Level Premium Permanent Insurance Accumulates A Reserve That Will Eventually

Breaking News Today

Mar 30, 2025 · 5 min read

Table of Contents

Level Premium Permanent Insurance: Understanding the Accumulating Cash Value

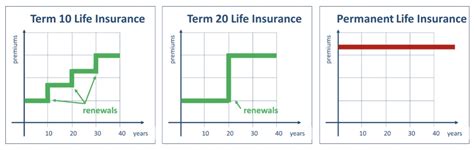

Level premium permanent life insurance offers a unique blend of lifelong coverage and a steadily growing cash value component. Unlike term life insurance, which provides coverage for a specified period, permanent insurance remains in force as long as premiums are paid, offering financial security for your entire life. A key feature of permanent life insurance, especially level premium policies, is the accumulation of a cash value reserve. This article will delve deep into how this reserve builds, its potential benefits, and factors that influence its growth.

How Level Premium Permanent Insurance Accumulates Cash Value

Level premium permanent insurance policies, such as whole life or universal life insurance, function on a simple yet powerful principle: premium payments exceed the cost of insurance in the early years. This surplus is invested, growing tax-deferred within the policy's cash value account.

The Power of Compound Interest

The growth of the cash value isn't just about adding the surplus each year. It’s significantly enhanced by the power of compound interest. This means that the interest earned each year is added to the principal, and subsequent interest is calculated on the larger amount. Over time, this compounding effect can substantially increase the cash value.

Mortality Charges and Expense Charges

It’s crucial to understand that not all of your premium payment contributes directly to cash value growth. A portion goes towards covering the cost of insurance, reflecting the risk the insurance company takes in providing lifelong coverage. This cost increases with age as the risk of mortality rises. Additionally, expense charges cover administrative costs associated with managing the policy. These charges are usually higher in the early years of the policy.

Investment Strategies (for certain types of permanent life insurance)

The way the cash value grows also depends on the type of permanent insurance policy. Whole life insurance usually has a fixed interest rate, offering predictable growth. Universal life and variable universal life insurance, on the other hand, often invest the cash value in a selection of sub-accounts, allowing for a potentially higher return but also exposing you to market risk. It's vital to understand the investment options available within your specific policy and the associated risks before making any choices.

Factors Influencing Cash Value Growth

Several factors significantly impact how quickly your cash value grows:

1. Premium Amount: The Foundation of Growth

The higher the premium you pay, the faster your cash value will accumulate. A larger premium directly translates to a greater surplus available for investment after accounting for mortality and expense charges. However, it's essential to choose a premium amount that aligns with your financial capabilities and overall financial goals. Avoid overextending yourself financially just to accelerate cash value growth.

2. Interest Rate (for whole life and some universal life policies): A Major Driver

For whole life policies and some forms of universal life, the interest rate credited to the cash value is a crucial determinant of growth. A higher credited rate will lead to faster accumulation. However, remember that interest rates are not guaranteed and can fluctuate over time, especially with universal life policies that may offer variable interest rates.

3. Investment Performance (for variable universal life insurance): The Risk-Reward Trade-off

Variable universal life (VUL) policies offer the opportunity for higher cash value growth through investment in market-linked sub-accounts. However, these investments come with market risk—the potential for losses. Your cash value growth in a VUL policy will depend heavily on the performance of the chosen investments. This increased risk should be considered against the potential for higher returns.

4. Policy Fees and Charges: Hidden Costs

Various fees and charges, including administrative fees, mortality charges, and possibly surrender charges (if you withdraw from the policy early), can detract from your cash value growth. It's imperative to carefully examine the policy's fee schedule and understand how these charges might impact your overall return.

5. Age at Policy Issuance: A Long-Term Perspective

The age at which you purchase the policy also matters. Younger individuals generally benefit from a longer accumulation period, allowing for a greater opportunity for compound interest to work its magic. The mortality charges in the early years are lower for younger people, meaning a bigger portion of the premium contributes to cash value growth.

When Will the Cash Value Eventually Reach a Significant Amount?

There is no single answer to this question. The timeline for a substantial cash value accumulation depends entirely on the factors mentioned above: the premium amount, interest rates, investment performance (if applicable), fees, and your age at policy issuance.

A significant cash value build-up often takes many years, sometimes decades. It's a long-term investment strategy rather than a quick-win solution. You shouldn't expect substantial returns in the short term. The power of compound interest truly shines over extended periods.

Utilizing the Cash Value: Options and Considerations

The cash value in your permanent life insurance policy can be accessed in several ways:

- Loans: You can borrow against the cash value, generally interest-free. However, failure to repay the loan could impact the death benefit or even result in policy lapse.

- Withdrawals: You can withdraw a portion of the cash value, but this might affect the death benefit and may incur tax implications depending on the policy type and the amount withdrawn.

- Surrender: You can surrender the policy entirely, receiving the accumulated cash value. However, surrendering often means incurring surrender charges, reducing the net amount received.

Careful consideration should be given to each option before utilizing the cash value. The implications on the death benefit and tax consequences should be fully understood. Consulting with a financial advisor is always recommended.

Conclusion: A Long-Term Strategy for Financial Security

Level premium permanent insurance, with its accumulating cash value, represents a long-term financial strategy that offers both lifelong death benefit protection and potential financial growth. The cash value can serve as a valuable resource for future needs, but its accumulation requires patience, consistent premium payments, and a thorough understanding of the policy's features, fees, and growth mechanisms. By understanding these factors and making informed decisions, you can leverage the power of level premium permanent insurance to build a secure financial future. Remember that seeking advice from a qualified financial advisor can help you make the best choices for your individual circumstances.

Latest Posts

Latest Posts

-

Goods That Are Considered To Be Needs Tend To Be

Apr 01, 2025

-

Dod Personnel Who Suspect A Coworker Of Possible Espionage

Apr 01, 2025

-

From A Security Perspective The Best Rooms Are Directly

Apr 01, 2025

-

Software Lab Simulation 21 1 Linux File System

Apr 01, 2025

-

Which Of The Following Drugs Is Not A Sedative Hypnotic

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Level Premium Permanent Insurance Accumulates A Reserve That Will Eventually . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.