The Incontestable Clause Allows An Insurer To Quizlet

Breaking News Today

Mar 24, 2025 · 7 min read

Table of Contents

The Incontestable Clause: Protecting Insurers and Policyholders

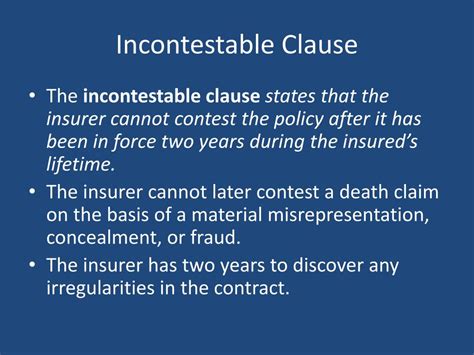

The incontestable clause is a crucial provision in life insurance policies that balances the interests of both the insurer and the insured. This clause, typically found in policies after a specific period (usually two years), limits the insurer's ability to contest the validity of the policy based on misrepresentations or omissions made by the insured during the application process. While seemingly one-sided at first glance, it serves a vital purpose in ensuring policy stability and protecting beneficiaries. This article will delve into the intricacies of the incontestable clause, exploring its benefits, limitations, exceptions, and overall significance in the life insurance landscape.

Understanding the Fundamentals of the Incontestable Clause

The core function of the incontestable clause is to create a sense of security and finality for both parties involved. After the incontestable period has passed (typically two years from the policy's issuance date), the insurer generally loses the right to contest the policy's validity due to material misrepresentations or omissions made in the application. This doesn't mean the insurer can't investigate claims or deny payouts due to issues unrelated to the application, such as a failure to meet policy conditions or evidence of fraud discovered after the incontestable period. The clause focuses specifically on inaccuracies or omissions within the initial application itself.

Key Aspects of the Incontestable Clause:

- Time Limit: The clause usually specifies a timeframe (often two years) after the policy's issuance. This period allows the insurer to thoroughly investigate the application and identify any potential inaccuracies. After this period, contesting the policy becomes significantly more difficult.

- Exceptions: There are some notable exceptions to the incontestable clause. These often include instances of fraud, intentional misrepresentation, or instances where the policy was procured through illegal means. These exceptions safeguard the insurer against deliberate deception.

- Materiality: The clause generally applies to material misrepresentations – information that significantly impacts the insurer's decision to issue the policy or the premiums charged. Minor inaccuracies are less likely to be grounds for contesting a policy, especially after the incontestable period expires.

- Beneficiary Protection: This clause offers significant protection to the policy beneficiary. Once the incontestable period lapses, the beneficiary's claim is more likely to be honored, reducing the risk of a dispute related to application inaccuracies.

The Benefits of the Incontestable Clause: A Balancing Act

The incontestable clause provides significant advantages for both insurers and policyholders.

Benefits for Insurers:

- Reduced Litigation: The clause limits the potential for protracted legal battles arising from disputes regarding application information. This reduces legal costs and resources spent on investigating older policies.

- Predictable Claims: By limiting the ability to contest claims after a certain period, the clause allows insurers to better predict and manage their financial obligations. This contributes to the overall financial stability of the insurance company.

- Efficient Operations: It streamlines the claims process, freeing up resources for other essential tasks like underwriting and customer service. A clearer process allows for quicker payout to beneficiaries.

Benefits for Policyholders:

- Peace of Mind: The clause offers policyholders a sense of security knowing that their policy is less likely to be challenged after the incontestable period. This is particularly important for long-term policies.

- Protection for Beneficiaries: This safeguards beneficiaries from losing out on the policy proceeds due to minor inaccuracies or honest mistakes in the application. The insured's family is better protected.

- Increased Policy Value: The stability and security offered by the incontestable clause can indirectly increase the perceived value of the policy. This can be especially significant for high-value life insurance policies.

Understanding the Limitations and Exceptions

Despite its significant benefits, the incontestable clause does have limitations and notable exceptions.

Limitations:

- Not a Guarantee of Coverage: The clause doesn't protect against all potential policy challenges. Fraud, non-payment of premiums, or violation of policy terms remain grounds for denying a claim, regardless of the incontestable period.

- Time Limit: The clause is only effective after the specified incontestable period lapses. During this period, the insurer retains the right to contest the policy's validity based on application information.

- State Variations: The specific wording and application of the incontestable clause can vary across different jurisdictions. It's essential to consult the specific policy wording and applicable state laws.

Exceptions to the Incontestable Clause:

Several exceptions commonly exist within the incontestable clause, allowing insurers to contest a policy even after the incontestable period has passed. These usually involve instances of deliberate deception or illegality.

- Fraud: If the application involves outright fraud – such as falsifying health information – the insurer can contest the policy regardless of the incontestable period. This is a crucial exception, protecting insurers from substantial financial losses due to intentional deception.

- Willful Misrepresentation: Similar to fraud, willful misrepresentation involves knowingly providing false information on the application. This differs from unintentional errors or omissions.

- Criminal Activity: Policies procured through criminal activity, such as money laundering or other illicit activities, are generally not protected by the incontestable clause.

- Material Misrepresentation (Outside the Incontestable Period): While the clause typically protects against material misrepresentations made within the application period, uncovering significant, material misrepresentations after the incontestable period that occurred outside the application period itself could still give grounds for contestation. For example, if the insured failed to disclose a pre-existing condition that significantly impacted their health and was only discovered by the insurance company after the incontestable period.

Navigating the Incontestable Clause: Practical Considerations

When dealing with life insurance policies, understanding the incontestable clause is paramount for both insurers and policyholders.

For Insurers:

- Thorough Underwriting: While the incontestable clause provides a degree of protection, insurers must still conduct thorough underwriting to minimize the risk of issuing policies based on inaccurate information. Diligent review of applications and verification processes remain critical.

- Clear Policy Wording: Insurers should use clear and unambiguous language in their policies to define the incontestable clause and its limitations. Clarity helps prevent future disputes and ensures compliance with legal requirements.

- Compliance with State Laws: Insurers need to stay informed about the specific regulations governing the incontestable clause in each jurisdiction where they operate.

For Policyholders:

- Accurate Application: Policyholders should complete their insurance applications accurately and honestly. Providing false information can invalidate the policy and potentially deny benefits to their beneficiaries.

- Understand the Clause: Policyholders should review their policy documents carefully and understand the terms of the incontestable clause, including the time limit and exceptions. If there are any questions or uncertainties, it's best to seek clarification from the insurer or a legal professional.

- Maintain Records: It's advisable for policyholders to retain copies of their application and policy documents. This ensures they have the necessary information to defend their claim if a dispute arises.

The Incontestable Clause and its Impact on the Insurance Industry

The incontestable clause has a profound impact on the life insurance industry, contributing to its stability and the trust placed in it. It provides a framework for balancing the interests of insurers and policyholders. This balance ensures that insurance continues to be a reliable mechanism for financial security and risk management. The clause, in essence, prevents insurers from unfairly denying claims based on minor or outdated information, while still protecting them against outright fraud. This carefully balanced approach ensures a sustainable and functional life insurance market.

In conclusion, the incontestable clause, while seemingly technical, plays a critical role in the functioning and reliability of the life insurance industry. Understanding its principles and limitations is vital for all stakeholders – from insurers ensuring efficient processes, to policyholders securing their family's future. Its careful balance safeguards against fraud, promotes trust, and ultimately contributes to the broader financial stability of millions of families and individuals. A thorough understanding of this clause is paramount in navigating the complexities of life insurance and achieving optimal protection and peace of mind.

Latest Posts

Latest Posts

-

The Transaction History At An Electronic Goods Store

Mar 25, 2025

-

Yo Descargar Fotos Internet

Mar 25, 2025

-

Which Of The Following Can Be Controlled By Copyright

Mar 25, 2025

-

An Organism That Is Eaten By Another Organism

Mar 25, 2025

-

Managers Who Redo Budgets Rethink Processes Or Revise Policies Are

Mar 25, 2025

Related Post

Thank you for visiting our website which covers about The Incontestable Clause Allows An Insurer To Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.