The Owner Has Separated Financially And Operationally

Breaking News Today

Mar 19, 2025 · 6 min read

Table of Contents

The Owner Has Separated Financially and Operationally: Navigating the Complexities of a Divided Business

When a business owner separates financially and operationally from their company, it signals a significant restructuring. This situation, while not always negative, presents a complex web of legal, financial, and operational challenges. This comprehensive guide delves into the intricacies of this scenario, exploring its various causes, implications, and the crucial steps involved in navigating this transition successfully.

Understanding the Separation: Financial vs. Operational

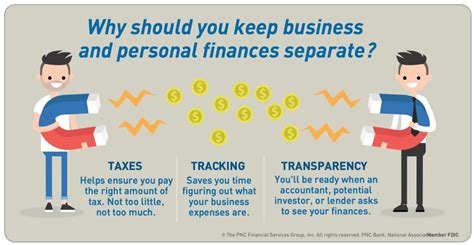

The phrase "financially and operationally separated" doesn't have a singular, universally accepted definition. It signifies a situation where the owner's personal finances are distinct from the company's finances, and their operational involvement in the day-to-day running of the business is significantly reduced or eliminated.

Financial Separation: This involves a clear demarcation between the owner's personal assets and liabilities and those of the business. This might involve:

- Formal Transfer of Ownership: The owner may sell a portion or all of their shares, transferring ownership to other investors or stakeholders.

- Debt Restructuring: The owner may restructure personal loans or debts that were previously intertwined with the business.

- Independent Financial Statements: Maintaining completely separate financial records for personal and business finances is crucial for clarity and compliance.

Operational Separation: This signifies a decreased or complete absence of the owner's direct involvement in the company's daily operations. This may include:

- Delegation of Responsibilities: The owner may appoint a CEO, manager, or other key personnel to handle day-to-day operations.

- Reduced Involvement in Decision-Making: The owner may shift to a more advisory role, focusing on strategic planning rather than operational details.

- Physical Absence from the Workplace: The owner may no longer work at the business's physical location.

Reasons for Financial and Operational Separation

Numerous reasons can lead to an owner's separation from their business, both voluntary and involuntary:

Voluntary Separations:

- Succession Planning: Owners nearing retirement or wishing to transfer ownership to the next generation may initiate this separation to ensure a smooth transition.

- Focus on New Ventures: Entrepreneurs may separate to pursue other business opportunities without jeopardizing their existing company.

- Improved Work-Life Balance: Owners seeking a healthier work-life balance may choose to step back from day-to-day operations.

- Investment Diversification: Separating financially allows for greater diversification of personal investment portfolios.

- Risk Mitigation: Separating personal assets from business liabilities protects personal wealth from business risks.

Involuntary Separations:

- Financial Distress: Significant financial problems within the business might force the owner to relinquish control or sell assets.

- Legal Disputes: Lawsuits or other legal issues may necessitate the owner's departure.

- Shareholder Conflicts: Disagreements among shareholders could lead to the owner being forced out.

- Health Issues: Illness or disability may prevent the owner from continuing their operational involvement.

Implications of the Separation

The separation of an owner, financially and operationally, carries profound implications for all stakeholders:

For the Owner:

- Loss of Control: The owner loses direct control over daily operations and decision-making.

- Reduced Income: Income may decrease if the owner is no longer actively involved in the business.

- Tax Implications: The separation may have significant tax implications, depending on the structure of the transaction.

- Emotional Impact: Letting go of a business can be emotionally challenging.

For the Business:

- Impact on Culture: A change in leadership can significantly impact company culture and employee morale.

- Operational Challenges: A lack of owner involvement could create operational inefficiencies or disruptions.

- Potential Loss of Expertise: The owner's expertise and knowledge might be lost if not properly transferred.

- Financial Instability (Potential): If the separation is due to financial issues, it could negatively impact the business's stability.

For Employees:

- Uncertainty and Anxiety: Employees may experience uncertainty about their jobs and the future of the company.

- Changes in Management Style: A new management team might implement changes that affect employee roles and responsibilities.

- Potential for Layoffs: In cases of financial distress, layoffs may occur.

For Investors:

- Changes in Return on Investment: The separation may impact the business's performance and, therefore, the investors' returns.

- Increased Risk: The absence of the owner might increase the business's risk profile.

- Changes in the Business Strategy: A new leadership team could alter the company's strategic direction.

Navigating the Separation: A Step-by-Step Guide

Successfully navigating the separation requires meticulous planning and execution. Key steps include:

1. Legal and Financial Counsel: Seek expert advice from lawyers and financial advisors specializing in business law and taxation. This ensures compliance with all relevant regulations and minimizes legal and tax risks.

2. Detailed Planning: Develop a comprehensive plan that outlines the financial and operational aspects of the separation. This plan should address all potential issues and contingencies.

3. Valuation of the Business: Accurately assessing the business's value is essential for fair and equitable transactions. Professional valuation services should be employed.

4. Transfer of Ownership (if applicable): If ownership is being transferred, legal documentation and procedures must be meticulously followed.

5. Transition of Operations: Implement a smooth transition of operational responsibilities to new management. This includes thorough training and documentation.

6. Communication with Stakeholders: Open and transparent communication with employees, investors, and other stakeholders is vital throughout the process. Addressing concerns proactively helps mitigate negative impacts.

7. Post-Separation Monitoring: After the separation, ongoing monitoring of the business's financial performance and operational efficiency is necessary. Regular review and adjustment may be needed.

8. Estate Planning (if applicable): If the separation is related to retirement or succession planning, comprehensive estate planning is essential to protect the owner's assets and ensure the continuity of the business.

Minimizing Negative Impacts

Several strategies can help minimize the negative impacts of an owner's separation:

- Phased Approach: A gradual transition of responsibilities can ease the impact on the business and employees.

- Succession Planning: Proactive succession planning reduces uncertainties and ensures a smoother transition.

- Employee Retention Strategies: Implement strategies to retain key employees during the transition period, such as offering incentives or enhanced benefits.

- Strong Communication: Maintaining open and honest communication with employees and investors can build trust and prevent speculation.

- Financial Planning: Careful financial planning before and after the separation helps protect the owner's personal finances and ensure the business's financial health.

Conclusion: A Strategic Transition

The separation of a business owner, financially and operationally, is a complex process demanding careful planning and execution. While it presents challenges, it also offers opportunities for growth, improved efficiency, and the long-term sustainability of the business. By following a structured approach and seeking expert advice, owners can navigate this transition successfully and minimize potential negative impacts on all stakeholders. Proactive planning, clear communication, and a focus on mitigating risk are key to achieving a positive outcome. Remember, professional guidance is invaluable throughout this journey. The goal should always be a strategic transition that preserves the value of the business and protects the interests of all involved parties.

Latest Posts

Latest Posts

-

The Six Pointed Star Of Life Emblem Identifies Vehicles That

Mar 19, 2025

-

Canvas Covered Head Forms Are Known As

Mar 19, 2025

-

The Sensing Portion Of A Bi Metallic Stem Thermometer Is

Mar 19, 2025

-

Compare And Contrast Relief Printing And Intaglio

Mar 19, 2025

-

Benicio Del Toro Es Un Beisbolista Puertorriqueno

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Owner Has Separated Financially And Operationally . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.