P Is Self Employed And Owns An Individual

Breaking News Today

Mar 17, 2025 · 6 min read

Table of Contents

P is Self-Employed and Owns an Individual: Navigating the Complexities of Self-Employment and Personal Liability

Being self-employed offers incredible freedom and flexibility, but it also presents unique challenges, particularly regarding personal liability. Understanding the implications of operating as a sole proprietor – where the individual is the business – is crucial for protecting your assets and ensuring long-term financial stability. This comprehensive guide delves into the intricacies of self-employment, focusing specifically on the scenario where 'P' is self-employed and owns an individual business. We will explore the legal implications, financial considerations, and strategies for managing risk.

Understanding the Structure: Sole Proprietorship and Personal Liability

When 'P' is self-employed and owns an individual business, they are operating as a sole proprietorship. This is the simplest business structure, characterized by the absence of legal distinction between the owner (P) and the business. This means personal liability is unlimited. This is a critical point: any debts or legal judgments against the business are also considered debts and judgments against P personally. This can extend to the seizure of personal assets, such as a house, car, or savings, to satisfy business debts.

The Risks of Unlimited Liability

Unlimited liability is the biggest drawback of a sole proprietorship. Imagine a scenario where P's business faces a lawsuit due to negligence or breach of contract. If the judgment exceeds the business's assets, creditors can pursue P's personal assets to recover the remaining amount. This financial exposure can be devastating.

- Lawsuits: A single significant lawsuit could wipe out P's personal savings and possessions.

- Business Debts: Unpaid business loans or supplier invoices can lead to personal debt collection actions.

- Accidents or Injuries on Business Premises: If someone is injured on P's business property, P could be held personally responsible for medical bills and other damages.

Protecting Yourself: Strategies for Risk Mitigation

While the risk of unlimited liability is inherent in a sole proprietorship, various strategies can help mitigate the exposure:

- Comprehensive Business Insurance: Purchasing liability insurance is paramount. This coverage helps protect P from financial losses resulting from lawsuits, accidents, or other incidents related to the business. Different types of insurance are available, including general liability, professional liability (errors and omissions), and product liability.

- Careful Contract Drafting: Ensuring all business contracts are meticulously drafted and reviewed by a legal professional is crucial. Clear terms and conditions can help prevent disputes and minimize the risk of lawsuits. Pay close attention to clauses regarding liability and indemnification.

- Maintaining Strong Financial Records: Accurate and organized accounting practices are essential. These records are critical for tax purposes and in the event of a legal dispute. They can also demonstrate the financial health of the business and potentially limit liability.

- Establishing a Separate Business Bank Account: Keeping business finances separate from personal finances is a fundamental best practice. This provides clear financial records, improves accounting accuracy, and can help protect personal assets in case of legal action.

Financial Considerations for Self-Employed Individuals

Managing finances effectively is crucial for any self-employed individual. The financial landscape for P differs significantly from that of an employee.

Tax Implications: Self-Employment Taxes

A major difference lies in taxation. P, as a self-employed individual, is responsible for paying self-employment taxes, including Social Security and Medicare taxes. These taxes are usually deducted from an employee's paycheck; however, P must pay both the employer and employee portions themselves. This significantly impacts their overall tax burden. Accurate income tracking and quarterly tax payments are crucial to avoid penalties.

Income Fluctuations and Financial Planning

Income for self-employed individuals often fluctuates. P needs a robust financial plan to manage periods of high and low income. This may involve creating a budget, establishing an emergency fund, and exploring various savings and investment options.

- Budgeting: A detailed budget helps track income and expenses, allowing P to anticipate potential cash flow shortages.

- Emergency Fund: An emergency fund provides a financial cushion to cover unexpected expenses, such as equipment repairs or medical bills.

- Retirement Planning: Self-employed individuals are responsible for planning their own retirement. Options include setting up a self-employed retirement plan, such as a SEP IRA or solo 401(k).

Legal Aspects of Self-Employment

Understanding the legal aspects of self-employment is crucial for 'P'. Beyond personal liability, other legal considerations include:

Business Licenses and Permits

P must comply with all applicable business licenses and permits at the local, state, and federal levels. These requirements vary depending on the type of business and location. Failure to obtain the necessary licenses and permits can result in fines or legal penalties.

Compliance with Employment Laws (if applicable)

If P employs others, they must comply with all applicable employment laws, including minimum wage, overtime, and workplace safety regulations. Non-compliance can lead to substantial fines and legal repercussions.

Intellectual Property Protection

If P's business involves creating or using intellectual property, such as trademarks, copyrights, or patents, they must take steps to protect their rights. This might involve registering trademarks or copyrights to prevent infringement.

Contract Law

Understanding contract law is fundamental. P needs to ensure that all contracts with clients, suppliers, and employees are legally sound and protect their interests.

Growth and Expansion Strategies

As P's business grows, they may consider strategies for expansion and enhanced risk management.

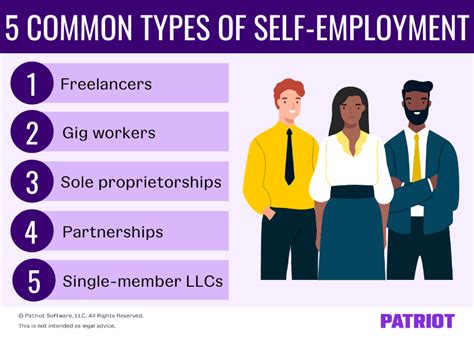

Business Structure Transition

As the business expands, transitioning from a sole proprietorship to a more complex structure like an LLC (Limited Liability Company) or corporation may be beneficial. This provides limited liability protection, separating personal assets from business liabilities. Consulting with a legal professional is advisable when considering such a transition.

Hiring Employees

As the workload increases, hiring employees can help P manage the business more effectively. However, it's crucial to understand and comply with all employment laws.

Seeking Professional Advice

At various stages of business growth, seeking professional advice from accountants, lawyers, and financial advisors is crucial. These professionals can provide guidance on financial planning, legal compliance, and risk management.

Conclusion: Proactive Management is Key

Being self-employed provides significant rewards, but it requires careful planning and proactive risk management. For 'P', understanding the implications of unlimited personal liability in a sole proprietorship is paramount. By implementing strategies such as comprehensive insurance, meticulous record-keeping, and proactive legal compliance, P can significantly mitigate risks and build a sustainable and successful business. Regular review and adaptation of their business plan, alongside professional advice, will ensure long-term stability and prosperity. Remember, proactive management is the cornerstone of success for the self-employed individual. Don't underestimate the importance of planning for the unexpected; it’s crucial for navigating the complexities of self-employment and preserving personal assets.

Latest Posts

Latest Posts

-

The Direct Carry Is Used To Transfer A Patient

Mar 18, 2025

-

The Emancipation Proclamation Of January 1 1863 Quizlet

Mar 18, 2025

-

These Cards Will Get You Drunk Quizlet

Mar 18, 2025

-

Did Quizlet Get Rid Of Q Chat

Mar 18, 2025

-

Myasthenia Gravis Is An Autoimmune Disease In Which Quizlet

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about P Is Self Employed And Owns An Individual . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.