The Overhead Variance Is The Difference Between:

Breaking News Today

Mar 17, 2025 · 5 min read

Table of Contents

The Overhead Variance: Unveiling the Difference Between Budgeted and Actual Overhead Costs

Understanding overhead variances is crucial for effective cost management and profitability analysis in any business. This comprehensive guide delves into the intricacies of overhead variances, exploring their different types, causes, and the significance of analyzing them for improved operational efficiency. We will dissect the core concept: the overhead variance is the difference between the budgeted overhead costs and the actual overhead costs incurred during a specific period. Let's break down this fundamental concept and its practical applications.

What is Overhead?

Before diving into variances, let's establish a clear understanding of overhead costs. Overhead, also known as indirect costs, represents expenses that aren't directly tied to producing a specific product or service. Instead, they support the overall operation of the business. Examples include:

- Factory Rent: The cost of leasing or owning the manufacturing facility.

- Utilities: Electricity, water, and gas consumed in the production process.

- Depreciation: The allocation of the cost of assets over their useful life.

- Salaries of Support Staff: Wages paid to administrative personnel, supervisors, and maintenance staff.

- Insurance: Premiums paid for property, liability, and other types of insurance.

- Property Taxes: Taxes levied on business property.

These costs are often difficult to trace directly to individual products but are essential for the business's ongoing operation. Accurate budgeting and control of overhead costs are vital for maintaining profitability.

Types of Overhead Variances

Overhead variances are categorized into two primary types:

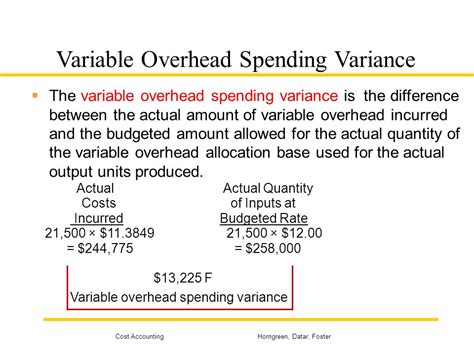

1. Budget (or Spending) Overhead Variance:

This variance measures the difference between the actual overhead costs incurred and the budgeted overhead costs for a specific period. The formula is:

Budget Overhead Variance = Actual Overhead Costs - Budgeted Overhead Costs

-

Favorable Variance: If actual overhead costs are less than budgeted overhead costs, the variance is favorable. This indicates that the business has managed its overhead expenses more efficiently than anticipated.

-

Unfavorable Variance: If actual overhead costs are more than budgeted overhead costs, the variance is unfavorable. This suggests that overhead costs have exceeded the planned amount, potentially impacting profitability.

2. Volume Overhead Variance:

This variance arises from differences between the actual level of activity and the budgeted level of activity. It reflects the impact of production volume on the application of overhead costs. There are two primary components to the volume overhead variance:

-

Fixed Overhead Volume Variance: This focuses solely on fixed overhead costs. It arises because fixed costs, by nature, remain constant regardless of production volume. If production falls below the budgeted level, a portion of the fixed overhead costs may be absorbed less effectively, resulting in an unfavorable variance. Conversely, if production surpasses the budget, the variance may be favorable.

-

Variable Overhead Volume Variance: This component deals with variable overhead costs. Variable overhead costs are directly proportional to production volume. A difference between the actual and budgeted production levels will directly impact the variable overhead costs incurred.

The calculation of the volume variance typically utilizes a predetermined overhead rate (POHR). The POHR is calculated by dividing the budgeted overhead costs by the budgeted activity level (e.g., machine hours, labor hours, units produced). The formula for the total volume variance is:

Volume Overhead Variance = (Actual Activity Level - Budgeted Activity Level) x Predetermined Overhead Rate

Analyzing and Interpreting Overhead Variances

Analyzing overhead variances isn't just about identifying favorable or unfavorable results; it's about understanding the underlying causes. This requires a detailed investigation into the contributing factors.

Investigating Budget Variances:

A significant unfavorable budget variance might stem from several sources:

- Inefficient Resource Management: Excessive waste of materials, energy, or labor.

- Higher-than-Expected Prices: Increases in the cost of utilities, supplies, or services.

- Unexpected Repairs or Maintenance: Unforeseen expenses related to equipment breakdowns.

- Ineffective Cost Control Measures: Failure to monitor and control overhead spending effectively.

To remedy unfavorable budget variances, businesses need to review their cost control processes, explore alternative suppliers, and seek ways to improve operational efficiency. Favorable variances, while positive, should also be investigated to identify areas of unexpected efficiency or possible cost-cutting opportunities.

Investigating Volume Variances:

Volume variances provide insights into the relationship between production levels and overhead costs. An unfavorable fixed overhead volume variance indicates that production levels fell short of expectations, leading to under-absorption of fixed overhead costs. This doesn't necessarily imply inefficiency but reflects the impact of lower-than-anticipated production.

Conversely, a favorable fixed overhead volume variance suggests that production exceeded expectations, leading to a higher absorption rate of fixed overhead costs.

Variable overhead volume variances should be closely aligned with production volume changes. Significant deviations indicate potential inefficiencies or unexpected changes in variable overhead costs per unit.

The Importance of Accurate Budgeting

The accuracy of overhead variance analysis hinges heavily on the accuracy of the initial budget. A poorly constructed budget will lead to misleading variance analysis. Key aspects of accurate budgeting include:

- Realistic Assumptions: Budgets should reflect realistic assumptions about production levels, resource costs, and operational efficiency.

- Detailed Cost Breakdown: A detailed breakdown of overhead costs allows for more precise variance analysis and identification of specific problem areas.

- Regular Monitoring and Review: Regular monitoring and review of budget performance ensure that variances are identified promptly and addressed effectively.

- Flexible Budgeting: Adjustments to the budget should be made based on changing circumstances to maintain its relevance.

Using Overhead Variance Analysis for Improvement

Overhead variance analysis is not just a retrospective exercise; it's a powerful tool for continuous improvement. By analyzing the causes of variances, businesses can identify areas where they can enhance their operations:

- Improved Cost Control: Implementing more stringent cost control measures to prevent future unfavorable variances.

- Enhanced Efficiency: Identifying and addressing inefficiencies in resource utilization.

- Process Optimization: Streamlining processes to reduce waste and improve productivity.

- Negotiating Better Terms: Negotiating better prices with suppliers and service providers.

- Investing in Technology: Investing in technology to automate tasks and improve efficiency.

Conclusion: Leveraging Data for Profitability

Understanding and analyzing overhead variances is a critical aspect of effective financial management. By carefully tracking actual overhead costs against budgeted amounts, and by meticulously examining the volume variances, businesses gain valuable insights into their operational efficiency and cost structure. This data-driven approach enables proactive measures to enhance profitability, control expenses, and drive continuous improvement throughout the organization. Regular review and analysis of these variances are indispensable for sustained success in today's competitive business environment. Through a robust understanding of overhead variances, companies can move from reactive problem-solving to proactive, strategic cost management.

Latest Posts

Latest Posts

-

Cdl Combination Test Questions And Answers Pdf

Mar 18, 2025

-

Life Insurance Exam Questions And Answers Pdf

Mar 18, 2025

-

The Direct Carry Is Used To Transfer A Patient

Mar 18, 2025

-

The Emancipation Proclamation Of January 1 1863 Quizlet

Mar 18, 2025

-

These Cards Will Get You Drunk Quizlet

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about The Overhead Variance Is The Difference Between: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.