The Real Rate Of Interest Is Quizlet

Breaking News Today

Mar 18, 2025 · 6 min read

Table of Contents

The Real Rate of Interest: A Deep Dive

The real rate of interest is a fundamental concept in economics and finance, representing the true return on an investment after accounting for the effects of inflation. Understanding this concept is crucial for making sound financial decisions, whether you're an individual investor, a corporation planning capital expenditures, or a central bank setting monetary policy. This article will delve deep into the real rate of interest, exploring its calculation, its significance, its relationship with nominal interest rates, and the factors that influence it.

What is the Real Rate of Interest?

The real rate of interest represents the increase in purchasing power an investor receives for delaying consumption. In simpler terms, it's the return on an investment after adjusting for the effects of inflation. Inflation erodes the value of money over time; if your investment earns a nominal return (the stated interest rate) that's less than the inflation rate, your purchasing power actually decreases. The real rate of interest compensates for this loss of purchasing power.

In essence, the real rate of interest reflects the true cost of borrowing or the true return on lending, after considering the impact of inflation.

Calculating the Real Rate of Interest: The Fisher Equation

The most common method for calculating the real rate of interest uses the Fisher equation, a simple yet powerful formula:

(1 + Real Interest Rate) = (1 + Nominal Interest Rate) / (1 + Inflation Rate)

This equation provides a more accurate approximation than simply subtracting the inflation rate from the nominal rate, especially when inflation rates are high. Let's illustrate with an example:

Suppose you have a savings account with a nominal interest rate of 5%, and the inflation rate is 2%. Using the Fisher equation:

(1 + Real Interest Rate) = (1 + 0.05) / (1 + 0.02) = 1.05 / 1.02 ≈ 1.0294

Therefore, the real interest rate is approximately 2.94%. This is slightly higher than the naive calculation of 5% - 2% = 3%, highlighting the importance of using the Fisher equation for accurate calculations.

Limitations of the Fisher Equation

While the Fisher equation is widely used, it has limitations. It assumes a stable and predictable relationship between nominal and real interest rates, which may not always hold true, particularly in times of economic uncertainty or volatility. Furthermore, the equation assumes that the inflation rate is accurately measured and consistently applied across all assets, which is often not the case.

The Relationship Between Nominal and Real Interest Rates

The nominal interest rate is the stated interest rate on a loan or investment. It’s the raw number you see advertised by banks and financial institutions. The real interest rate is the nominal interest rate adjusted for inflation. The relationship can be described as follows:

- Nominal Interest Rate = Real Interest Rate + Inflation Rate (approximately) This is a simplified version and is less accurate than the Fisher Equation, especially for higher inflation rates.

Understanding the difference is crucial. A high nominal interest rate might seem attractive, but if inflation is even higher, the real return on your investment could be negative, meaning you're actually losing purchasing power.

Factors Influencing the Real Rate of Interest

Numerous factors influence the real rate of interest, making it a dynamic and ever-changing figure. These include:

1. Time Preference:

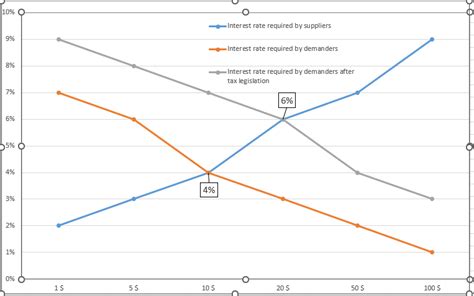

Individuals naturally prefer to consume goods and services now rather than later. This inherent preference for present consumption is known as time preference. Higher time preference implies a higher demand for immediate gratification, leading to higher real interest rates. Conversely, lower time preference leads to lower real interest rates.

2. Productivity of Capital:

The productivity of capital, meaning how efficiently capital can be used to generate output, significantly affects real interest rates. Higher capital productivity boosts investment returns, thereby increasing the demand for loanable funds and pushing up real interest rates. Conversely, lower productivity leads to lower real interest rates.

3. Risk:

Investors demand a higher return for taking on greater risk. This risk premium is incorporated into the real interest rate. Higher perceived risk in lending or investing results in higher real interest rates to compensate lenders or investors for the potential loss.

4. Government Policies:

Monetary policy, implemented by central banks, plays a crucial role in influencing real interest rates. Central banks can manipulate interest rates by adjusting reserve requirements, the discount rate, or through open market operations. Fiscal policy, concerning government spending and taxation, can also indirectly affect real interest rates by influencing inflation and overall economic activity.

5. Inflation Expectations:

Expectations about future inflation are built into nominal interest rates. If investors anticipate high inflation, they will demand a higher nominal interest rate to compensate for the expected erosion of purchasing power. Consequently, the real interest rate may not change significantly even if the nominal rate increases, as it simply reflects the expected inflation.

6. Global Economic Conditions:

Global economic factors, such as international trade, capital flows, and global economic growth, also exert influence. Strong global growth can boost demand for loanable funds, pushing up real interest rates. Conversely, global economic downturns can reduce demand, leading to lower rates.

The Significance of the Real Rate of Interest

Understanding the real rate of interest is essential for various aspects of economic decision-making:

1. Investment Decisions:

Investors must consider the real rate of return when evaluating investment opportunities. A project with a nominal return exceeding the real rate of interest may be profitable, while a project with a lower nominal return may not be viable.

2. Borrowing Decisions:

Borrowers should assess the real cost of borrowing, which is the real interest rate. If the real interest rate exceeds the expected return on the borrowed funds, borrowing may not be economically justifiable.

3. Monetary Policy:

Central banks use real interest rates as a key indicator of monetary policy effectiveness. They aim to keep real interest rates at a level that supports economic growth without fueling excessive inflation.

4. Economic Growth:

The real rate of interest plays a significant role in economic growth. Lower real interest rates can stimulate investment and consumption, boosting economic activity. Conversely, higher real rates can dampen economic growth.

5. Valuation of Assets:

The real rate of interest is a crucial input in discounted cash flow (DCF) analysis, a widely used method for valuing assets such as stocks, bonds, and real estate. Changes in real rates significantly influence asset valuations.

Conclusion: The Real Rate of Interest in the Broader Economic Picture

The real rate of interest is a multifaceted concept with far-reaching implications for individuals, businesses, and economies. While its calculation might seem straightforward, understanding the underlying factors that influence it and its significance in various economic contexts is crucial for informed decision-making. By appreciating the nuances of the real rate of interest and its interplay with nominal rates, inflation, and other economic variables, we can navigate the complexities of financial markets and contribute to sound economic management. Remember, the real rate of interest isn’t just a number; it’s a reflection of the dynamic forces shaping our economic landscape. Continuously monitoring and analyzing this key indicator is vital for making well-informed economic and financial decisions. The real rate of interest provides a crucial lens through which to view investment opportunities, borrowing costs, and the overall health of an economy. By understanding its intricacies, we can build a more robust and resilient financial future.

Latest Posts

Latest Posts

-

The Emancipation Proclamation Of January 1 1863 Quizlet

Mar 18, 2025

-

These Cards Will Get You Drunk Quizlet

Mar 18, 2025

-

Did Quizlet Get Rid Of Q Chat

Mar 18, 2025

-

Myasthenia Gravis Is An Autoimmune Disease In Which Quizlet

Mar 18, 2025

-

Fun Sex Questions For Couples Quizlet With Answers

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about The Real Rate Of Interest Is Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.