Porter's Five Competitive Forces Form A Model For ______ Analysis.

Breaking News Today

Mar 29, 2025 · 8 min read

Table of Contents

Porter's Five Competitive Forces: A Model for Industry Analysis

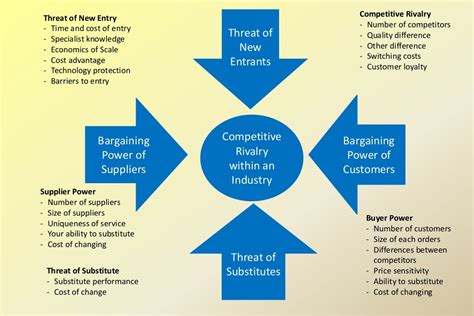

Porter's Five Competitive Forces is a framework for industry analysis and business strategy development. It helps businesses understand the competitive landscape they operate in and make informed decisions about how to compete effectively. Developed by Michael E. Porter, a renowned Harvard Business School professor, this model is widely used by businesses of all sizes across various industries to analyze their competitive position and plan for future success. The five forces assess the attractiveness of an industry and its inherent profitability, ultimately guiding strategic planning and decision-making. This analysis isn't just about identifying competitors; it delves deep into the underlying dynamics shaping the industry's competitive structure and potential for profitability.

Understanding the Five Competitive Forces

The five forces that shape competition within an industry are:

-

Threat of New Entrants: This force considers how easy or difficult it is for new companies to enter the market. High barriers to entry (e.g., high capital requirements, stringent regulations, strong brand loyalty) lead to a less competitive landscape, benefiting existing players. Low barriers to entry result in increased competition and potentially lower profit margins for incumbents.

-

Bargaining Power of Suppliers: This force assesses the power suppliers have over businesses in the industry. Powerful suppliers can dictate prices and terms, reducing the profitability of businesses. This power is influenced by factors like the number of suppliers, the uniqueness of their products or services, and the switching costs for businesses to change suppliers.

-

Bargaining Power of Buyers: This force examines the power buyers (customers) have over businesses in the industry. Powerful buyers can demand lower prices or better quality, squeezing profit margins. Factors influencing buyer power include the number of buyers, the size of their orders, and their price sensitivity. Buyers with multiple options tend to hold more power.

-

Threat of Substitute Products or Services: This force evaluates the potential for alternative products or services to meet the same customer needs. The presence of strong substitutes can limit the pricing power of businesses and reduce their profitability. For example, the rise of video streaming services poses a significant threat to traditional cable television providers.

-

Rivalry Among Existing Competitors: This force focuses on the intensity of competition among existing businesses in the industry. High rivalry can lead to price wars, increased marketing spending, and reduced profitability. Factors driving rivalry include the number of competitors, the industry's growth rate, and the level of product differentiation.

Applying Porter's Five Forces: A Detailed Analysis

Let's delve deeper into how each force impacts industry analysis and its implications for strategic decision-making.

1. Threat of New Entrants: Barriers to Entry

Analyzing the threat of new entrants requires understanding the barriers that prevent new businesses from easily entering the market. These barriers can be:

- High Capital Requirements: Industries requiring substantial upfront investment (e.g., automotive manufacturing) naturally deter new entrants.

- Economies of Scale: Existing businesses with large production volumes often enjoy lower per-unit costs, making it difficult for new entrants to compete on price.

- Product Differentiation: Strong brand recognition and customer loyalty create barriers to entry, as new entrants struggle to establish their brands.

- Switching Costs: High switching costs for customers (e.g., specialized software) protect incumbents from new entrants.

- Access to Distribution Channels: Established distribution networks can hinder the ability of new companies to reach consumers.

- Government Policy: Regulations and licensing requirements can make entry into specific industries challenging.

- Network Effects: Some industries benefit from network effects, where the value of a product increases with the number of users. This makes it difficult for new entrants to gain traction.

Strategic Implications: Businesses should analyze the barriers to entry in their industry to assess the vulnerability of their competitive position. Strong barriers protect incumbents, while weak barriers signal a higher threat of new competition, necessitating proactive strategies such as strengthening brand loyalty or investing in innovation to maintain a competitive edge.

2. Bargaining Power of Suppliers: Dependency and Control

The bargaining power of suppliers is determined by several key factors:

- Supplier Concentration: Fewer suppliers translate to greater supplier power, as businesses have less choice and leverage.

- Switching Costs: High costs associated with switching suppliers increase supplier power.

- Supplier Differentiation: Unique or highly specialized supplier products or services enhance supplier bargaining power.

- Threat of Forward Integration: The ability of suppliers to enter the industry themselves (forward integration) increases their negotiating power.

- Importance of the Supplier's Product: Essential raw materials or components give suppliers significant leverage.

Strategic Implications: Businesses need to actively manage their relationships with key suppliers. Strategies might include diversifying their supplier base, developing long-term contracts, or even vertically integrating to gain more control over the supply chain.

3. Bargaining Power of Buyers: Customer Influence

The bargaining power of buyers is affected by several key aspects:

- Buyer Concentration: Fewer buyers, especially large volume buyers, increase their negotiating power.

- Buyer Switching Costs: Low switching costs for buyers empower them to demand better prices or services.

- Product Differentiation: Undifferentiated products or services reduce buyer power, as customers have fewer alternatives.

- Threat of Backward Integration: Buyers' ability to acquire suppliers or produce the product themselves increases their bargaining power.

- Price Sensitivity: Highly price-sensitive buyers exert more pressure on businesses to reduce prices.

Strategic Implications: Understanding buyer power helps businesses tailor their offerings and strategies. Strategies might involve building strong customer relationships, differentiating products, or developing loyalty programs to reduce buyer power.

4. Threat of Substitute Products or Services: Alternative Solutions

Substitute products or services offer similar functionality or benefits but may come from different industries. Analyzing this threat involves considering:

- Price-Performance Ratio: Substitutes that offer comparable performance at a lower price pose a significant threat.

- Buyer Switching Costs: Low switching costs between products or services increase the threat of substitution.

- Buyer Propensity to Substitute: Consumer willingness to switch to alternatives impacts the threat level.

Strategic Implications: Businesses need to monitor the market for potential substitute products or services and proactively innovate to stay ahead of the curve. This might involve developing superior features, enhancing customer service, or exploring new market segments.

5. Rivalry Among Existing Competitors: Intense Competition

Rivalry among existing competitors is the most direct form of competition. The intensity of rivalry is determined by factors such as:

- Number of Competitors: More competitors lead to more intense rivalry.

- Industry Growth Rate: Slow growth intensifies competition as companies fight for market share.

- Product Differentiation: Low product differentiation leads to price wars and increased competition.

- Exit Barriers: High exit barriers (e.g., sunk costs, government regulations) can intensify rivalry, as struggling businesses stay in the market.

- Fixed Costs: High fixed costs encourage businesses to produce at full capacity, even if it means lowering prices and increasing competition.

Strategic Implications: Businesses need to understand their competitive position relative to rivals and develop strategies to differentiate their offerings, build strong brands, and secure market share. Strategies might include focusing on innovation, building customer loyalty, or developing efficient cost structures.

Using Porter's Five Forces for Strategic Decision-Making

Porter's Five Forces isn't just a descriptive model; it's a powerful tool for strategic decision-making. After analyzing the five forces, businesses can:

-

Assess Industry Attractiveness: The overall strength of the five forces determines the attractiveness of an industry in terms of profitability and potential for growth. A highly competitive industry (strong forces) may present a lower potential for profit, whereas an industry with weak forces offers greater potential.

-

Identify Strategic Opportunities: By understanding the strengths and weaknesses of the five forces, businesses can identify opportunities to exploit competitive advantages, improve efficiency, or expand into new markets.

-

Develop Competitive Strategies: The analysis guides the development of strategies to mitigate threats and capitalize on opportunities. For example, if the threat of new entrants is high, a business may choose to invest heavily in research and development to maintain a competitive edge.

-

Improve Business Performance: By anticipating and responding to competitive pressures, businesses can enhance their operational efficiency and profitability.

-

Inform Mergers and Acquisitions: The model helps evaluate the attractiveness of potential acquisition targets by assessing the target's competitive environment.

Limitations of Porter's Five Forces

While immensely valuable, Porter's Five Forces has limitations:

-

Static Analysis: The model provides a snapshot of the competitive landscape at a specific point in time and may not adequately capture dynamic changes in the market.

-

Oversimplification: The model simplifies complex market interactions and may not fully capture the nuances of specific industry dynamics.

-

Difficulty in Quantifying: The forces are often qualitative, making it difficult to assign numerical values to their relative strengths.

-

Industry Definition: Defining the appropriate industry boundaries can be challenging, affecting the accuracy of the analysis.

Conclusion: A Powerful Tool for Industry Analysis

Despite its limitations, Porter's Five Forces remains a cornerstone of strategic management. It provides a structured framework for analyzing the competitive landscape, identifying key threats and opportunities, and informing strategic decision-making. By understanding the forces at play, businesses can develop robust strategies to achieve sustainable competitive advantage and maximize profitability. The model's enduring relevance stems from its ability to provide a clear, concise, and actionable framework for understanding the competitive dynamics of any industry, making it a valuable asset for businesses striving for success in today's dynamic market environment. Remember that regular reassessment and adaptation of your Porter's Five Forces analysis is vital to remain agile and responsive to evolving market conditions. This ensures the model remains a valuable strategic tool, capable of adapting to changing market realities and maintaining its effectiveness over time.

Latest Posts

Latest Posts

-

Regional Impacts Of The Embargo Of 1807 The West

Mar 31, 2025

-

10 Interesting Facts About The Holocaust Quizlet

Mar 31, 2025

-

Ati Nursing Informatics And Technology Informatics Quizlet

Mar 31, 2025

-

Apoptosis Refers To Cell Death And Quizlet

Mar 31, 2025

-

Debt Consolidation Loans Can Be Used To Quizlet

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Porter's Five Competitive Forces Form A Model For ______ Analysis. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.