The Discount On Bonds Payable Account Is

Breaking News Today

Mar 17, 2025 · 5 min read

Table of Contents

The Discount on Bonds Payable Account: A Comprehensive Guide

The discount on bonds payable account is a crucial element in understanding corporate finance, particularly when a company issues bonds at a price below their face value. This comprehensive guide will delve into the intricacies of this account, explaining its nature, accounting treatment, amortization methods, and impact on financial statements. We'll also explore the reasons behind bond discounts and their implications for investors and the issuing company.

What is a Discount on Bonds Payable?

When a company issues bonds, they're essentially borrowing money from investors. The face value (or par value) of a bond is the amount the issuer promises to repay at maturity. However, the market price of a bond can fluctuate based on various factors, including interest rates, creditworthiness of the issuer, and market conditions.

A discount on bonds payable arises when a company issues bonds at a price less than their face value. This means the company receives less cash upfront than it will ultimately repay. The discount represents the difference between the face value and the issue price of the bond. For example, if a company issues a $1,000 bond at $950, the $50 difference is the discount.

This discount isn't a loss immediately recognized on the income statement. Instead, it's treated as a deferred charge and amortized over the life of the bond, effectively increasing the interest expense over time.

Why Do Bonds Sell at a Discount?

Several factors contribute to bonds selling at a discount:

1. Market Interest Rates:

This is the most common reason. If market interest rates rise after a company issues bonds, newly issued bonds will offer higher yields to attract investors. Existing bonds with lower coupon rates become less attractive, leading to a decrease in their market price, resulting in a discount.

2. Creditworthiness of the Issuer:

If a company's credit rating deteriorates, investors perceive a higher risk of default. To compensate for this increased risk, they demand a lower price for the bonds, creating a discount.

3. Bond Features:

Certain bond features, such as call provisions (allowing the issuer to redeem the bond before maturity) or convertibility (allowing the bondholder to convert the bond into equity), can impact the bond's price. Less favorable features might lead to a discount.

4. Market Conditions:

General economic conditions and investor sentiment can influence bond prices. During periods of economic uncertainty, investors may demand lower prices for bonds, creating discounts.

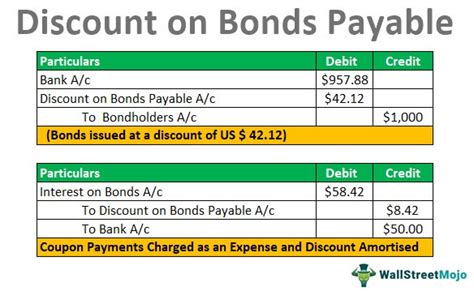

Accounting for Discount on Bonds Payable

The discount on bonds payable is a contra-liability account. This means it's deducted from the bonds payable account on the balance sheet, reducing the total liabilities reported. The initial entry upon issuance involves debiting cash for the proceeds received, debiting the discount on bonds payable account, and crediting bonds payable for the face value.

Example:

A company issues $1,000,000 face value bonds at 98. The discount is 2% ($1,000,000 x 0.02 = $20,000). The journal entry would be:

- Debit Cash: $980,000

- Debit Discount on Bonds Payable: $20,000

- Credit Bonds Payable: $1,000,000

Amortization of Discount on Bonds Payable

The discount is not recognized as an expense immediately. Instead, it's systematically amortized over the bond's life, increasing the interest expense reported each period. There are two primary methods for amortizing the discount:

1. Straight-Line Amortization:

This method is simpler and allocates an equal amount of the discount to interest expense each period. The annual amortization amount is calculated by dividing the total discount by the number of years until maturity.

Example:

Using the previous example, if the bonds have a 10-year maturity, the annual amortization would be $20,000 / 10 = $2,000. Each year, the company would record an additional $2,000 as interest expense beyond the coupon payment.

2. Effective Interest Method:

This method is more complex but provides a more accurate representation of the interest expense over time. It calculates interest expense based on the carrying value of the bonds (face value less unamortized discount) and the effective interest rate. The effective interest rate is the market rate at the time of issuance. The difference between the calculated interest expense and the cash coupon payment represents the amortization of the discount.

Example:

Let's assume an effective interest rate of 6%. In the first year, the interest expense would be calculated as $980,000 (carrying value) x 0.06 = $58,800. If the annual coupon payment is $60,000, the amortization of the discount for the first year would be $60,000 - $58,800 = $1,200.

Impact on Financial Statements

The discount on bonds payable affects the balance sheet and income statement.

-

Balance Sheet: The discount reduces the carrying value of the bonds payable, resulting in a lower reported liability. As the discount is amortized, the carrying value increases until it reaches the face value at maturity.

-

Income Statement: The amortization of the discount increases the interest expense, thus reducing net income.

Disclosure Requirements

Generally accepted accounting principles (GAAP) require companies to disclose details about their bonds payable, including the face value, carrying value, and the discount or premium. This information is typically found in the notes to the financial statements.

Impact on Investors

Investors need to understand the implications of bond discounts. While a bond purchased at a discount offers a higher yield to maturity than its coupon rate, it also carries inherent risks associated with the reasons the bond is selling at a discount, such as the issuer's creditworthiness.

Conclusion

The discount on bonds payable is a complex but vital aspect of corporate finance. Understanding its nature, accounting treatment, and impact on financial statements is crucial for both companies issuing bonds and investors analyzing their investments. Accurate accounting and reporting are essential for transparency and a true reflection of a company's financial position. Choosing between straight-line and effective interest amortization methods depends on factors like the complexity desired and the materiality of the difference in results. By understanding these nuances, stakeholders can make informed decisions. The insights provided in this comprehensive guide should aid in a deeper understanding of this financial instrument. Remember to always consult with financial professionals for personalized advice tailored to your specific circumstances.

Latest Posts

Latest Posts

-

The Emancipation Proclamation Of January 1 1863 Quizlet

Mar 18, 2025

-

These Cards Will Get You Drunk Quizlet

Mar 18, 2025

-

Did Quizlet Get Rid Of Q Chat

Mar 18, 2025

-

Myasthenia Gravis Is An Autoimmune Disease In Which Quizlet

Mar 18, 2025

-

Fun Sex Questions For Couples Quizlet With Answers

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about The Discount On Bonds Payable Account Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.