The Entry To Establish A Petty Cash Fund Includes

Breaking News Today

Mar 28, 2025 · 7 min read

Table of Contents

The Entries to Establish a Petty Cash Fund: A Comprehensive Guide

Establishing a petty cash fund is a common practice for businesses of all sizes. It provides a readily available source of cash for small, everyday expenses that are not practical to process through regular accounting procedures. However, accurately recording the establishment and subsequent transactions of a petty cash fund is crucial for maintaining accurate financial records. This article will delve deep into the accounting entries required to establish a petty cash fund, explain the importance of proper documentation, and offer practical advice for managing this essential aspect of business finance.

Understanding Petty Cash Funds

A petty cash fund is a small amount of cash kept on hand to cover minor expenses. These expenses can include things like postage, office supplies, minor repairs, or employee reimbursements for small purchases. The fund's size depends on the business's needs, but it's typically a relatively small amount, ranging from a few hundred to a few thousand dollars. The key is that these expenditures are too small to justify the time and administrative costs of processing them through regular purchasing and payment procedures.

Why use a petty cash fund?

- Convenience: Facilitates quick payments for small, unexpected expenses without delaying operations.

- Efficiency: Avoids the administrative burden of processing numerous small transactions through accounts payable.

- Control: Provides a level of control over small expenditures, preventing fraud and misuse of company funds.

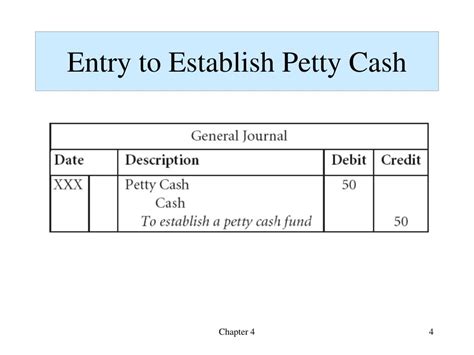

Establishing the Petty Cash Fund: The Initial Journal Entry

The initial establishment of a petty cash fund requires a journal entry to reflect the transfer of funds from the main checking account to the petty cash account. This is a crucial step that lays the foundation for accurate tracking and management of the fund.

The journal entry will debit the "Petty Cash" account and credit the "Cash" account. The debit increases the petty cash account, showing the fund's establishment, while the credit decreases the cash account, reflecting the withdrawal of funds from the main account.

Example:

Let's say a business decides to establish a petty cash fund of $200. The journal entry would be as follows:

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| October 26 | Petty Cash | $200 | |

| Cash | $200 | ||

| To establish petty cash fund |

This entry clearly shows the movement of $200 from the company's general cash account to the newly established petty cash fund. The description "To establish petty cash fund" provides essential context for the transaction.

The Petty Cash Custodian: Responsibilities and Importance

A designated custodian is responsible for managing the petty cash fund. This individual is entrusted with the physical cash and is responsible for maintaining accurate records of all transactions. Choosing a responsible and trustworthy employee for this role is critical.

Responsibilities of the Petty Cash Custodian:

- Disbursing funds: Paying for approved small expenses.

- Maintaining accurate records: Keeping detailed receipts for every expenditure.

- Reconciling the fund: Regularly comparing the cash on hand with the recorded expenditures.

- Requesting reimbursement: Submitting a report to the accounting department when the fund needs replenishment.

Replenishing the Petty Cash Fund: The Subsequent Journal Entries

As the petty cash custodian makes payments, the cash on hand in the fund will decrease. When the fund reaches a pre-determined low level, it needs to be replenished. This involves documenting all expenditures, collecting receipts, and making a journal entry to restore the fund to its initial level.

The replenishment process involves several steps:

- Counting the cash: The custodian counts the remaining cash in the petty cash box.

- Gathering receipts: All receipts for expenses paid from the fund are collected and organized.

- Calculating the reimbursement: The difference between the initial fund balance and the remaining cash, plus the total amount of receipts, represents the amount needed to replenish the fund.

Example:

Let's assume the initial petty cash fund was $200. After several expenses, $80 remains in the fund. Receipts totaling $120 document these expenses (e.g., $50 for office supplies, $30 for postage, $40 for miscellaneous expenses). To replenish the fund, the following journal entry would be made:

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| October 31 | Office Supplies | $50 | |

| Postage | $30 | ||

| Miscellaneous Expenses | $40 | ||

| Cash | $120 | ||

| Petty Cash | $120 | ||

| To replenish petty cash fund |

This entry debits the various expense accounts reflecting the specific nature of the expenditures and credits the "Cash" account for the amount reimbursed. The "Petty Cash" account is not directly affected during the replenishment since the overall balance remains at $200. Notice that the sum of debits equals the sum of credits, maintaining the accounting equation's balance.

Increasing or Decreasing the Petty Cash Fund

The initial fund amount might need adjustment based on business needs. Increasing the fund involves a similar journal entry as the initial establishment. Decreasing the fund requires a journal entry debiting the "Cash" account and crediting the "Petty Cash" account for the amount of the reduction.

Example (Increasing the fund):

Let's say the business decides to increase the petty cash fund from $200 to $300. The journal entry would be:

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| November 15 | Petty Cash | $100 | |

| Cash | $100 | ||

| To increase petty cash fund |

Example (Decreasing the fund):

If the business decides to reduce the fund from $200 to $150, the entry would be:

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| November 30 | Cash | $50 | |

| Petty Cash | $50 | ||

| To decrease petty cash fund |

Importance of Proper Documentation

Meticulous record-keeping is paramount when managing a petty cash fund. This involves:

- Detailed receipts: Every expenditure must be supported by a receipt that clearly indicates the date, vendor, amount, and purpose of the purchase.

- Petty Cash Voucher: A formal document used to record and authorize each petty cash disbursement.

- Petty Cash Register: A ledger or spreadsheet to track all transactions, including the date, description, amount, and receipt number.

- Regular Reconciliation: The custodian should regularly reconcile the fund by comparing the cash on hand with the total expenses documented in the register. Any discrepancies need immediate investigation.

Preventing Fraud and Misuse

Implementing strong internal controls is essential to prevent fraud and misuse of the petty cash fund. This involves:

- Clear authorization procedures: Establish clear guidelines for authorized expenditures and require approval for all disbursements.

- Regular audits: Periodic audits of the petty cash fund should be conducted by someone independent of the custodian.

- Segregation of duties: The person responsible for managing the petty cash should not be the same person responsible for recording the transactions in the accounting system.

- Surprise cash counts: Unannounced counts of the petty cash can deter potential fraud.

Using Technology for Petty Cash Management

Modern technology offers tools to streamline petty cash management. Software solutions and mobile apps can automate tasks like tracking expenses, generating reports, and facilitating reimbursements, increasing efficiency and minimizing errors.

Conclusion

Establishing and managing a petty cash fund is a fundamental aspect of business finance. While seemingly simple, accurate accounting entries, robust documentation, and strong internal controls are vital for maintaining financial integrity and preventing irregularities. By adhering to the guidelines outlined in this article, businesses can ensure the efficient and secure management of their petty cash funds. Remember that consistency, accuracy, and attention to detail are key to successful petty cash management. Regular reviews of your procedures will help to adapt your system to your business’s evolving needs.

Latest Posts

Latest Posts

-

Defining Research With Human Subjects Sbe Quizlet

Mar 31, 2025

-

Hesi A2 Anatomy And Physiology Quizlet 2023

Mar 31, 2025

-

A Disorder Caused By Hyperthyroidism Is Quizlet

Mar 31, 2025

-

An Example Of An Automatic Stabilizer Is Quizlet

Mar 31, 2025

-

Budgeting For Life After High School Worksheet Answers Quizlet

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about The Entry To Establish A Petty Cash Fund Includes . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.