The Purpose Of Expansionary Monetary Policy Is To Increase

Breaking News Today

Mar 26, 2025 · 6 min read

Table of Contents

The Purpose of Expansionary Monetary Policy is to Increase: A Deep Dive into Economic Stimulus

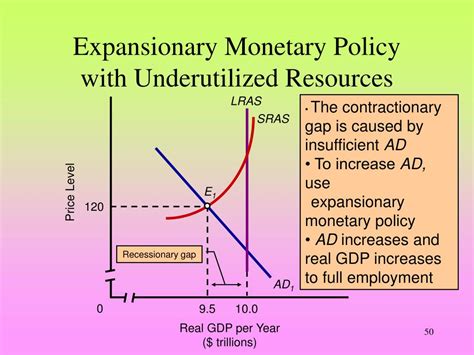

The purpose of expansionary monetary policy is to increase aggregate demand within an economy. This seemingly simple statement belies a complex interplay of economic levers, market forces, and potential consequences. Understanding expansionary monetary policy requires a thorough examination of its goals, mechanisms, and the potential trade-offs involved. This article will delve into these aspects, providing a comprehensive overview of this crucial tool used by central banks worldwide.

Understanding the Fundamentals: Aggregate Demand and Economic Slack

Before diving into the specifics of expansionary monetary policy, it's crucial to establish a foundational understanding of its target: aggregate demand (AD). Aggregate demand represents the total demand for goods and services within an economy at a given price level. It's the sum of consumer spending, investment spending, government spending, and net exports.

When an economy experiences a downturn—characterized by high unemployment, low economic growth, and potentially deflation—there's significant economic slack. This means the economy is operating below its potential output. Expansionary monetary policy aims to stimulate AD, thereby closing this output gap and moving the economy towards full employment.

The Mechanisms of Expansionary Monetary Policy: How it Increases Aggregate Demand

Central banks employ several mechanisms to implement expansionary monetary policy, all aimed at lowering interest rates and increasing the money supply. The most common tools include:

1. Lowering the Policy Interest Rate: The Primary Tool

The most direct method is lowering the policy interest rate. This is the rate at which commercial banks borrow money from the central bank. A reduction in this rate signals to commercial banks that they should also lower their lending rates. Lower borrowing costs encourage businesses to invest more (increased investment spending) and consumers to borrow more for purchases like homes and cars (increased consumer spending), thereby boosting AD.

2. Quantitative Easing (QE): Injecting Liquidity into the Market

When interest rates are already very low (near zero), central banks may resort to quantitative easing (QE). This involves purchasing government bonds or other assets from commercial banks and other financial institutions. This injects liquidity (cash) into the financial system, increasing the money supply and lowering long-term interest rates, further stimulating borrowing and investment. QE aims to increase the money supply even when traditional interest rate cuts are no longer effective.

3. Reducing Reserve Requirements: Freeing Up Bank Lending Capacity

Central banks can also reduce reserve requirements, which are the minimum percentage of deposits that commercial banks must hold in reserve. By lowering this requirement, banks have more money available to lend, further boosting the money supply and stimulating borrowing and investment. This ultimately contributes to the increase in aggregate demand.

4. Forward Guidance: Managing Expectations

Central banks often use forward guidance to influence market expectations. By clearly communicating their intentions regarding future monetary policy, they can help shape market interest rates and influence the behavior of businesses and consumers. This can be particularly effective in creating confidence and encouraging spending and investment. Clear and consistent communication is key to effective forward guidance.

The Intended Effects: A Cascade of Economic Activity

The goal of expansionary monetary policy is to trigger a cascade of positive economic effects:

1. Increased Investment: Businesses Expand and Hire

Lower interest rates make borrowing cheaper for businesses, encouraging them to invest in new equipment, expand their operations, and hire more workers. This leads to increased production and economic growth. The increased investment is a direct consequence of lower borrowing costs and a more optimistic economic outlook fueled by expansionary monetary policy.

2. Increased Consumption: Consumers Spend More Freely

Lower interest rates also make it cheaper for consumers to borrow money for purchases like homes, cars, and other durable goods. This increased consumer spending further boosts aggregate demand and contributes to economic growth. The increased consumer confidence also plays a significant role in this increased consumption.

3. Reduced Unemployment: More Jobs Created

As businesses invest and expand, they create more jobs, leading to a decrease in unemployment. This is a key indicator of the success of expansionary monetary policy. Lower unemployment also leads to increased consumer spending and overall economic well-being.

4. Increased Inflation: A Potential Trade-Off

While the primary goal is to boost economic activity, expansionary monetary policy often leads to increased inflation. This is because the increased money supply can outpace the increase in the supply of goods and services, leading to higher prices. Managing inflation is a key challenge for central banks when employing expansionary monetary policy. The central bank must carefully monitor inflationary pressures and adjust policy accordingly.

The Potential Risks and Side Effects: Navigating the Trade-offs

While expansionary monetary policy can be highly effective in stimulating economic growth, it also carries several potential risks and side effects:

1. Inflationary Pressures: The Risk of Overheating

As mentioned, a key risk is inflation. If the stimulus is too strong, it can lead to excessive inflation, eroding purchasing power and creating economic instability. Central banks must carefully monitor inflation indicators and adjust policy to prevent overheating. This requires a delicate balancing act between stimulating economic growth and controlling inflation.

2. Asset Bubbles: Speculative Investment and Market Volatility

Expansionary monetary policy can also lead to the formation of asset bubbles. Low interest rates can encourage excessive speculation in asset markets, leading to rapid price increases that are not sustainable. When these bubbles burst, they can trigger significant economic disruptions. Careful monitoring of asset markets is crucial to mitigate this risk. Regulatory oversight also plays a vital role in preventing excessive speculation.

3. Currency Depreciation: Impact on Imports and Exports

Lower interest rates can lead to currency depreciation. This can make exports more competitive but also make imports more expensive. The net effect on the economy depends on the relative size of the export and import sectors. Central banks must consider the international implications of their monetary policy decisions.

4. Ineffectiveness in Certain Circumstances: Liquidity Traps and Debt Dynamics

Expansionary monetary policy may be ineffective in certain circumstances, such as during a liquidity trap. This occurs when interest rates are already very low and further reductions fail to stimulate borrowing and investment. Additionally, high levels of debt can limit the effectiveness of expansionary monetary policy, as highly indebted individuals and businesses may be unwilling or unable to borrow more money even at lower interest rates.

Conclusion: A Powerful Tool Requiring Careful Management

Expansionary monetary policy is a powerful tool that central banks can use to stimulate economic growth and reduce unemployment. However, it's crucial to understand its mechanisms, potential risks, and the delicate balance between stimulating economic activity and managing inflation. Central banks must carefully monitor economic indicators, adjust policy as needed, and communicate their intentions clearly to market participants. The effectiveness of expansionary monetary policy depends on a nuanced understanding of the economic landscape and the ability to adapt strategies to changing conditions. The ultimate purpose of expansionary monetary policy—to increase aggregate demand and improve economic well-being—requires skillful navigation of these complex economic realities. It's not a one-size-fits-all solution, and its success hinges on careful planning, constant monitoring, and a deep understanding of the interconnectedness of various economic factors.

Latest Posts

Latest Posts

-

Which Of The Following Characteristics Do Homologous Chromosomes Exhibit

Mar 26, 2025

-

Functions Of The Spleen Include All Of Those Below Except

Mar 26, 2025

-

Driving When Tired Sick Or Medicated Causes

Mar 26, 2025

-

Concerned Is To Distressed As Confused Is To

Mar 26, 2025

-

Types Of Map Projections Ap Human Geography

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about The Purpose Of Expansionary Monetary Policy Is To Increase . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.