P Is The Insured On A Participating Life Policy

Breaking News Today

Mar 29, 2025 · 7 min read

Table of Contents

- P Is The Insured On A Participating Life Policy

- Table of Contents

- P is the Insured on a Participating Life Policy: A Comprehensive Guide

- What is a Participating Life Insurance Policy?

- P: The Insured's Central Role

- The Insured (P) vs. The Policy Owner

- Implications of the Insured-Owner Distinction

- P's Role in Claim Settlement

- The Impact of P's Health on the Policy

- P's Role in Maintaining the Policy

- Ethical Considerations When P is Not the Policy Owner

- Frequently Asked Questions (FAQs)

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

P is the Insured on a Participating Life Policy: A Comprehensive Guide

Understanding life insurance can be complex, especially when delving into the intricacies of participating policies. This comprehensive guide will dissect the role of the insured, 'P', within the context of a participating life insurance policy, clarifying key aspects like policy ownership, beneficiary designation, and the impact on death benefits and cash value accumulation.

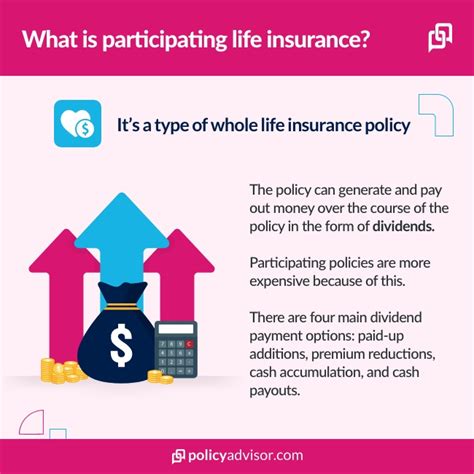

What is a Participating Life Insurance Policy?

Before we dive into the role of the insured, let's define what a participating life insurance policy is. Unlike term life insurance, which provides coverage for a specified period, participating policies are a type of permanent life insurance. This means they offer lifelong coverage as long as premiums are paid. Crucially, participating policies share a portion of the insurer's profits with the policyholders in the form of dividends. These dividends are not guaranteed, but they can significantly enhance the policy's cash value and overall return. The potential for these dividends is a key feature differentiating participating policies from non-participating policies.

P: The Insured's Central Role

In a participating life insurance policy, 'P' represents the insured individual. This is the person whose life is insured. The policy's death benefit will be paid to the designated beneficiary upon P's death. While 'P' might also be the policy owner, this isn't always the case. Understanding the distinction between the insured and the policy owner is vital for comprehending the policy's dynamics.

The Insured (P) vs. The Policy Owner

Often, 'P' and the policy owner are the same person. However, situations exist where they differ:

-

Parents insuring their children: A parent might purchase a participating life insurance policy on their child's life, making the child the insured ('P') and the parent the policy owner. This is commonly done to secure future financial stability for the child or to cover potential future expenses. The parent is responsible for paying premiums and making all policy decisions until the child reaches the age of majority.

-

Business partnerships: In a business context, partners might take out policies on each other's lives, designating the business as the policy owner. Upon the death of one partner, the policy provides funds to the surviving partner(s) or the business, aiding in business continuity and facilitating financial settlement. This is a strategic financial planning tool often used to mitigate risk and ensure the stability of the partnership.

-

Trust arrangements: Sometimes, a trust is appointed as the policy owner, with the insured being a separate individual. This setup is often part of estate planning strategies, allowing for greater control over the distribution of death benefits and minimizing estate taxes. The trustee acts on behalf of the beneficiaries, ensuring the policy proceeds are managed according to the trust's guidelines.

Implications of the Insured-Owner Distinction

The separation of the insured and policy owner holds significant implications:

-

Premium payments: The policy owner is responsible for paying all premiums. Failure to do so can result in policy lapse, thus negating the coverage for the insured.

-

Policy decisions: The policy owner holds the right to make all decisions concerning the policy, including changes to the beneficiary designation, surrendering the policy for its cash value, or choosing different dividend options. The insured, even if they’re aware of the policy, may not have any say in these decisions.

-

Beneficiary designation: While the policy owner typically designates the beneficiary, the insured's wishes are often considered, especially when both are the same person. However, a change in beneficiary requires the policy owner's authorization. This aspect is especially critical when considering the emotional and financial implications for those designated as beneficiaries. Carefully choosing and regularly reviewing the beneficiary designation is vital.

-

Death benefit payout: Upon the insured's death, the death benefit is paid to the designated beneficiary as specified in the policy. It's crucial to ensure the beneficiary information is accurate and up to date to facilitate a smooth claims process. Delay or complications can arise from outdated information.

P's Role in Claim Settlement

When 'P' (the insured) passes away, the beneficiary initiates the claims process. The policy owner (if different from P) may play a role in providing necessary documentation. The insurance company verifies the claim based on:

-

Policy documentation: This includes the original policy documents, death certificate, and proof of insurance. Accuracy and completeness of these documents are crucial for a timely and efficient claims settlement.

-

Medical information: In certain cases, additional medical information related to P's death may be required, depending on the cause of death and the policy's terms.

-

Beneficiary information: Accurate beneficiary information is critical to ensuring the death benefit is paid to the correct individual(s) or entity. Keeping beneficiary information updated is a responsibility of the policy owner, even if the insured and owner are the same person.

The Impact of P's Health on the Policy

P's health status influences the policy, albeit indirectly. While the health of the insured does not usually impact the policy after it has been issued (unless there are specific clauses related to material misrepresentation in the application), it heavily impacts the underwriting process before the policy is issued. Individuals in poor health may face higher premiums, limitations on coverage, or even policy rejection.

P's Role in Maintaining the Policy

Even though 'P' may not control all aspects of the policy (if the policy owner is someone else), their health and life are intrinsically linked to the policy’s purpose. If 'P' is aware of the policy's existence, it is beneficial for them to understand the following:

-

Premium payment schedule: Knowing the due dates for premiums helps ensure the policy remains active. While the policy owner is responsible, the insured's awareness contributes to the policy's longevity.

-

Policy benefits and features: Understanding the policy's features, such as cash value accumulation and dividend options, can help 'P' participate in relevant decisions or at least be aware of the financial implications for themselves and their beneficiaries.

-

Beneficiary updates: Even if the insured isn't the policy owner, staying aware of the designated beneficiary and recommending updates to reflect changing circumstances is beneficial to ensure the proceeds go to the intended recipients.

Ethical Considerations When P is Not the Policy Owner

When the insured and policy owner are different, ethical considerations come into play. The policy owner has a fiduciary responsibility to act in the best interests of the insured and beneficiary. This responsibility necessitates transparency and open communication, especially regarding policy decisions and potential implications for the insured's family.

Frequently Asked Questions (FAQs)

Q: Can the insured cancel a participating life insurance policy?

A: No, the insured cannot unilaterally cancel the policy. Only the policy owner has the authority to cancel or surrender the policy.

Q: What happens if the policy owner dies before the insured?

A: The policy will typically pass on to the named beneficiary or according to the terms outlined within the policy itself. This often involves the named beneficiary taking over the responsibilities of the policy owner.

Q: Can the beneficiary be changed after the policy is issued?

A: Yes, the policy owner can change the beneficiary at any time, provided they follow the insurer's procedures.

Conclusion

The role of 'P', the insured, in a participating life insurance policy is multifaceted. Understanding the interplay between the insured and the policy owner is crucial for ensuring the policy serves its intended purpose. Whether or not the insured is also the policy owner, it is important to have a clear understanding of the policy's terms, features, and implications. Open communication and responsible decision-making are vital, especially in situations where different individuals hold the roles of insured and policy owner. Through careful planning and proactive management, a participating life insurance policy can provide lasting financial security and peace of mind. Seeking professional advice from a financial advisor can further help in navigating the complexities of such policies and ensuring they align with individual needs and goals.

Latest Posts

Latest Posts

-

Understanding A Credit Card Statement Answer Key

Apr 02, 2025

-

Surgical Correction Is Generally Only Required For

Apr 02, 2025

-

Volleyball Helps People Reach Their Fitness Goals By

Apr 02, 2025

-

Which Statement Best Summarizes How American Families Are Changing

Apr 02, 2025

-

The Results Of Can Lead To Changes In Scientific Knowledge

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about P Is The Insured On A Participating Life Policy . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.