The Manufacturing Overhead Account Is Debited When

Breaking News Today

Mar 19, 2025 · 6 min read

Table of Contents

The Manufacturing Overhead Account is Debited When: A Comprehensive Guide

The manufacturing overhead account is a crucial element in cost accounting, particularly within the context of a manufacturing business. Understanding when and why this account is debited is fundamental to accurately tracking and managing production costs. This comprehensive guide delves into the intricacies of the manufacturing overhead account, explaining the various scenarios that lead to debit entries and providing practical examples to solidify your understanding.

Understanding Manufacturing Overhead

Before we dive into the debit entries, let's establish a clear understanding of what manufacturing overhead encompasses. Manufacturing overhead, also known as factory overhead or indirect costs, represents all costs incurred in the production process except for direct materials and direct labor. These indirect costs are difficult to trace directly to specific products but are nonetheless essential for the manufacturing process.

Key Components of Manufacturing Overhead

Several cost categories fall under the umbrella of manufacturing overhead. These include:

-

Indirect Materials: These are materials used in production but are not directly incorporated into the finished product. Examples include lubricants, cleaning supplies, and small tools.

-

Indirect Labor: This comprises wages paid to factory workers who do not directly work on the product. Examples include supervisors, maintenance personnel, and quality control inspectors.

-

Factory Rent and Utilities: Costs associated with the factory building, including rent, electricity, water, and gas.

-

Factory Insurance: Insurance premiums covering the factory building and equipment.

-

Depreciation on Factory Equipment: The allocation of the cost of factory equipment over its useful life.

-

Factory Supplies: Items used in the factory but not directly part of the product, such as stationery and cleaning supplies.

-

Factory Maintenance: Costs associated with maintaining and repairing factory equipment.

When the Manufacturing Overhead Account is Debited

The manufacturing overhead account is debited when costs are incurred that relate to the indirect aspects of production. This means that any expense incurred that fits the definition of manufacturing overhead will result in a debit to the manufacturing overhead account. This increases the balance of the account.

Common Scenarios Leading to Debit Entries

Let's explore the most frequent situations leading to a debit in the manufacturing overhead account:

1. Incurrence of Indirect Material Costs: Whenever indirect materials are used in the production process, the cost is debited to the manufacturing overhead account.

- Example: $500 worth of lubricants used in the machinery during the month would be debited to the manufacturing overhead account.

2. Payment of Indirect Labor Costs: The wages paid to indirect labor employees are debited to the manufacturing overhead account.

- Example: Salaries totaling $10,000 paid to factory supervisors during the month are debited to the manufacturing overhead account.

3. Payment of Factory Rent, Utilities, and Insurance: These costs are directly debited to the manufacturing overhead account as they are incurred.

- Example: A monthly rent payment of $3,000 for the factory building is debited to the manufacturing overhead account. Similarly, the monthly electricity bill of $1,500 and the factory insurance premium of $800 are also debited to this account.

4. Recording Depreciation on Factory Equipment: Depreciation expense related to factory equipment is debited to the manufacturing overhead account. This reflects the allocation of the equipment's cost over its useful life.

- Example: The monthly depreciation expense on factory machinery is calculated as $2,000. This amount is debited to the manufacturing overhead account.

5. Recording Factory Maintenance and Repair Costs: Expenses incurred for maintaining and repairing factory equipment are debited to the manufacturing overhead account.

- Example: A repair bill of $750 for a broken machine in the factory is debited to the manufacturing overhead account.

6. Recording Factory Supplies Used: The cost of factory supplies consumed during the production process is debited to the manufacturing overhead account.

- Example: $200 worth of cleaning supplies used in the factory is debited to the manufacturing overhead account.

7. Other Indirect Costs: Numerous other costs may be classified as manufacturing overhead and debited to the account, including:

- Property taxes on the factory building

- Factory security costs

- Costs of factory supervision

- Spoilage and waste (if not directly traceable)

- Small tools used in production

The Importance of Accurate Manufacturing Overhead Accounting

Accurate tracking of manufacturing overhead is paramount for several reasons:

-

Costing of Products: Accurate overhead allocation is crucial for determining the true cost of producing each product. This allows for better pricing decisions and profitability analysis. Incorrect overhead costing can lead to inaccurate pricing and ultimately impact the company's profitability.

-

Inventory Valuation: Manufacturing overhead is a significant component of the cost of goods sold and the value of finished goods inventory. Errors in overhead accounting can distort the financial statements.

-

Performance Evaluation: Monitoring manufacturing overhead costs helps management identify areas for cost reduction and improve operational efficiency. Accurate data is essential for making informed decisions about resource allocation and process improvements.

-

Decision-Making: Accurate manufacturing overhead data plays a vital role in informed decision-making, such as deciding whether to invest in new equipment, outsourcing production, or changing production methods.

Allocating Manufacturing Overhead

After accumulating all manufacturing overhead costs, the next crucial step is to allocate these costs to individual products or jobs. This allocation is essential for accurate cost accounting. Several methods exist for allocating overhead costs, including:

-

Predetermined Overhead Rate: This method involves estimating the total manufacturing overhead costs for a period (e.g., a year) and dividing it by an estimated activity base (e.g., machine hours or direct labor hours). This results in a predetermined overhead rate, which is then applied to individual products or jobs.

-

Activity-Based Costing (ABC): ABC assigns overhead costs to products based on the activities that consume those costs. It’s a more refined method than using a single overhead rate, as it takes into account various cost drivers specific to each activity.

-

Plantwide Overhead Rate: This simpler method uses a single predetermined overhead rate for the entire factory. It's less accurate than other methods but is easier to implement.

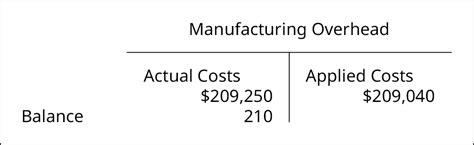

The Credit Side of the Manufacturing Overhead Account

While this article focuses primarily on debit entries, it is important to remember that the manufacturing overhead account also has a credit side. The manufacturing overhead account is credited when overhead costs are applied to products. This usually happens at the end of the accounting period using the predetermined overhead rate. Any difference between the actual overhead costs (debits) and the applied overhead costs (credits) results in an over- or under-applied overhead balance. This difference is usually adjusted at the end of the accounting period.

Conclusion

Understanding when the manufacturing overhead account is debited is crucial for accurate cost accounting in a manufacturing environment. By meticulously tracking all indirect costs, businesses can gain valuable insights into their production processes, make informed decisions, and ensure the accurate valuation of inventory and cost of goods sold. The accuracy of this accounting directly impacts the reliability of financial statements and the effectiveness of management decision-making. Remember to choose an appropriate overhead allocation method that aligns with the complexity of your production process and the desired level of accuracy. Consult with a qualified accountant if you have any questions or uncertainties regarding the proper accounting treatment of manufacturing overhead.

Latest Posts

Latest Posts

-

What Is The Central Idea Of This Excerpt

Mar 19, 2025

-

Colorless Liquid Hydrocarbon Of The Alkane Series

Mar 19, 2025

-

What Types Of Mollusks Have A Closed Circulatory System

Mar 19, 2025

-

Why Are Deserts Often Found Near Mountain Ranges

Mar 19, 2025

-

List Four Common Characteristics Of All Animals

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Manufacturing Overhead Account Is Debited When . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.