The Par Value Per Share Of Common Stock Represents The

Breaking News Today

Mar 23, 2025 · 6 min read

Table of Contents

The Par Value Per Share of Common Stock Represents the Minimum Legal Capital

The par value per share of common stock represents the minimum legal capital a company must retain for the protection of creditors. It's a nominal value assigned to each share during the incorporation process and isn't necessarily reflective of the share's market value. Understanding par value is crucial for investors, entrepreneurs, and anyone involved in corporate finance. This article delves deep into the meaning, implications, and significance of par value in the context of common stock.

What is Par Value?

Par value, also known as nominal value or face value, is the stated value of a share of stock as specified in the corporation's charter. This value is typically a very small amount (e.g., $0.01, $0.001, or even $1), and it doesn't reflect the actual market price of the stock, which fluctuates based on supply and demand. Think of it as a legal formality rather than an economic indicator.

The Legal Significance of Par Value

The primary significance of par value lies in its legal implications. It dictates the minimum amount of capital a company must maintain to protect its creditors. If a company issues shares below par value, it's considered to be issuing shares at a discount, potentially exposing the company to legal challenges. The company's assets are considered a security for creditors, and the par value serves as a safeguard against asset stripping.

Par Value vs. Market Value

It's critical to distinguish between par value and market value. Par value is a legal construct, while market value is determined by supply and demand in the open market. A company might have a par value of $0.01 per share, but its market value could be $100 per share or more, depending on investor sentiment, company performance, and industry trends. The difference between these two values is significant and shouldn't be conflated.

Why Do Companies Assign Par Value to Shares?

While seemingly arbitrary, the assignment of par value serves several important purposes:

-

Legal Compliance: It fulfills legal requirements for incorporation and ensures compliance with corporate laws. Different jurisdictions have varying regulations regarding par value.

-

Creditor Protection: As previously mentioned, it establishes a minimum capital base that protects creditors in case of insolvency. This minimum capital acts as a buffer against potential losses.

-

Accounting Simplicity (Historically): In the past, par value simplified accounting processes, particularly when it came to recording share capital. Modern accounting practices, however, rely less on par value for this purpose.

-

Shareholder Equity Calculation (Historically): Par value, along with additional paid-in capital, was used in calculating the total shareholder equity on the balance sheet. While still relevant, other factors and accounting standards play a larger role.

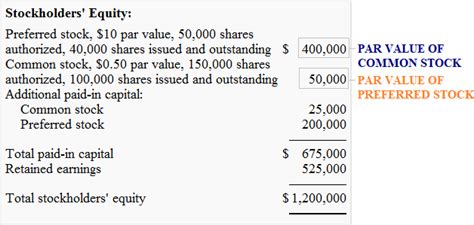

Par Value and Different Classes of Stock

Companies may issue different classes of stock, each with its own par value. For instance, a company might have common stock with a par value of $0.01 and preferred stock with a par value of $1.00. The par value is often different to reflect the different rights and privileges associated with each class of stock. Preferred stockholders, for example, usually have preferential rights to dividends and asset distribution in case of liquidation. The par value for preferred stock will usually reflect this higher priority.

No-Par Value Stock

Many modern companies choose to issue no-par value stock. This means no nominal value is assigned to the shares. While it eliminates the complexities associated with par value, it doesn't completely eliminate the need for minimum capital requirements. Instead, the state will usually impose a minimum stated capital requirement. This approach offers greater flexibility in setting share prices and avoids potential legal issues related to issuing shares below par.

Implications of Par Value for Investors

For investors, understanding par value is less crucial than understanding market value and the company's financial health. Par value doesn't provide any direct indication of a stock's investment potential. Instead, investors should focus on factors such as:

- Earnings per share (EPS): A key indicator of profitability.

- Price-to-earnings ratio (P/E): A valuation metric that compares a company's stock price to its earnings.

- Return on equity (ROE): A measure of how effectively a company is using its shareholders' investment.

- Debt-to-equity ratio: An indicator of a company's financial leverage.

- Company growth prospects: Future earning potential.

Implications of Par Value for Companies

For companies, understanding par value is crucial for legal compliance and financial reporting. It impacts:

- Capital Structure: The mix of equity and debt financing.

- Financial Statements: Information presented on the balance sheet.

- Shareholder Equity: Calculation of shareholder investment and retained earnings.

- Dividend Distributions: Understanding limitations and legal requirements.

- Legal Compliance: Adhering to state and federal regulations.

Common Misconceptions about Par Value

Several misunderstandings surround par value:

- Par value equals market value: This is incorrect. Market value is determined by supply and demand, while par value is a nominal value.

- Par value affects dividend payments: While dividend payouts are influenced by the company's profits and financial health, they are not directly determined by par value. Dividends are usually expressed per share and calculated as a percentage or fixed amount.

- Par value determines stock's worth: The value of the stock is determined by the market and is not directly tied to par value.

The Role of Par Value in Mergers and Acquisitions

Par value plays a minimal direct role in mergers and acquisitions. The focus instead shifts to the market value of the target company's shares. However, the par value of shares might be considered when determining accounting treatment and post-merger capital structure adjustments.

Impact of Par Value on Corporate Governance

While not a primary focus in corporate governance, par value indirectly relates to transparency and adherence to legal and regulatory requirements. Strong corporate governance practices generally prioritize fair valuation, accurate financial reporting, and adherence to all relevant laws, including those related to share issuance and capital requirements.

Conclusion

The par value per share of common stock, while seemingly insignificant at first glance, holds crucial legal and accounting implications. It represents the minimum legal capital a company must maintain to protect creditors and comply with corporate regulations. However, it's vital to remember that par value has little to do with the actual market value of a share of stock. Investors should instead focus on market value, financial statements, and other key performance indicators to gauge a company's investment potential. Understanding the distinctions between par value and market value is critical for anyone involved in corporate finance, investments, or entrepreneurship. The importance of par value lies primarily in its legal and regulatory framework, while the actual value of a company's stock is determined by the forces of supply and demand in the market.

Latest Posts

Latest Posts

-

A Service Dog Is Easily Identified By Its Quizlet

Mar 24, 2025

-

What Is A Distributed Denial Of Service Attack Quizlet

Mar 24, 2025

-

Ati Comprehensive Predictor 2024 With Ngn Quizlet

Mar 24, 2025

-

How Does Mining Impact The Environment Quizlet

Mar 24, 2025

-

What Is Not An Effect Of Growth Hormone Quizlet

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about The Par Value Per Share Of Common Stock Represents The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.