Information For Each Transaction Recorded In A Journal

Breaking News Today

Mar 23, 2025 · 7 min read

Table of Contents

The Comprehensive Guide to Journal Entry Information: A Deep Dive into Transaction Recording

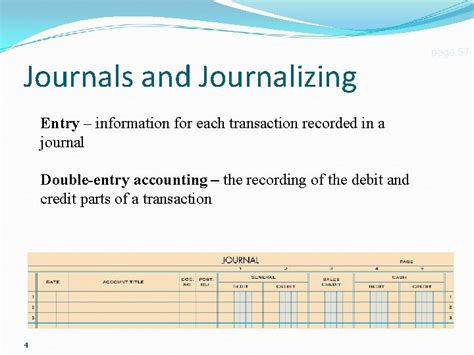

Understanding the intricacies of journal entries is crucial for anyone involved in accounting or finance. A journal, the foundational record in the accounting cycle, meticulously documents every financial transaction a business undertakes. This guide delves deep into the essential information required for each journal entry, explaining its significance and providing practical examples. Mastering this knowledge is vital for maintaining accurate financial records, generating reliable financial statements, and ultimately, ensuring the financial health of any organization.

The Core Components of a Journal Entry

A complete journal entry consists of several key components, each serving a critical role in providing a comprehensive picture of the transaction. These include:

1. Date: The Chronological Marker

The date of the transaction is the first and most fundamental piece of information. This ensures chronological order, crucial for tracing financial activities and preparing accurate financial reports. The date should be clearly and unambiguously stated in the format consistent with your organization's accounting standards (e.g., MM/DD/YYYY, DD/MM/YYYY). Inconsistent dating can lead to significant errors in the financial record.

2. Account Titles: Identifying the Accounts Affected

This section identifies the specific accounts impacted by the transaction. This is arguably the most critical element, demanding precision and a thorough understanding of the chart of accounts. Each transaction involves at least two accounts—a debit and a credit—following the fundamental accounting equation (Assets = Liabilities + Equity). Choosing the incorrect account can significantly distort financial statements.

Understanding Debit and Credit:

- Debit: Increases the balance of asset, expense, and dividend accounts; decreases the balance of liability, owner's equity, and revenue accounts.

- Credit: Increases the balance of liability, owner's equity, and revenue accounts; decreases the balance of asset, expense, and dividend accounts.

This seemingly simple concept is the cornerstone of double-entry bookkeeping. Each transaction must always balance, with total debits equaling total credits.

3. Debit and Credit Columns: Quantifying the Transaction's Impact

These columns quantify the monetary value of the debit and credit entries. Accurate recording of amounts is paramount; any discrepancies here lead to inaccurate financial reporting and potential legal issues. The numbers entered here directly impact the balance sheet, income statement, and cash flow statement. Using clear and consistent formatting ensures readability and minimizes errors.

4. Description/Narrative: Contextualizing the Transaction

A brief, yet descriptive narrative accompanies each entry to explain the transaction's nature. This provides crucial context for understanding the financial activity. The narrative should succinctly describe the transaction, including relevant parties and any essential details. This information assists in auditing, reconciliation, and future reference. A clear and concise description saves time and potential misunderstandings in the future.

5. Reference Number (Optional but Recommended): Streamlining Tracking

A reference number can be added to connect the journal entry to supporting documents, such as invoices, receipts, or bank statements. This cross-referencing enhances accuracy and simplifies audits. This number acts as a bridge, providing a clear trail from the journal entry to its source documentation, facilitating easier investigation and verification of transactions.

Detailed Examples of Journal Entries with Explanations

Let's examine several detailed examples illustrating the importance of including all necessary information in each journal entry.

Example 1: Purchase of Office Supplies with Cash

| Date | Account Titles | Debit | Credit | Description | Reference No. |

|---|---|---|---|---|---|

| 2024-03-15 | Office Supplies | $50 | Purchase of office supplies | 1234 | |

| Cash | $50 |

This entry records the purchase of office supplies. The debit increases the Office Supplies asset account, while the credit decreases the Cash asset account.

Example 2: Sale of Goods on Credit

| Date | Account Titles | Debit | Credit | Description | Reference No. |

|---|---|---|---|---|---|

| 2024-03-18 | Accounts Receivable | $1000 | Sale of goods on credit to ABC Company | 5678 | |

| Sales Revenue | $1000 |

This entry records a credit sale. Accounts Receivable increases (debit) reflecting the money owed by ABC Company, while Sales Revenue increases (credit), recording the sale.

Example 3: Payment of Salaries

| Date | Account Titles | Debit | Credit | Description | Reference No. |

|---|---|---|---|---|---|

| 2024-03-22 | Salaries Expense | $2000 | Payment of employee salaries | 9101 | |

| Cash | $2000 |

This entry shows the payment of employee salaries. Salaries Expense increases (debit), reflecting the expense incurred, while Cash decreases (credit) representing the outgoing payment.

Example 4: Receiving a Loan

| Date | Account Titles | Debit | Credit | Description | Reference No. |

|---|---|---|---|---|---|

| 2024-03-25 | Cash | $5000 | Loan received from First National Bank | 1112 | |

| Loans Payable | $5000 |

This shows receiving a loan. Cash increases (debit), and Loans Payable increases (credit) acknowledging the loan liability.

Example 5: Depreciation Expense

| Date | Account Titles | Debit | Credit | Description | Reference No. |

|---|---|---|---|---|---|

| 2024-03-31 | Depreciation Expense | $100 | Depreciation of office equipment | 1314 | |

| Accumulated Depreciation - Equipment | $100 |

This reflects depreciation, a non-cash expense. Depreciation Expense increases (debit), and Accumulated Depreciation, a contra-asset account, increases (credit), reducing the net book value of the equipment.

The Importance of Accurate Journal Entries

The accuracy of your financial records directly stems from the meticulous recording of each journal entry. Inaccuracies can have far-reaching consequences, including:

- Misleading Financial Statements: Incorrect journal entries lead to inaccurate financial statements, presenting a distorted view of the company's financial health. This can negatively impact decisions related to investment, lending, and expansion.

- Auditing Challenges: Auditors scrutinize journal entries to ensure compliance with accounting standards. Inconsistent or inaccurate entries complicate the audit process and potentially raise red flags.

- Tax Implications: Errors in journal entries can result in incorrect tax filings, leading to potential penalties and legal ramifications.

- Internal Control Issues: Poorly maintained journal entries can highlight weaknesses in the company's internal control system, exposing it to fraud and other financial risks.

- Difficulty in Decision Making: Unreliable financial data hinders effective decision-making. Inaccurate journal entries directly impact financial analysis and forecasting.

Best Practices for Maintaining Accurate Journal Entries

Several best practices ensure accuracy and efficiency in journal entry recording:

- Use a Standardized Chart of Accounts: Establish a consistent and comprehensive chart of accounts for proper categorization of transactions.

- Document All Transactions: Maintain supporting documentation for every transaction to facilitate easy reconciliation and audit trails.

- Implement Internal Controls: Develop robust internal control mechanisms to prevent errors and ensure accuracy. This could include segregation of duties and regular reconciliation procedures.

- Regular Review and Reconciliation: Regularly review journal entries and reconcile them with bank statements and other supporting documents to identify and correct errors promptly.

- Utilize Accounting Software: Employ accounting software to automate the recording process and minimize manual errors.

- Stay Updated on Accounting Standards: Keep abreast of changes in Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) to ensure compliance.

Conclusion: The Foundation of Sound Financial Management

The detailed and accurate recording of information in each journal entry is not just a procedural step; it's the bedrock of sound financial management. By meticulously following the principles outlined in this guide, businesses can ensure the reliability of their financial records, fostering informed decision-making and promoting overall financial health. The comprehensive recording of every transaction, with attention to detail and adherence to accounting best practices, is the key to unlocking valuable insights from financial data and ensuring long-term financial success. The effort invested in accurate journal entries translates directly into stronger financial control and more effective management of resources.

Latest Posts

Latest Posts

-

Medical Ethics And Detainee Operations Basic Course Quizlet

Mar 24, 2025

-

The Most Common Cause Of Mechanical Bowel Obstruction Is Quizlet

Mar 24, 2025

-

Both State And Federal Government Have The Power To Quizlet

Mar 24, 2025

-

Lack Of A Antitrypsin In Emphysema Causes Quizlet

Mar 24, 2025

-

Rbt Practice Exam 75 Questions Free Quizlet

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about Information For Each Transaction Recorded In A Journal . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.