomes. Real-world markets are far more nuanced, but the foundation laid by the concept of pure competition remains essential to understanding the economic forces that drive production and consumption.

Latest Posts

Latest Posts

-

What Is The Central Idea Of This Excerpt

Mar 19, 2025

-

Colorless Liquid Hydrocarbon Of The Alkane Series

Mar 19, 2025

-

What Types Of Mollusks Have A Closed Circulatory System

Mar 19, 2025

-

Why Are Deserts Often Found Near Mountain Ranges

Mar 19, 2025

-

List Four Common Characteristics Of All Animals

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about In Pure Competition Producers Compete Exclusively On The Basis Of . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.