Net Working Capital Is Defined As Quizlet

Breaking News Today

Mar 18, 2025 · 6 min read

Table of Contents

Net Working Capital: A Deep Dive into Definition, Calculation, and Significance

Net working capital (NWC) is a crucial metric in assessing a company's short-term financial health and operational efficiency. While a simple definition might suffice for a quiz, a true understanding requires a deeper exploration of its components, calculation methods, significance for various stakeholders, and its limitations. This comprehensive guide will provide a thorough understanding of net working capital, going far beyond a simple quizlet definition.

What is Net Working Capital (NWC)?

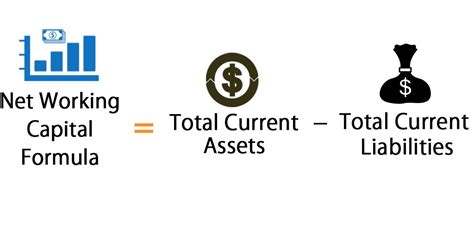

Net working capital represents the difference between a company's current assets and its current liabilities. It essentially shows the amount of liquid assets a company has available to meet its short-term obligations. A positive NWC indicates that a company has enough liquid assets to cover its immediate debts, while a negative NWC suggests a potential liquidity problem.

In essence: Net Working Capital = Current Assets - Current Liabilities

This seemingly straightforward formula hides a wealth of information about a company's financial position and operational effectiveness. Let's delve into the components:

Current Assets: The Resources at Your Disposal

Current assets encompass assets that can be readily converted into cash within a year or less. These typically include:

- Cash and Cash Equivalents: This is the most liquid asset, comprising readily available cash, bank balances, and short-term, highly liquid investments.

- Accounts Receivable: Money owed to the company by its customers for goods or services sold on credit. The efficiency of collecting these receivables is a key indicator of financial health.

- Inventory: Raw materials, work-in-progress, and finished goods held for sale. Managing inventory effectively is critical to avoid excessive storage costs and potential obsolescence.

- Prepaid Expenses: Expenses paid in advance, such as insurance premiums or rent. These are considered assets because they represent future benefits.

The composition and management of current assets significantly impact the overall NWC. For example, a company with high inventory levels might show high current assets but could also indicate inefficient inventory management leading to potential losses.

Current Liabilities: The Short-Term Obligations

Current liabilities are obligations due within one year or less. These include:

- Accounts Payable: Money owed to suppliers for goods or services purchased on credit. Managing accounts payable efficiently can improve cash flow and build strong supplier relationships.

- Short-Term Debt: Loans and other borrowings due within a year. This includes lines of credit, short-term bank loans, and commercial paper.

- Accrued Expenses: Expenses incurred but not yet paid, such as salaries, wages, and utilities.

- Current Portion of Long-Term Debt: The portion of long-term debt that is due within the next year.

The level of current liabilities reveals a company's immediate financial obligations. High current liabilities relative to current assets can signal potential solvency issues.

Calculating Net Working Capital: A Step-by-Step Approach

Calculating NWC is straightforward once you've identified the relevant current assets and liabilities. Let's illustrate with an example:

Company X Financial Statement (Partial):

- Current Assets:

- Cash: $50,000

- Accounts Receivable: $100,000

- Inventory: $75,000

- Prepaid Expenses: $25,000

- Current Liabilities:

- Accounts Payable: $60,000

- Short-Term Debt: $40,000

- Accrued Expenses: $30,000

Calculation:

- Total Current Assets: $50,000 + $100,000 + $75,000 + $25,000 = $250,000

- Total Current Liabilities: $60,000 + $40,000 + $30,000 = $130,000

- Net Working Capital: $250,000 - $130,000 = $120,000

In this example, Company X has a positive NWC of $120,000, indicating a healthy short-term financial position.

The Significance of Net Working Capital

NWC is a critical indicator used by various stakeholders to assess a company's financial health and operational efficiency:

For Investors: A Gauge of Liquidity and Solvency

Investors use NWC to evaluate a company's ability to meet its short-term obligations. A healthy NWC signifies a lower risk of default and improved liquidity, making it a desirable trait for potential investors. A declining or negative NWC, on the other hand, can raise significant concerns.

For Creditors: Assessing Creditworthiness

Creditors use NWC to assess the creditworthiness of a company before extending loans or credit. A strong NWC demonstrates the company's capacity to repay its debts, reducing the creditor's risk.

For Management: Monitoring Operational Efficiency

Management utilizes NWC to monitor operational efficiency. Analyzing changes in NWC over time can reveal inefficiencies in inventory management, accounts receivable collection, and accounts payable. This allows management to take corrective actions to improve cash flow and profitability.

For Suppliers: Evaluating Payment Reliability

Suppliers rely on NWC to evaluate a company's ability to pay its bills on time. A company with a strong NWC is more likely to be a reliable customer, reducing the supplier's risk of non-payment.

Limitations of Net Working Capital

While NWC is a valuable metric, it does have certain limitations:

- Industry Variations: NWC requirements vary significantly across industries. Comparing NWC across different industries can be misleading without considering industry-specific benchmarks.

- Seasonality: Seasonal businesses may experience fluctuations in NWC throughout the year. Analyzing NWC in isolation without considering seasonal effects can be deceptive.

- Inflationary Effects: Inflation can distort the NWC figures. The real value of current assets and liabilities may not be accurately reflected in nominal values.

- Qualitative Factors: NWC doesn't consider qualitative factors, such as the quality of accounts receivable or the efficiency of inventory management. A high NWC may mask underlying operational inefficiencies.

Improving Net Working Capital: Strategies and Tactics

Companies can employ various strategies to improve their NWC:

- Efficient Inventory Management: Implementing Just-in-Time (JIT) inventory systems can reduce storage costs and minimize the risk of obsolescence.

- Accelerated Accounts Receivable Collection: Implementing stricter credit policies and efficient collection procedures can improve cash flow.

- Negotiated Extended Payment Terms with Suppliers: Negotiating longer payment terms with suppliers can free up cash for other purposes.

- Improved Forecasting and Budgeting: Accurate forecasting and budgeting can help companies anticipate cash flow needs and manage their working capital effectively.

Net Working Capital Ratios: Adding Context

While NWC itself is a valuable metric, it's often more informative when analyzed in conjunction with other relevant ratios, including:

- Current Ratio: Current Assets / Current Liabilities. This ratio provides a broader perspective on short-term liquidity. A higher ratio generally indicates better liquidity.

- Quick Ratio (Acid-Test Ratio): (Current Assets - Inventory) / Current Liabilities. This ratio is a more stringent measure of liquidity, excluding less liquid inventory.

- Cash Ratio: (Cash + Cash Equivalents) / Current Liabilities. This ratio focuses solely on the most liquid assets available to meet current obligations.

Analyzing these ratios in conjunction with NWC offers a more holistic understanding of a company's short-term financial health.

Conclusion: Beyond the Quizlet Definition

While a simple definition of net working capital might suffice for a quiz, a comprehensive understanding requires a deeper dive into its components, calculation, significance for different stakeholders, limitations, and related ratios. By considering all these aspects, businesses and investors can gain valuable insights into a company's short-term financial health and operational efficiency, enabling better decision-making. Remember, a strong NWC is a foundation for sustainable growth and financial stability. Continuous monitoring and improvement of NWC are crucial for maintaining a healthy financial position and mitigating potential risks.

Latest Posts

Latest Posts

-

The Direct Carry Is Used To Transfer A Patient

Mar 18, 2025

-

The Emancipation Proclamation Of January 1 1863 Quizlet

Mar 18, 2025

-

These Cards Will Get You Drunk Quizlet

Mar 18, 2025

-

Did Quizlet Get Rid Of Q Chat

Mar 18, 2025

-

Myasthenia Gravis Is An Autoimmune Disease In Which Quizlet

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Net Working Capital Is Defined As Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.