The Fed May Respond To A Recession By

Breaking News Today

Mar 15, 2025 · 6 min read

Table of Contents

The Fed May Respond to a Recession By… A Deep Dive into Monetary Policy Tools

The Federal Reserve (Fed), the central bank of the United States, plays a crucial role in maintaining economic stability. A significant part of this role involves responding to economic downturns, or recessions. When the economy falters, the Fed deploys various monetary policy tools to stimulate growth and mitigate the severity of the recession. Understanding these tools and their potential impacts is crucial for anyone following economic trends. This article delves into the various ways the Fed might respond to a recession, analyzing their effectiveness, potential drawbacks, and the complexities of navigating a delicate economic landscape.

Understanding the Fed's Mandate: Price Stability and Maximum Employment

Before exploring the Fed's recessionary responses, it's vital to understand its dual mandate: price stability and maximum employment. The Fed aims to maintain a healthy balance between these two objectives. High inflation erodes purchasing power, while high unemployment signifies economic hardship. The Fed constantly walks a tightrope, aiming for a sustainable economic environment that minimizes both inflation and unemployment. A recession typically presents a challenge to this balance, often characterized by rising unemployment and potentially falling (or at least stagnating) inflation.

The Fed's Arsenal: Tools to Combat Recession

The Fed's toolkit for combating recessions primarily involves manipulating interest rates and influencing the money supply. Let's examine each tool in detail:

1. Federal Funds Rate Targeting: The Primary Weapon

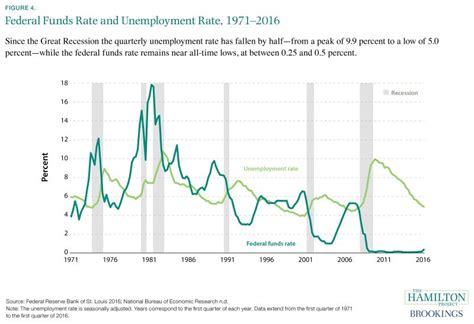

The most widely known tool is the federal funds rate. This is the target rate that the Fed wants banks to charge each other for overnight lending of reserves. Lowering the federal funds rate makes borrowing cheaper for banks, encouraging them to lend more to businesses and consumers. This increased lending fuels economic activity, potentially stimulating investment and consumption. During a recession, the Fed typically aggressively lowers the federal funds rate, sometimes even approaching zero (a policy known as zero lower bound).

How it affects the economy: A lower federal funds rate translates to lower interest rates across the board – mortgages, auto loans, business loans, etc. This stimulates borrowing and spending, boosting aggregate demand.

Potential Drawbacks: Lowering interest rates too much or for too long can lead to inflation. If businesses and consumers become overly reliant on cheap credit, it can lead to unsustainable levels of debt, eventually increasing financial instability.

2. Quantitative Easing (QE): Unconventional Measures

When interest rates are already near zero, the Fed may resort to quantitative easing (QE). This involves the Fed purchasing long-term government bonds and other securities from the market. This injects liquidity into the financial system, lowering long-term interest rates and encouraging lending and investment. QE is considered an unconventional monetary policy tool, employed during times of severe economic stress.

How it affects the economy: QE increases the money supply, directly impacting longer-term interest rates and boosting asset prices (like stocks and bonds). This can improve investor sentiment and encourage investment.

Potential Drawbacks: QE can lead to inflation if the money injected into the economy doesn't translate into increased production. It can also create asset bubbles, potentially leading to future financial instability. Furthermore, the effectiveness of QE is debated, with some arguing that its impact is less potent than other policies.

3. Forward Guidance: Managing Expectations

Forward guidance involves the Fed communicating its intentions regarding future monetary policy. By clearly outlining its plans, the Fed attempts to manage market expectations and influence borrowing and investment decisions. During a recession, the Fed might signal its commitment to keeping interest rates low for an extended period, boosting confidence and encouraging lending.

How it affects the economy: Clear communication reduces uncertainty, allowing businesses and consumers to make informed decisions based on the expected future policy environment. This can stabilize the economy and promote investment.

Potential Drawbacks: If the Fed's forecasts are inaccurate, forward guidance can backfire, leading to market volatility. The effectiveness of forward guidance also depends on the credibility of the Fed.

4. Reserve Requirements: A Less Frequently Used Tool

The Fed can also adjust the reserve requirements for banks. This refers to the percentage of deposits that banks are required to hold in reserve. Lowering the reserve requirement increases the amount of money banks can lend, boosting credit availability. However, this tool is used less frequently than interest rate targeting because it has a more significant and direct impact on the money supply.

How it affects the economy: Reducing reserve requirements directly increases the money supply available for lending, potentially boosting economic activity.

Potential Drawbacks: A significant reduction in reserve requirements can increase the risk of financial instability if banks become overly leveraged.

5. Discount Rate Adjustments: Lending to Banks Directly

The discount rate is the interest rate at which commercial banks can borrow money directly from the Federal Reserve. Lowering the discount rate can encourage banks to borrow more, increasing the money supply. However, this is less frequently utilized than the federal funds rate.

How it affects the economy: A lower discount rate incentivizes banks to borrow more, increasing their lending capacity and potentially stimulating economic activity.

Potential Drawbacks: Similar to other interest rate adjustments, there is a risk of creating inflationary pressures if borrowing is excessive.

The Complexity of Recessionary Responses: Balancing Act

Responding to a recession is a complex balancing act. The Fed needs to consider multiple factors, including the severity of the recession, the strength of inflation, and the potential for future economic growth. There's no one-size-fits-all solution, and the optimal response often depends on the specific circumstances.

The Fed's actions can have both intended and unintended consequences. While lowering interest rates can stimulate economic growth, it can also lead to inflation if not managed carefully. QE can boost asset prices, but it can also create bubbles and exacerbate existing inequalities.

The Role of Fiscal Policy: A Complementary Approach

It's crucial to remember that monetary policy isn't the sole tool used to combat recessions. Fiscal policy, implemented by the government through taxation and spending, plays a complementary role. Fiscal stimulus, such as increased government spending or tax cuts, can boost aggregate demand and support economic recovery. The effectiveness of monetary and fiscal policies often depends on their coordination. A well-coordinated approach, where monetary and fiscal policies work together, can lead to a more effective response to a recession.

Conclusion: Navigating Uncertain Economic Waters

The Fed's response to a recession is a dynamic and multifaceted process. The tools at its disposal are powerful but require careful management to avoid unintended consequences. The optimal response depends on the specific characteristics of the recession and the broader economic landscape. Understanding the Fed's mandate, its arsenal of tools, and the interplay between monetary and fiscal policies is crucial for anyone seeking to grasp the complexities of macroeconomic management and the challenges of navigating uncertain economic waters. The ongoing evolution of the global economy and financial markets will inevitably necessitate further adaptations and innovations in monetary policy strategies, requiring constant vigilance and responsiveness from the Federal Reserve.

Latest Posts

Latest Posts

-

Label The Veins Of The Upper Limb

Mar 15, 2025

-

Is A Long Standing Connection Or Bond With Others

Mar 15, 2025

-

What Does Gtd 4pm Stand For In Hotels

Mar 15, 2025

-

Place The Following Events In Chronological Order

Mar 15, 2025

-

Topic 6 8 Immigration And Migration In The Gilded Age

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about The Fed May Respond To A Recession By . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.