Obligations That Are Due Within One Year Are

Breaking News Today

Mar 21, 2025 · 6 min read

Table of Contents

Obligations Due Within One Year: A Comprehensive Guide

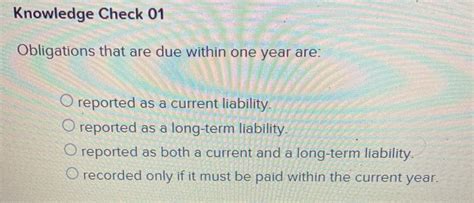

Current liabilities are a crucial aspect of a company's financial health, representing obligations due within the next 12 months. Understanding these obligations is vital for effective financial planning, accurate financial reporting, and informed decision-making. This comprehensive guide explores the various types of obligations due within one year, their implications, and best practices for managing them effectively.

What are Current Liabilities?

Current liabilities are a company's short-term financial obligations that are due within one year or the operating cycle, whichever is longer. They represent debts and other financial commitments that need to be settled relatively soon. Accurate accounting and management of these liabilities are essential for maintaining liquidity and avoiding financial distress. Failure to properly manage current liabilities can lead to missed payments, damaged credit ratings, and ultimately, business failure.

Key Types of Current Liabilities Due Within One Year

Several categories fall under the umbrella of current liabilities due within one year. Let's explore some of the most common:

1. Accounts Payable (Trade Payables):

- Definition: These are short-term debts owed to suppliers for goods or services purchased on credit. They represent the most common type of current liability.

- Importance: Managing accounts payable efficiently is critical for maintaining strong supplier relationships and securing favorable payment terms. Late payments can damage these relationships and potentially lead to disruptions in supply chains.

- Example: A retailer purchasing inventory from a wholesaler on credit has an accounts payable obligation.

2. Short-Term Loans:

- Definition: These are loans with a maturity date of less than one year. They can be obtained from banks, credit unions, or other financial institutions.

- Importance: Short-term loans provide crucial funding for short-term operational needs, such as covering payroll expenses or purchasing inventory. However, careful management is necessary to avoid excessive interest costs and potential financial strain.

- Example: A small business securing a loan to cover seasonal inventory needs.

3. Notes Payable:

- Definition: These are formal written promises to repay a debt, often issued to lenders or suppliers. They typically specify the repayment terms, including the principal amount, interest rate, and maturity date.

- Importance: Notes payable offer a structured approach to borrowing, providing a clear outline of repayment obligations. Failure to adhere to the terms of a note payable can have serious legal and financial repercussions.

- Example: A company borrowing money from a bank and signing a promissory note.

4. Salaries and Wages Payable:

- Definition: These are amounts owed to employees for salaries, wages, and other compensation earned but not yet paid.

- Importance: Accurate and timely payment of salaries and wages is crucial for maintaining employee morale and complying with labor laws. Failure to pay employees on time can lead to legal issues and reputational damage.

- Example: A company's obligation to pay its employees at the end of the pay period.

5. Taxes Payable:

- Definition: These represent taxes owed to various government agencies, including income taxes, sales taxes, and property taxes.

- Importance: Failure to pay taxes on time can result in significant penalties and interest charges, as well as potential legal action from tax authorities. Accurate tax accounting and timely payment are essential for maintaining compliance.

- Example: A company's obligation to remit sales taxes collected from customers to the relevant tax authority.

6. Interest Payable:

- Definition: This liability represents interest accrued on outstanding debt but not yet paid.

- Importance: Accurately tracking and paying interest on time is essential for maintaining a positive relationship with lenders and avoiding penalties.

- Example: Interest accrued on a short-term bank loan.

7. Unearned Revenue:

- Definition: This represents payments received from customers for goods or services that have not yet been delivered or performed.

- Importance: Unearned revenue is a liability because the company has an obligation to provide the goods or services in the future. Accurate accounting of unearned revenue is crucial for reflecting the company's true financial position.

- Example: A subscription-based software company receiving payment for a year's worth of service upfront.

Analyzing and Managing Current Liabilities

Effective management of current liabilities is crucial for a company's financial health. Several key strategies can help:

1. Monitoring and Forecasting:

Regularly monitoring current liabilities, including their amounts and due dates, is essential. Forecasting future liabilities helps anticipate potential cash flow challenges and allows for proactive planning.

2. Maintaining Strong Supplier Relationships:

Negotiating favorable payment terms with suppliers can improve cash flow and provide more flexibility in managing accounts payable. Building strong relationships can also lead to extended payment periods in times of need.

3. Optimizing Inventory Management:

Efficient inventory management reduces the need for short-term financing to purchase inventory, thus lowering current liabilities. Just-in-time inventory systems are often employed to minimize storage costs and reduce the risk of obsolescence.

4. Effective Cash Management:

Strong cash management practices are essential for meeting short-term obligations. This includes careful budgeting, forecasting cash inflows and outflows, and optimizing cash collection from customers. Techniques like factoring invoices can provide immediate access to funds tied up in receivables.

5. Debt Management:

Strategically managing short-term debt is critical. This includes exploring different financing options, comparing interest rates, and selecting the most suitable loan terms. Careful planning can ensure the company can comfortably meet its repayment obligations without undue financial strain.

The Impact of Current Liabilities on Financial Statements

Current liabilities are prominently featured on a company's balance sheet, providing a snapshot of its short-term financial obligations. They are also used in calculating key financial ratios, such as the current ratio and quick ratio, which assess a company's ability to meet its short-term obligations. A high level of current liabilities relative to current assets can indicate a potential liquidity risk.

Implications of Poor Current Liability Management

Neglecting the management of current liabilities can lead to severe consequences:

- Damaged Credit Rating: Consistent late payments can significantly harm a company's creditworthiness, making it more difficult and expensive to secure future financing.

- Legal Action: Failure to meet financial obligations can result in legal action from creditors and government agencies.

- Business Failure: Inability to meet short-term obligations can lead to insolvency and ultimately, business failure.

- Lost Opportunities: Poor financial health can deter investors and limit growth opportunities.

Best Practices for Managing Current Liabilities

To effectively manage current liabilities, consider these best practices:

- Develop a comprehensive budget: Accurate budgeting and forecasting are vital for anticipating cash flow needs and managing expenses.

- Maintain accurate records: Meticulous record-keeping ensures timely payment of obligations and avoids penalties.

- Negotiate favorable payment terms: Collaborate with suppliers to secure favorable terms that align with your cash flow capabilities.

- Monitor key financial ratios: Regularly review key financial ratios, such as the current ratio, to assess liquidity and identify potential problems.

- Seek professional advice: Consult with financial professionals for guidance on debt management and financial planning.

Conclusion

Successfully managing current liabilities is paramount for the financial health and stability of any business. Understanding the various types of obligations, their implications, and effective management strategies is essential for long-term success. By implementing the strategies and best practices outlined in this guide, businesses can proactively address their short-term obligations, maintain strong relationships with creditors, and build a solid foundation for growth and prosperity. Regular monitoring, proactive planning, and effective communication with stakeholders are key to navigating the complexities of current liabilities and ensuring a strong financial future. Remember, proactive management is far more effective and less costly than reacting to a crisis.

Latest Posts

Latest Posts

-

Entrar Al Edificio Que Esta Al Lado Del Banco Popular

Mar 28, 2025

-

Consumer Reports Requested By An Underwriter During The Application

Mar 28, 2025

-

Define The Following Terms Space Depth Mass

Mar 28, 2025

-

When Is Inhaled Especially When Accompanied By Smoking

Mar 28, 2025

-

A Quilt Of A Country Answer Key

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about Obligations That Are Due Within One Year Are . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.