The Financial Responsibility Law Requires You To Have

Breaking News Today

Mar 25, 2025 · 6 min read

Table of Contents

The Financial Responsibility Law: What You Need to Know

Financial responsibility laws are a cornerstone of safe and fair driving. These laws vary by state, but the core principle remains the same: drivers must demonstrate the ability to cover the costs associated with accidents they cause. This isn't just about having insurance; it's about proving you can handle the financial burden of potential damages, injuries, and legal fees. Understanding these laws is crucial for every driver, as non-compliance can lead to significant penalties and restrictions.

What Does Financial Responsibility Law Require?

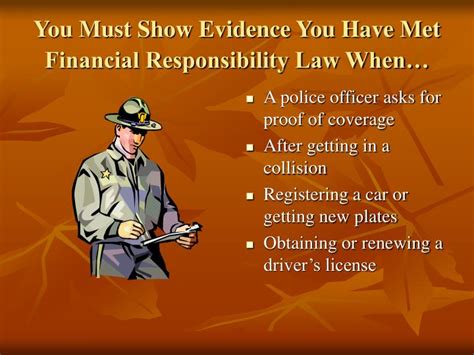

At its heart, financial responsibility law mandates that drivers prove they have the resources to compensate others for damages resulting from accidents they cause. The exact requirements differ depending on your state, but common methods of demonstrating financial responsibility include:

1. Motor Vehicle Insurance:

This is the most common way to meet financial responsibility requirements. Car insurance policies typically include liability coverage, which pays for the other driver's injuries and property damage if you're at fault in an accident. The minimum liability coverage varies by state; some states have higher minimums than others, reflecting the higher costs of living and healthcare in those areas. It's crucial to understand your state's minimum requirements and consider purchasing higher coverage limits for added protection. Uninsured/underinsured motorist coverage is also highly recommended, protecting you in case you're hit by a driver without insurance or with insufficient coverage.

2. Surety Bond:

A surety bond is a financial guarantee issued by an insurance company or bonding agency. It acts as a promise to pay damages up to a specific amount if you're involved in an at-fault accident. Essentially, it's a form of insurance, but it's handled through a bonding agency rather than a traditional insurance company. The cost of a surety bond is usually higher than the cost of comparable insurance coverage.

3. Cash Deposit:

Some states allow drivers to meet financial responsibility requirements by depositing a substantial sum of money with the state's Department of Motor Vehicles (DMV). This deposit acts as a guarantee that you can pay for damages arising from an accident. The amount required is usually quite high, making this option less attractive for most drivers. The deposited funds remain untouched unless you are involved in a collision where you are at fault and are ordered by the court to pay damages.

4. Certificate of Self-Insurance:

This option is generally available only to large corporations or individuals with significant assets. It involves proving to the state that you possess sufficient assets to cover potential damages without needing insurance or a bond. This involves a rigorous financial audit and is a very complex procedure. This option is generally not pursued by individuals.

Penalties for Non-Compliance

Failing to meet your state's financial responsibility requirements can result in serious consequences. These penalties can include:

- Suspension or revocation of your driver's license: This is a common penalty, preventing you from driving legally until you meet the requirements.

- Vehicle registration suspension: Your vehicle's registration may be suspended, preventing you from driving it legally.

- Fines and court costs: You may face substantial fines and court costs for violating the law.

- Difficulty obtaining insurance in the future: A history of non-compliance can make it challenging to obtain affordable insurance coverage in the future. Insurers view this as a high-risk factor, leading to higher premiums or outright refusal of coverage.

- Jail time: In some cases, particularly if non-compliance leads to an accident resulting in significant harm, you may even face jail time.

SR-22 Insurance: A Special Case

In many states, drivers who have been convicted of serious driving offenses, such as driving under the influence (DUI) or driving with a suspended license, are required to obtain an SR-22 certificate. This isn't a separate type of insurance, but rather a certificate that confirms you have the minimum required liability insurance coverage. Your insurance company files this certificate with your state's DMV. This certificate demonstrates to the state that you are maintaining the necessary insurance coverage. The SR-22 requirement typically lasts for a set period, usually three to five years. Maintaining SR-22 insurance is crucial; if it lapses, your license will be suspended immediately.

Understanding Your State's Specific Requirements

The details of financial responsibility laws vary significantly from state to state. It's essential to check your state's DMV website for precise information on the minimum liability coverage limits, acceptable methods of proving financial responsibility, and penalties for non-compliance. The requirements are clearly outlined on the official website and any ambiguity should be clarified with local authorities. Don't rely on generalizations; always consult official sources to ensure you are fully compliant with the law.

Beyond the Minimum: Protecting Yourself and Others

While meeting the minimum requirements is essential to avoid legal penalties, it's wise to consider purchasing higher liability coverage limits than the state mandates. This provides a much greater safety net if you're involved in a serious accident, protecting you from potentially devastating financial losses. Higher limits give you added protection against significant medical bills, property damage, and legal fees that could arise from an accident.

Consider the following when deciding on your insurance coverage:

- Your assets: If you have significant assets (home, investments, savings), consider higher liability coverage to protect these assets from potential lawsuits.

- Your driving record: A poor driving record might increase the likelihood of accidents and make higher coverage more important.

- The value of your vehicle: If you drive a high-value vehicle, it's crucial to have adequate coverage to handle potential damages or repairs.

- The cost of living in your area: Higher costs of medical care and property repair in some states suggest the need for higher coverage amounts.

Proactive Steps for Financial Responsibility Compliance

To ensure you are always compliant with financial responsibility laws:

- Maintain adequate insurance coverage: Regularly review your policy to confirm it meets your state's minimum requirements and your personal needs. Inform your insurer immediately of any changes in your circumstances that might affect your coverage.

- Pay your premiums on time: Failing to pay premiums will result in policy cancellation and subsequent non-compliance. Set up automatic payments or reminders to ensure timely payments.

- Keep records: Maintain records of your insurance policy, payment confirmations, and any other documentation related to your financial responsibility compliance.

- Check your state's DMV website: Periodically check your state's DMV website to ensure you are still compliant with the current regulations. Laws and requirements can change.

- Consult with an insurance professional: If you have any questions or concerns about financial responsibility laws or your insurance coverage, consult with an independent insurance professional. They can provide tailored advice based on your specific situation.

Conclusion: Responsibility on the Road

Financial responsibility laws aren't designed to punish drivers; they are in place to ensure that those who cause accidents are held accountable for the damages they inflict. By understanding these laws and taking proactive steps to meet your obligations, you protect yourself, other drivers, and the broader community. Remember that compliance is not just about avoiding penalties; it's about demonstrating responsible behavior on the road and contributing to a safer driving environment for everyone. Always prioritize safe driving practices, regularly review your insurance coverage, and stay informed about the financial responsibility laws in your state. This proactive approach is crucial for protecting both yourself and others while ensuring compliance with the law.

Latest Posts

Latest Posts

-

The Intent Of The Monkees Television Show Was To

Mar 28, 2025

-

Using Accrual Accounting Revenue Is Recorded And Reported Only

Mar 28, 2025

-

Which Artist Utilized Benday Dots In His Artwork

Mar 28, 2025

-

A Computer Training Business Needs To Hire

Mar 28, 2025

-

When A Client Expresses Anxiety About Being Given Anesthesia

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about The Financial Responsibility Law Requires You To Have . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.