Requires An Organization To Be A Separate Economic Unit

Breaking News Today

Mar 25, 2025 · 6 min read

Table of Contents

What Makes an Organization a Separate Economic Unit?

The question of what constitutes a separate economic unit is crucial in understanding organizational structure, financial accounting, and economic analysis. While the concept might seem straightforward, the nuances require a closer examination. An organization's standing as a separate economic unit hinges on several interconnected factors, going beyond mere legal registration. This article delves deep into the key characteristics, exploring various perspectives and implications.

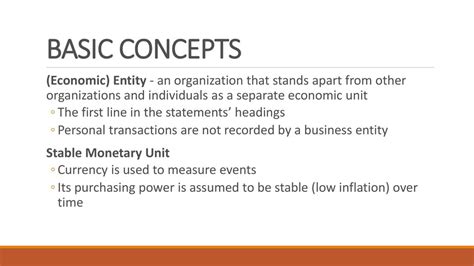

Defining a Separate Economic Unit: Beyond Legal Existence

A separate economic unit isn't simply a legally registered entity; it's an organization that operates independently in the economic sphere, engaging in distinct activities with its own resources, objectives, and accountability. This independence is demonstrated in several ways:

1. Distinct Resource Control and Ownership: The Cornerstone of Independence

A fundamental characteristic is the control and ownership of distinct resources. This includes:

- Financial Resources: A separate economic unit possesses its own funds, bank accounts, and financial instruments, separate from those of its owners or other entities. It can independently raise capital, manage its finances, and incur debts. The absence of this independence would suggest a lack of separate economic existence.

- Physical Assets: Ownership or control over physical assets like property, equipment, and inventory is crucial. The organization isn't merely using assets belonging to another entity; it has the authority to deploy and dispose of these resources as it sees fit within legal frameworks.

- Human Resources: A separate economic unit employs its workforce, independently managing hiring, compensation, training, and performance evaluations. This contrasts with situations where personnel are essentially seconded from another organization.

2. Independent Operational Control: Decision-Making Autonomy

A separate economic unit possesses significant autonomy in its operational decisions. This encompasses:

- Strategic Planning: It formulates and executes its own strategic plans, setting its own objectives, target markets, and operational strategies. A lack of strategic independence suggests subordination to another entity.

- Operational Management: The organization manages its day-to-day operations independently, making decisions on production, distribution, marketing, and other crucial aspects of its business.

- Risk Management: It assumes responsibility for its own risks, developing and implementing strategies to mitigate potential losses. The inability to independently manage risk points towards a lack of separate economic standing.

3. Distinct Accounting and Reporting Systems: Maintaining Financial Transparency

Transparency and accountability are hallmarks of a separate economic unit. This is evident in:

- Separate Accounting Records: It maintains its own set of accounts, preparing financial statements that reflect its unique activities, revenues, expenses, and financial position. Consolidated accounts with another entity undermine its independent economic status.

- Independent Audits: Its financial records are subject to independent audits to ensure the accuracy and reliability of its financial reporting. The absence of independent audits casts doubt on its separate economic existence.

- Tax Obligations: It files its own tax returns, paying taxes independently as a distinct legal and economic entity. This underscores its operational autonomy and separate existence.

4. Legal and Contractual Independence: Formal Recognition

While not exclusively defining, legal and contractual frameworks significantly contribute to establishing separate economic standing:

- Legal Registration: In most jurisdictions, formal registration as a corporation, partnership, or other legal entity is necessary. This provides legal recognition of its independent existence and establishes liability parameters.

- Independent Contracts: The organization enters into its own contracts with suppliers, customers, and employees, demonstrating its capacity to independently engage in economic transactions.

- Liability Segregation: The organization's liabilities are separate from those of its owners or other related entities. This limits the exposure of individuals or other organizations to the economic risks associated with the entity's operations.

Implications of Separate Economic Unit Status: Navigating the Economic Landscape

Understanding the characteristics of a separate economic unit has far-reaching implications across various domains:

1. Financial Accounting and Reporting: Maintaining Clarity and Transparency

Accurate financial reporting hinges on correctly identifying and treating separate economic units. Consolidation of accounts is necessary when entities are not truly independent, while treating genuinely independent entities separately ensures accurate reflection of their financial performance and position. Misidentification can lead to distorted financial statements and misleading information for investors and other stakeholders.

2. Economic Analysis and Forecasting: Understanding Market Dynamics

Recognizing separate economic units is essential for accurate economic analysis and forecasting. Analyzing the performance of individual entities provides insights into market dynamics, competition, and overall economic health. Aggregating data from improperly identified entities can obscure valuable information and lead to inaccurate conclusions.

3. Taxation and Regulatory Compliance: Adhering to Legal Frameworks

Proper identification of separate economic units is critical for complying with tax laws and regulations. Each entity has its own tax obligations, and incorrect classification can result in penalties and legal repercussions.

4. Investment Decisions and Market Valuation: Assessing Opportunities and Risks

Investors use the characteristics of separate economic units to assess investment opportunities and risks. The financial health, operational efficiency, and legal standing of an entity as an independent economic unit are critical factors in making informed investment decisions.

5. Mergers and Acquisitions: Strategic Decision Making

The concept of separate economic units plays a critical role in mergers and acquisitions. Careful evaluation of the individual entities’ resources, operations, and legal structures is essential for determining the feasibility and strategic implications of such transactions. Understanding their individual economic strengths and weaknesses is crucial for successful integration.

Distinguishing Between Separate Economic Units and Other Entities

It's crucial to distinguish between truly separate economic units and entities that might appear independent but lack critical characteristics:

- Subsidiaries: While legally distinct, subsidiaries are often not fully independent economic units due to significant control exerted by the parent company. While they might have their own operational structure, strategic direction often originates from the parent, limiting their autonomy.

- Joint Ventures: These involve shared ownership and control. While each party might have separate accounting, the extent of independence is limited by the shared nature of the venture and the mutual decision-making processes.

- Franchises: Franchises have considerable operational independence but often share branding, operational systems, and certain other aspects, limiting their complete economic autonomy. While financially independent in terms of profits and losses, they remain fundamentally bound to the franchisor's model.

Conclusion: Navigating the Complexities of Economic Independence

Determining whether an organization constitutes a separate economic unit requires careful consideration of its resource control, operational autonomy, accounting systems, and legal standing. The implications extend far beyond legal formalities, affecting financial reporting, economic analysis, taxation, investment decisions, and many other critical aspects. Understanding the nuances of this concept is vital for accurate financial reporting, sound economic analysis, and informed decision-making across various sectors. Failing to accurately distinguish truly independent economic units from other organizational structures can lead to significant errors and misinterpretations, affecting both individual entities and the broader economic landscape.

Latest Posts

Latest Posts

-

Ensure You Record Data About Your Communication Devices

Mar 26, 2025

-

This Indicates The Antilock Braking System Is Functioning

Mar 26, 2025

-

Correctly Label The Features Of The Larynx

Mar 26, 2025

-

You May Have Found Your Purpose If

Mar 26, 2025

-

Insert A Built In Bibliography Without A Preformatted Heading

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about Requires An Organization To Be A Separate Economic Unit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.